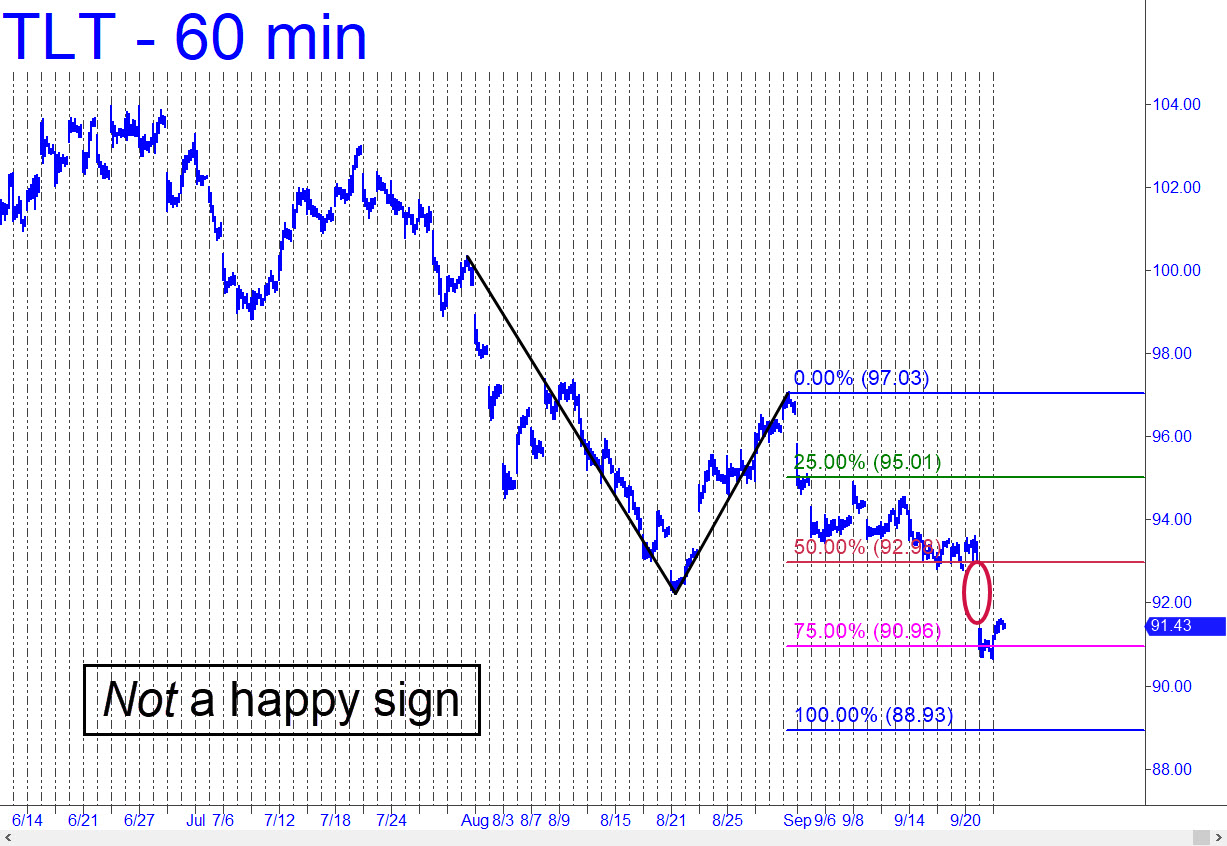

The dinky little ‘A’ high I’ve selected does not provide a worst-case low for this cinder block, but the 88.93 downside target shown will do for now. Only a powerful rally that creates an island-gap reversal could prevent a further fall, but we would first have to imagine its cause to become believers. It’s easier and arguably more plausible to picture ‘A’ at the 102.95 high recorded in mid-July. That would give us a new, lower target at 86.31. It would equate to a 4.81% yield on the long bond, by the way. See this week’s ‘Morning Line commentary for further details.

The dinky little ‘A’ high I’ve selected does not provide a worst-case low for this cinder block, but the 88.93 downside target shown will do for now. Only a powerful rally that creates an island-gap reversal could prevent a further fall, but we would first have to imagine its cause to become believers. It’s easier and arguably more plausible to picture ‘A’ at the 102.95 high recorded in mid-July. That would give us a new, lower target at 86.31. It would equate to a 4.81% yield on the long bond, by the way. See this week’s ‘Morning Line commentary for further details.

TLT – Lehman Bond ETF (Last:91.43)

Posted on September 24, 2023, 5:24 pm EDT

Last Updated September 25, 2023, 9:08 pm EDT

Posted on September 24, 2023, 5:24 pm EDT

Last Updated September 25, 2023, 9:08 pm EDT