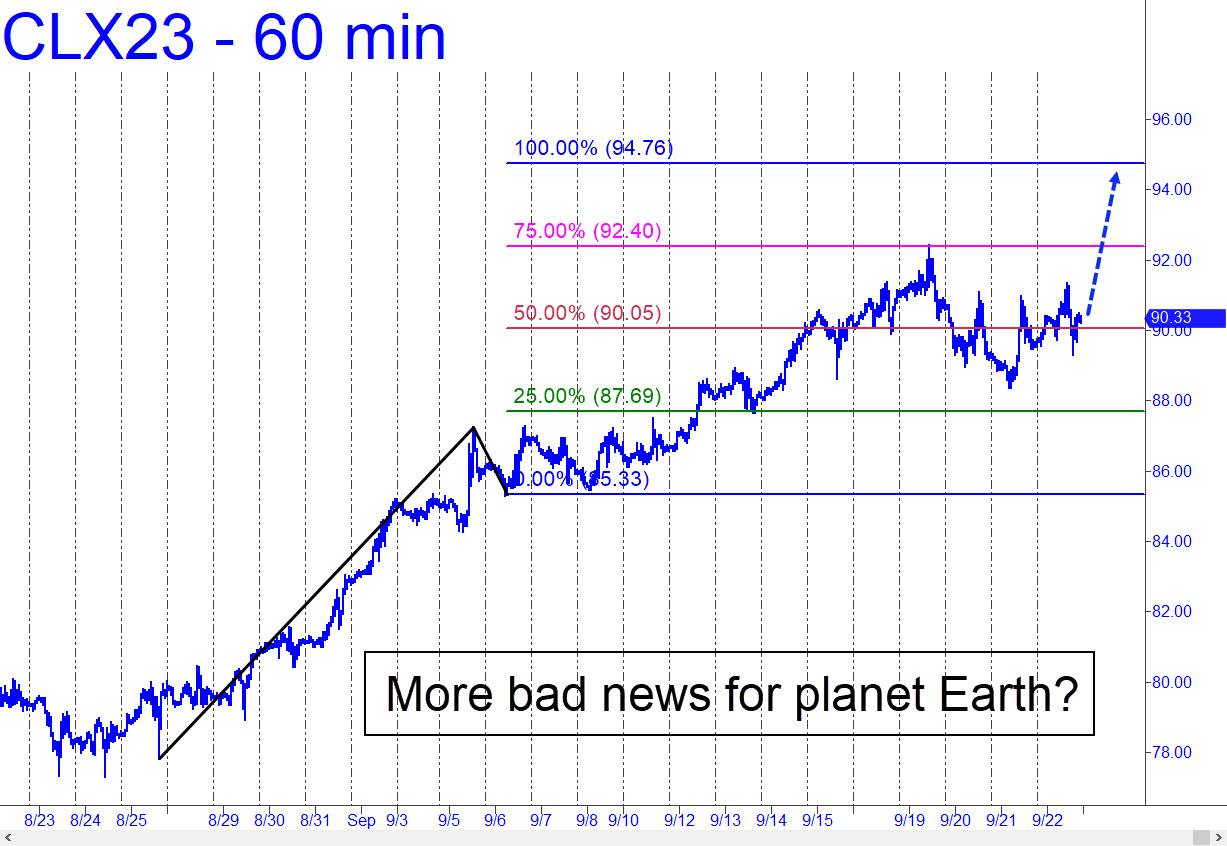

Crude turned sluggish last week, but not before generating a bullish impulse leg on Friday that will likely hold positive consequences for the near term. I say ‘positive’ while acknowledging that another turn of the screw could send the world’s fragile economy into a tailspin. Pump prices are already above $4/gallon and will become headline news when it looks as though $5 is coming. To get in step with that eventuality, I’ve lowered the point ‘A’ low of the chart we’ve been using to produce a somewhat higher target at 94.76. A swoon to the green line (x=87.69) would generate an attractive ‘mechanical’ buy signal, but we’ll wait until it is close to happening before we hatch a strategy to trade it. _______ UPDATE (Sep 28, 1:54 p.m. EDT): November Crude has plunged after topping a hair from the 94.76 target billboarded in the current tout. This adds to the evidence that The Big Picture may have changed, since the dollar and Treasury rates have also reversed sharply after achieving important Hidden Pivot targets precisely.

Crude turned sluggish last week, but not before generating a bullish impulse leg on Friday that will likely hold positive consequences for the near term. I say ‘positive’ while acknowledging that another turn of the screw could send the world’s fragile economy into a tailspin. Pump prices are already above $4/gallon and will become headline news when it looks as though $5 is coming. To get in step with that eventuality, I’ve lowered the point ‘A’ low of the chart we’ve been using to produce a somewhat higher target at 94.76. A swoon to the green line (x=87.69) would generate an attractive ‘mechanical’ buy signal, but we’ll wait until it is close to happening before we hatch a strategy to trade it. _______ UPDATE (Sep 28, 1:54 p.m. EDT): November Crude has plunged after topping a hair from the 94.76 target billboarded in the current tout. This adds to the evidence that The Big Picture may have changed, since the dollar and Treasury rates have also reversed sharply after achieving important Hidden Pivot targets precisely.

CLX23 – November Crude (Last:91.51)

Posted on September 24, 2023, 5:11 pm EDT

Last Updated September 28, 2023, 1:53 pm EDT

Posted on September 24, 2023, 5:11 pm EDT

Last Updated September 28, 2023, 1:53 pm EDT