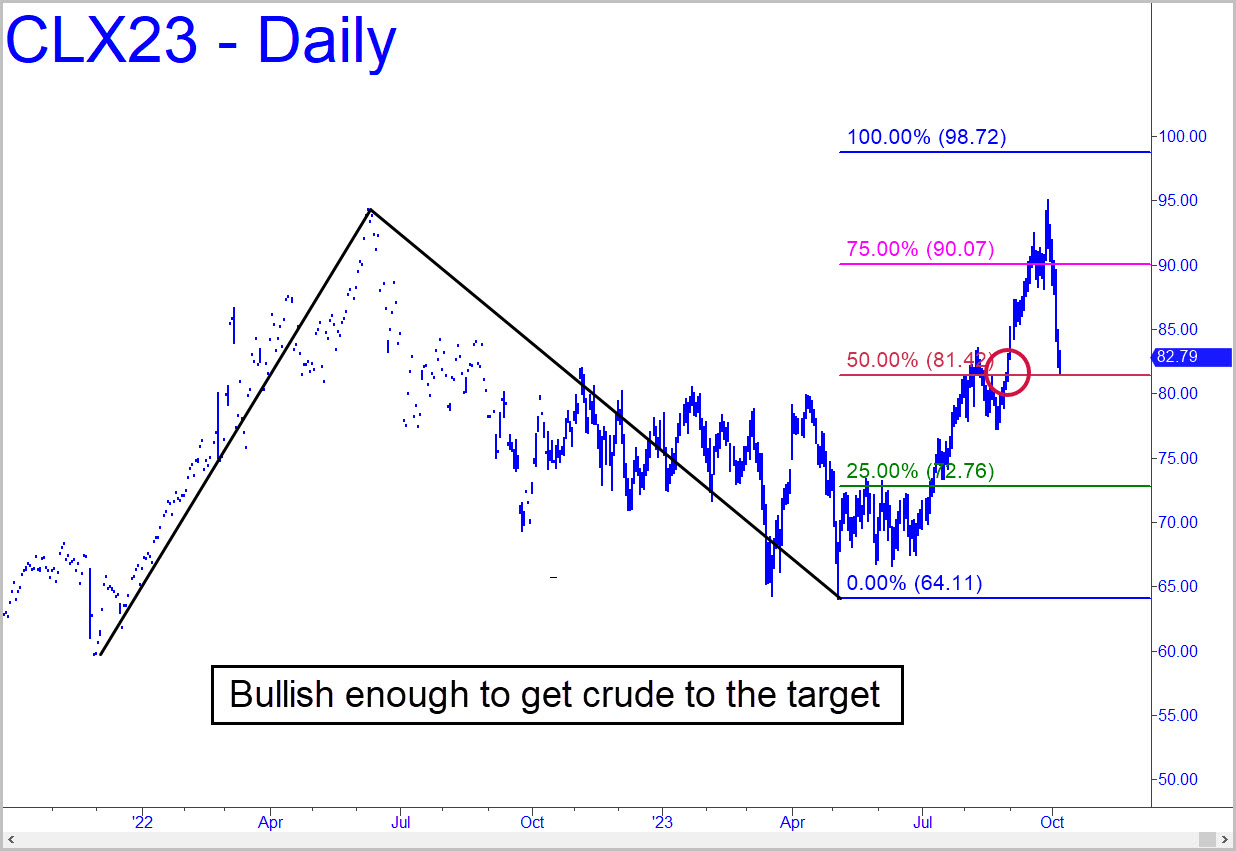

The last push wasn’t strong enough to get the futures to the 98.72 target (a presumptive weigh-station enroute to the $117 target of a larger pattern featured in last week’s commentary). However, the thrust in early September that impaled a midpoint resistance at 81.42 was sufficiently powerful to suggest November crude will head up to the target once this correction has run its course. To get a precise handle on trend strength, I’ll suggest tracking a red-line ‘mechanical’ buy at 81.42 that would take a 75.65 stop-loss. If the trade makes (hypothetical) money with a move to at least p2, it would shorten the odds of a further move to D=98.72. If not, I’ll need to adjust the odds for a blowoff to $117.

The last push wasn’t strong enough to get the futures to the 98.72 target (a presumptive weigh-station enroute to the $117 target of a larger pattern featured in last week’s commentary). However, the thrust in early September that impaled a midpoint resistance at 81.42 was sufficiently powerful to suggest November crude will head up to the target once this correction has run its course. To get a precise handle on trend strength, I’ll suggest tracking a red-line ‘mechanical’ buy at 81.42 that would take a 75.65 stop-loss. If the trade makes (hypothetical) money with a move to at least p2, it would shorten the odds of a further move to D=98.72. If not, I’ll need to adjust the odds for a blowoff to $117.

CLX23 – November Crude (Last:82.79)

Posted on October 8, 2023, 5:08 pm EDT

Last Updated October 6, 2023, 6:43 pm EDT

Posted on October 8, 2023, 5:08 pm EDT

Last Updated October 6, 2023, 6:43 pm EDT