I let it all hang out in the interview I did Friday with USAWatchdog‘s Greg Hunter. Do I actually believe the U.S. economy is headed into a condition of barter? Yes, I do. It will be that bad. And global. Americans in particular will face a long period of severe hardship when these boom times end. That’s because the USA is where credit excesses and wealth-effect hubris have been at their most visible and disconcerting. Presumably, the cataclysm required to wreck the banking system would occur in the late stages of a bear market that has always been inevitable.

I don’t mean to imply that the damage would necessarily take a long time to complete, however. Indeed, it is likely to happen with shocking speed. Imagine it as the collapse of a financial black hole, powered by the implosion of more than $2 quadrillion of derivatives backed chiefly by gaseous vapor. When the initial rumbling is felt, portfolio managers, including sovereign funds and the biggest investment firms in the world, will urge investors to keep their cool. Some will, at least for a short while. But mounting waves of redemptions will eventually force BlackRock, Fidelity, State Street et al. to dump the shares of clients desperate to raise cash in order to meet margin calls or worse.

What Is Your ‘Plan C’?

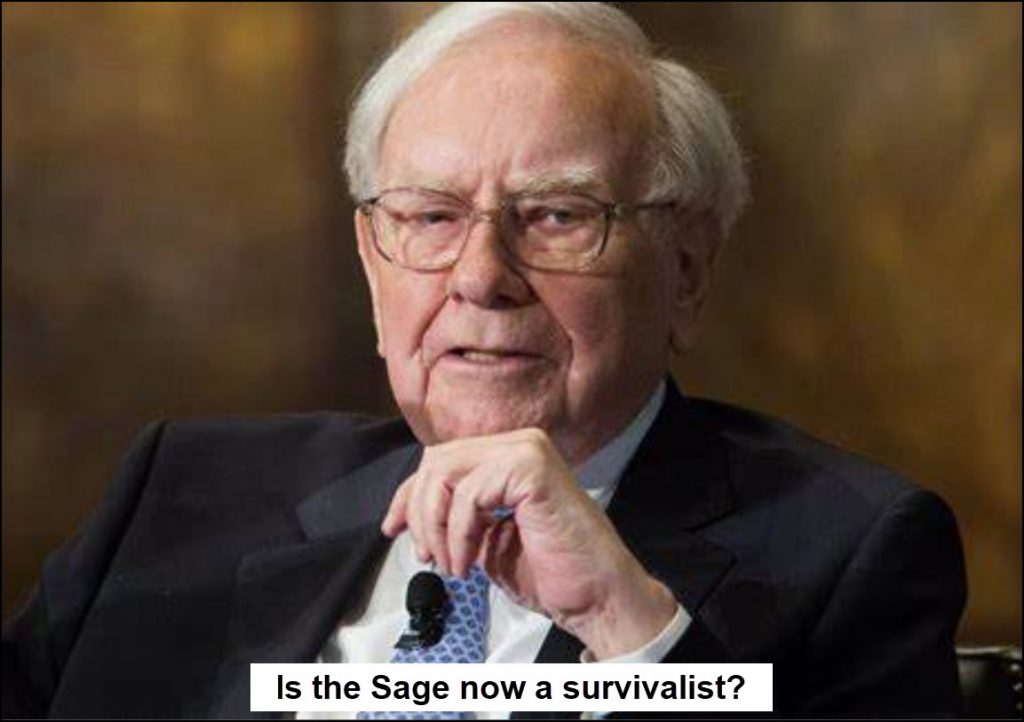

Who will the buyers be in this avalanche? That is a question for which there can be no comforting answer. In the meantime, we should be thinking through what my colleague Charles Hugh Smith refers to as ‘Plan C’. This doesn’t mean hunkering down in suburban cul-de-sacs, hoping for the best. Rather, it might require moving to a town or locale with sufficient human and material resources to reduce dependency on distant providers of food, water and energy. The goal is not self-sufficiency, he points out, but rather the forging of communities able to cope with the hardest times imaginable. Since the collapse will be fundamentally a deleveraging event, you can forget about making a pile of money on the way down. Holding onto just a fraction of one’s current net worth will pose a severe challenge even for financial geniuses. Warren Buffett reportedly has been cashing out of stocks and buying T-bills in a huge way. Shouldn’t all investors be doing this — i.e., buying stuff that has been shunned for years?

Berkshire Hathaway holds a significant portion of its $147 billion cash and equivalents in T-bills, with over $120 billion invested in T-bills …

Quite different from T Notes and Bonds, which he eschews

TNX target 6.3 %

TYX Target 7.425 %

Lots of pain

&&&&

Thanks for clarifying that important point, Richard. I am in the process of cashing out myself, and T-bills is where the money will be going, at least for the time being. RA