Price action last week in the charts of three bellwethers suggests that this year’s ‘October surprise’ could arrive right on schedule and that it could be a doozy. The first shows the dollar’s so-far shallow correction off a minor Hidden Pivot rally target. This portends yet more strength, threatening to turn Powell’s tightening regime into a globally ruinous debt deflation. Second, rates on the 30-Year Bond topped at 4.81%, precisely matching the prediction featured here last week. And now let me add this detail: If yields pop above 4.81%, they should be presumed headed for exactly 4.98%, a top that I regard as very unlikely to be surpassed. Interest rates presumably would fall thereafter — for a long, long time — discounting a weakening economy bound for, if not depression, then at least a very severe and prolonged recession. Don’t expect falling rates to stimulate economic growth, since asset values will be falling even more steeply. That means rates will actually be rising in real terms, as occurred during the nearly fatal debt deflation of 2007-08.

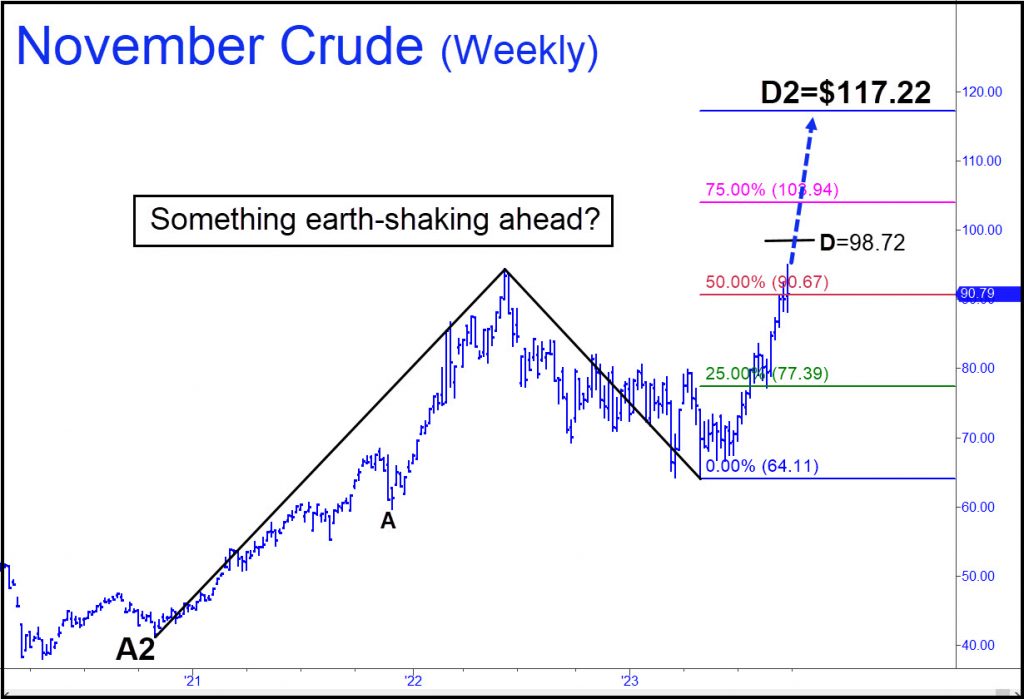

One of the updated charts packed quite a surprise: NYMEX Crude. We’ve been quite bullish on oil since early this year, when quotes were lingering around $72/barrel. However, the rally turned unusually steep in May and hit a high last week at 95.03 that fell a few dollars shy of a $98 target we’d been using as a minimum upside objective. This prompted a look at a longer-term chart. Lo, the weekly bars imply an impending run-up to $117 a barrel. Moreover, last week’s decisive move through the pattern’s Hidden Pivot midpoint at 90.67 implies that a surge to $117 is no worse than an even-money bet. Could this mean that a long-anticipated war in the Middle East is about to break about? Regardless, if the price of oil is in fact bound for $117, something world-shaking is about to occur.

October the month of Halloween, Harry Potter, hobgoblins and Black Pope Vatican See.

When markets break outside their normal range, they tell us something re capital preservation, worth noting for our positions.

In the case of $USD, target + 52 % from 106.908 to 162, Normal Risk to 103.7, they tell us Cash is King.

$TYX target + 54 % from 4.8386% to 7.4 % tells us credit tightening to new highs may attempt to balance our economy by repossessing debtors, seizing litigants with 87,000 armed IRS agents and 240,000 DHS agents.

$WTIC Target + 62 % from 88.46 to 143.01, Normal Risk to 83.6 suggests inflation accelerating for now.

The counter-intuitive wild card is GLD’s inside target of – 5 % from 170.08 to 161, Normal Risk to 185.39.

Watched targets can require exceptional patience.

Ahoy Rick et al

May have to binge old episodes of Heartland to calm down…