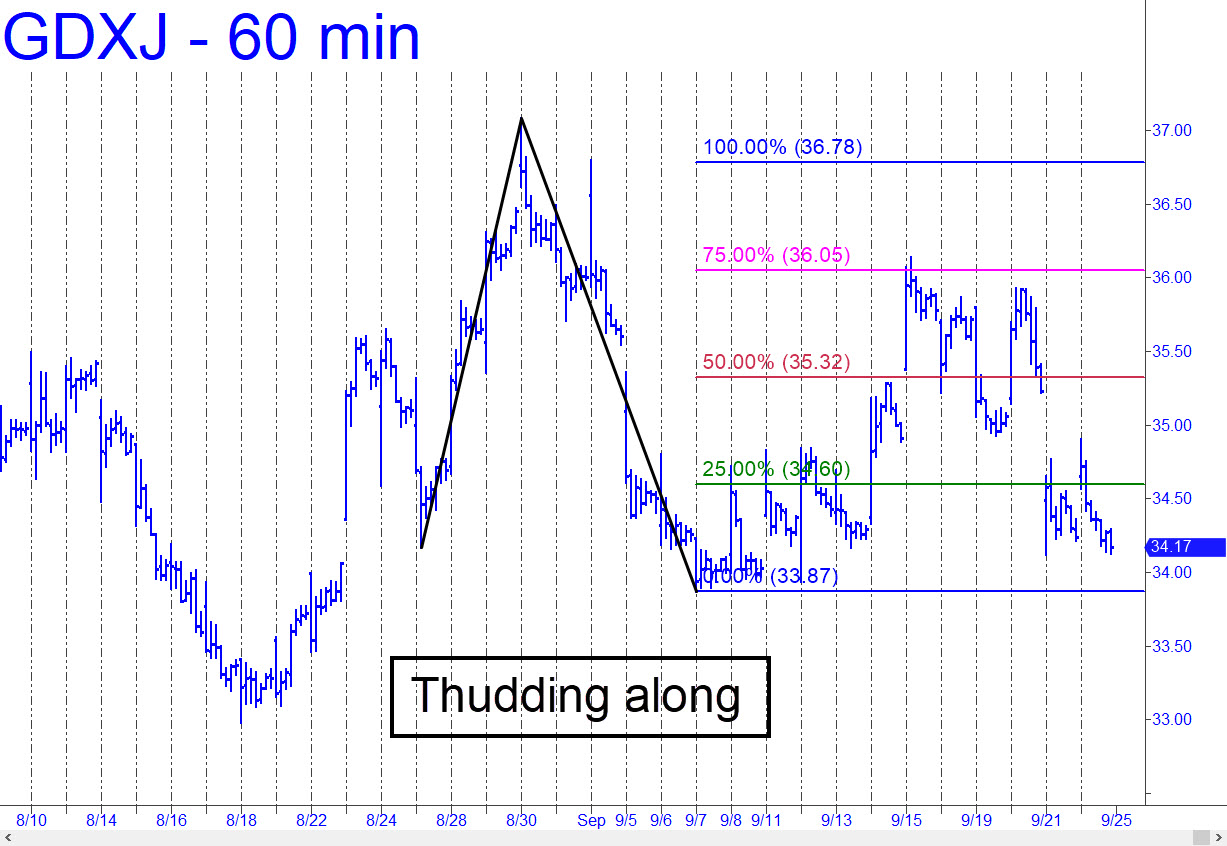

We’re long 400 shares from a ‘mechanical’ buy at the green line (x=34.60). Friday’s bull-trap rally on the opening bar strongly implies GDXJ will take out at least another low or two before it can get traction. So that we don’t get caught like everyone else in a stressful second-guessing game, I’ll suggest sticking with the 34.11 stop-loss I posted in the chat room on Thursday. My hunch is that a more tradeable low will occur near 33.21 (60-min, A=36.80 on 9/1). We can try again to get long there rather than suffering-and-shuffling along with the herd in the meantime. _______ UPDATE (Sep 25, 10:04 p.m.): Today’s nasty dive stopped out the trade for a loss of about $200. This is a sign of rotten health, considering the textbook appeal of the pattern we used to get long ‘mechanically,’

We’re long 400 shares from a ‘mechanical’ buy at the green line (x=34.60). Friday’s bull-trap rally on the opening bar strongly implies GDXJ will take out at least another low or two before it can get traction. So that we don’t get caught like everyone else in a stressful second-guessing game, I’ll suggest sticking with the 34.11 stop-loss I posted in the chat room on Thursday. My hunch is that a more tradeable low will occur near 33.21 (60-min, A=36.80 on 9/1). We can try again to get long there rather than suffering-and-shuffling along with the herd in the meantime. _______ UPDATE (Sep 25, 10:04 p.m.): Today’s nasty dive stopped out the trade for a loss of about $200. This is a sign of rotten health, considering the textbook appeal of the pattern we used to get long ‘mechanically,’

GDXJ – Junior Gold Miner ETF (Last:33.72)

Posted on September 24, 2023, 5:13 pm EDT

Last Updated September 26, 2023, 9:04 am EDT

Posted on September 24, 2023, 5:13 pm EDT

Last Updated September 26, 2023, 9:04 am EDT