[The following was sent out to clients in late July by my friend Doug Behnfield, a wealth manager and senior vice president at Morgan Stanley Wealth Management in Boulder, CO. Long-time followers of Rick’s Picks will be familiar with Doug’s work, since his thoughts have appeared here many times. I have always considered him not only one of the smartest investors I know, but also one of the smartest guys. I am grateful to him for allowing me to share the insightful report with you. RA]

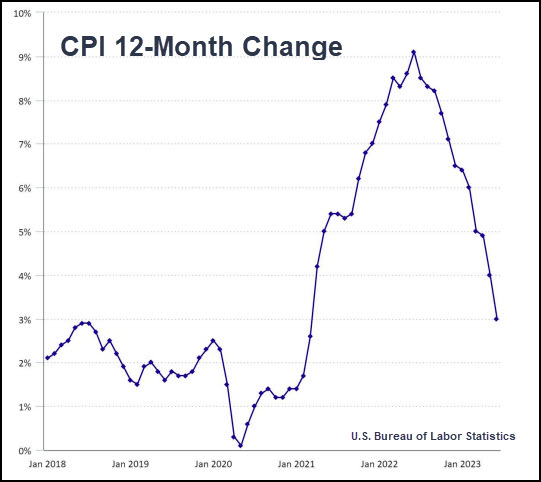

On July 12, the Bureau of Labor Statistics reported that the Consumer Price Index (CPI) for the 12 months ending in June came in at 3% inflation. This annualized inflation rate represents a drop from 9.1% in June of last year, which was the peak in this cycle. The interest rate on long-term bonds correlates very closely with CPI, so it is unusual that bond yields have not followed inflation down in a meaningful way so far.

[Editor’s note: At this point the report displayed a chart showing bond yields increasing into late October and then going sideways. However, just after the report went out in late July, yields exploded upward in a manner unforeseen herein. Here is a chart that shows this. If it has changed Doug’s outloook, we will share his thoughts with you at a later date.] One contributing factor to this sideways action is that long-term bond yields also correlate very closely with the Fed’s interest rate policy and the Fed has continually raised the Fed Funds (overnight) Rate since inflation peaked last summer. In June 2022, the Fed was still at 1.5% on Fed Funds, but since then they have hiked rates by 4%. The Fed has also hiked rates by 2.25% since October, even as long bond rates have declined from 4.4% to 3.9% currently. Clearly, Fed rate policy is driven by factors other than current inflation readings.

It seems clear from the chart of CPI above that the rise from 0% at the Covid lows in 2020 to the high of 9.1% last year after the economy reopened has a lot to do with the historically steep drop in CPI that has occurred since the peak. There is much discussion about where CPI goes from here, with some believing that it will continue down into modest deflation while others believe that it will be “sticky” from here, potentially halting or reversing the current slide. While some of the discussion is based on speculative assumptions of what the future holds for prices in the economy, there are a few things that enter the discussion where the handwriting is on the wall.

One of those items is the ‘Shelter’ component of the CPI, which includes rent, and a survey-based calculation of the cost of home ownership, which is called Owner’s Equivalent Rent (OER). Surprisingly, survey respondents have demonstrated an accurate understanding of what their homes would rent for, so rent and OER have a 99% correlation.

Shelter (Rent and OER)

Shelter represents the largest single component (almost 34%) of the CPI, so a thoughtful understanding of it is essential when attempting to understand inflation. Food and energy together make up less than 21% and other goods and services make up the remaining 46%. In addition to the sheer size of shelter as a CPI component, it is reported in CPI with long and well documented lags. This is because of the long duration (1-3 years) of lease terms. As a result, current data (as opposed to CPI data on shelter) provides a much less speculative view of its future impact on CPI than any of the other components. CoreLogic is an organization that provides some of the most current and comprehensive data on home rentals and many other components of the housing/shelter market in the United States. Their methodology for gathering rent data includes:

“Median rent price data is produced monthly by CoreLogic RentalTrends. RentalTrends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes.”

According to CoreLogic, the rate of inflation in single family home rents peaked in April 2022 at an annual rate of 14%. The most recent data was reported on July 18 and includes data through May 2023. At the end of May, rent inflation had declined to only 3.4%.

Shelter data in the current CPI report is generally believed to have a lag of 12-18 months. There is a good reason for this. As mentioned, when leases are signed to rent a home or apartment, the term of the lease is typically 1-3 years. However, current data on new lease rates can confidently be expected to eventually be reflected within this accepted lag period. Shelter inflation as reported in the CPI peaked in April at an annual rate of 8.2%. In the most recent June CPI report, shelter had only declined to 7.8%.

The important consideration in the current rent data as it relates to the inflation outlook is that base effects suggest that shelter data inputs into CPI for the next 12 months or so will exert a powerful disinflationary impact. Said another way, it will bring the inflation number down.

As mentioned earlier, predicting the price of food, energy and other goods and services going forward is highly speculative and heavily dependent on whether the economy falls into recession. The impact of real-time disinflation in shelter, the single largest component of the CPI, is not.

Fed Interest Rate Policy

The two economic elements that most closely correlate with the yield on long-term Treasury bonds are Fed Interest Rate Policy and Inflation. (Surprisingly, federal budget deficits and foreign buying or selling of Treasuries have very low correlations). Because inflation has come down so dramatically, Fed Policy has become one of the most important macroeconomic factors currently determining bond yields, and therefore bond prices, by default.

Over the last 12 months of plummeting inflation, the Fed has maintained a “hawkish” tone while continually hiking short term rates. Their rationale has been centered on concerns about ongoing “tight” labor market conditions, sticky “core” inflation data, and relatively strong spending by the consumer. They have downplayed leading indicators in the economy that have traditionally foreshadowed a recession and are contained in the Conference Board’s Index of Leading Indicators. The Conference Board highlighted the extreme readings of this index in their most recent report:

“The Leading Index has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession. Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead. We forecast that the US economy is likely to be in recession from Q3 2023 to Q1 2024. Elevated prices, tighter monetary policy, harder-to-get credit, and reduced government spending are poised to dampen economic growth further.”

In this report they mentioned deteriorating Capital Spending, Housing, Employment, and Consumer Spending intentions (all of which are Current or Lagging Indicators) as the source of the weakness.

There is a running debate about why the Fed would be focused on Lagging Indicators rather than Leading Indicators. The Fed has a history of raising rates too far, for too long and helping cause a recession. Alternatively, Wall Street analysts and experts have a history of being too hopeful that the Fed will engineer a “soft-landing” by raising rates just enough to quash inflation while avoiding a recession. The Fed’s track record during the post-WWII period is quite poor and the current recessionary indicators in the economy are at the more extreme end of the spectrum.

In fact, the Fed warned the public that their policies would lead to job loss and “pain” last summer at the Jackson Hole Symposium and the Fed Economics staff recently published a report in which they predict a recession in this year’s 4th Quarter. However, “financial conditions” have remained quite easy, considering the magnitude of the rate hikes and the recent bank failures that have led to more restrictive lending conditions. The strength of the stock market in particular and to a lesser degree, the resilience of the residential real estate market is primarily to blame for financial conditions being of great concern to the Fed.

The Fed’s efforts to slow down the pace of rate hikes has led to a chorus on Wall Street suggesting (alternatively) an economic soft landing or no landing at all. Still, the stock market has rocketed up primarily on the back of a small number of companies that stand to benefit from Artificial Intelligence (AI). As was the case in previous periods of transition from expansion to recession, the stock market has rallied to approach a “double top” based on enthusiasm that the Fed “pause” would lead to a new expansion in the economy and that the recession would be avoided.

Jay Powell and many other Fed Governors have expressed a commitment to keep rates “higher for longer” until the “job is done” in terms of vanquishing inflation. This suggests that they have grave concerns that inflation can come roaring back unless they create financial conditions that are so tight that financial leverage in the system comes down dramatically from current levels. I have referred to this in the past as “taking the punch bowl away.” This is a quote from a former Fed Chairman in the 1950s (when punch bowls were common). As long as the public remains of the opinion that the asset markets go up in linear fashion, they will not leave the party unless someone makes them. This is a big part of what the Fed has taken on as its mission, even though it is something they would prefer not to articulate too strongly. At the same time, it is reasonable to consider that one condition of a pause and the eventual pivot to rate cuts is a cyclical bear market that sobers everyone up. This is akin to Alan Greenspan’s “Irrational Exuberance” warnings back in the late 1990s. In such a circumstance, it is possible that the Fed’s intention is to sacrifice a “soft landing” in favor of a more powerful long-term inflation accomplishment.

Mike Wilson, Morgan Stanley’s Chief Investment Strategist, continues to anticipate that the “profits recession” that we have been in for several quarters will intensify. The stock market rally from the lows last fall has been accompanied by declining corporate earnings combined with a dramatic increase in valuations. Although he admits that his bearish call this year has been “wrong” so far, he makes the case that profit declines are likely to persist. His focus is also on disinflation, in that corporations are receiving lower prices for their unit sales. This is reducing revenues and profits which he expects will worsen in dramatic fashion as the year progresses. This leaves a fundamental case for the type of market decline that could impact the Fed’s view of the inflation risks that remain.

The Bond Market

As mentioned at the top of this report, interest rates on long-term Treasury bonds have been declining in irregular fashion (and prices have been increasing) since last October. This is true of long-term municipal bonds too. However, during this nine-month period, the Fed has been aggressively hiking short-term rates, causing the yield curve to invert to unprecedented levels. The reason this inversion has occurred is that bond market investors believe the more the Fed raises short-term rates the more likely it is that we will have a recession (and possibly a severe one). If a severe recession occurs, the Fed will be in a position to cut Fed Fund rates dramatically. The yield on long-term bonds will drop commensurately. This bullish scenario for bond prices has caused bond market participants to support the long end of the market in the face of rising short-term rates. As the Fed gets closer to a definitive “pause”, long rates typically accelerate their decline. The Fed will eventually cut rates in a recessionary environment and that is typically the period where long bond yields drop the most.

The Fed has a dual mandate from Congress. It consists of “Stable prices and maximum sustainable employment.” The Fed’s intentions for the long-term implications of the “stable prices” part of their two-part mandate appears to take precedence over the second part, (which is “maximum employment”) in the Jay Powell Fed. In any case, the Fed has historically raised rates during tightening cycles to the point of being forced to cut rates abruptly due to a recession appearing rather than the “soft landing” that becomes consensus. In fact, in the post-WWII period, there have been 14 Fed tightening cycles and so far, 11 have ended in recession because they have gone too far. Current economic and financial conditions are more common with those that did end in recession, particularly from the perspective of the inverted yield curve and the decline in the Index of Leading Indicators. When combined with the added downward pressure on inflation indicated by shelter costs going forward, it is reasonable to expect that the Fed will be pausing well before year-end and possibly cutting rates. This would, in turn support bond prices breaking out of their sideways performance so far in 2023. [For a gonzo perspective on our deeply troubled world and the stock market’s rabid madness, click here to access my latest interview with Howe Street’s Jim Goddard. RA]

Fed wants price stability!? That is a joke. They decreased rates lower and lower so the world could binge in debt. They create the bubble with free money and then pretend they need to raise rate at the worst time to create a busts and deflation. These guys are criminals and thieve. They are not stupid they just implement the plan to crash the system to impose the new one so people don’t complain. Shock and Awe tactic. Create a problem with the solution ready in advance. And the solution usually mean more power and control for the them. I mean just just at his body language his mouth is so tight and clenched, it shows his body is making great effort to keep it shut and not telling the truth.

They use the narrative of self inflicted inflation with sanctions+shortages to increase rates at the fastest pace in history! Banks do not have enough time to adapt their portfolios to the increases and that is also on purpose to get rid of he smaller banks and force merger and takeover for dimes on the dollar. This way they gain more control on the financial sector to implement the new system (programmable CBDC). Otherwise smaller banks could have decided not to jump in and it would have rogue banks.

https://quantific.substack.com/p/svb-panic-bad-bank-of-bad-fed

https://quantific.substack.com/p/the-fed-is-destroying-the-economy