Is Mr. Market about to deliver the coup de grace to bond bulls? It certainly appears that way. They’ve been getting schmeissed regularly since a frightening few days back in March 2020. At the time, investors were struggling to decide how covid would affect their financial lives. The wild gyrations near the top, followed by the subsequent collapse of Treasurys as yield soared, attests to the fact that they all got it wrong — and so did everyone else who subsequently jumped in.

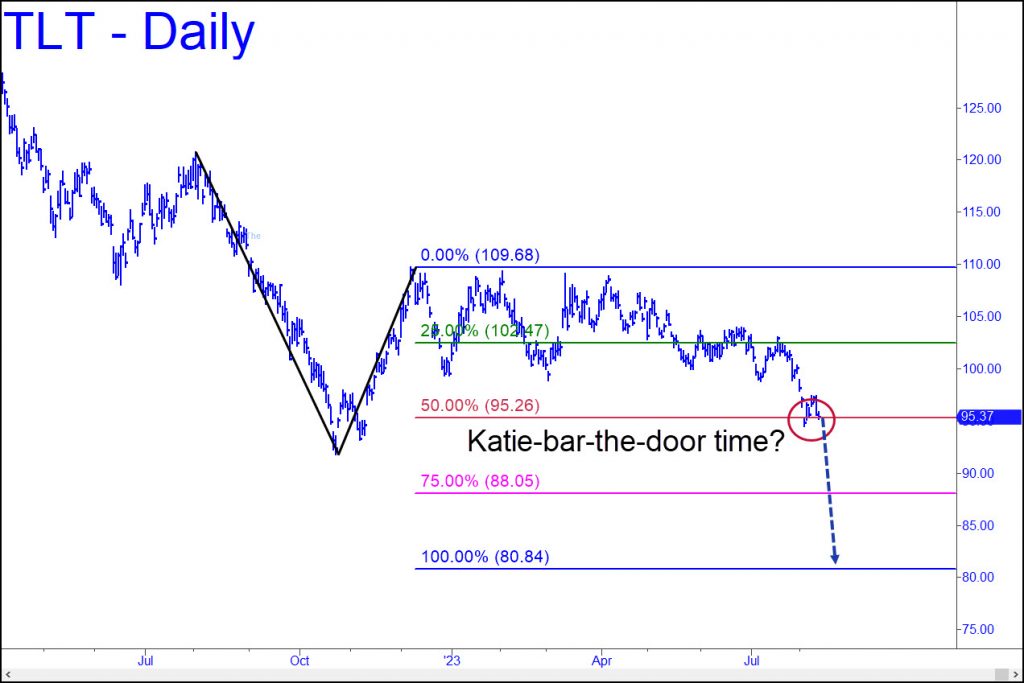

In technical terms, TLT, an ETF proxy for T-Bonds maturing in 20+ years, is on thin ice. It tested a key support two weeks ago when it came down to the red line, a ‘midpoint Hidden Pivot support’ that must hold if TLT is to avoid a further fall to the 80.84 target. Although the line has yet to be penetrated decisively, it looks to be giving way. A two-day close beneath it would likely send TLT down to at least 88.05, a last-ditch support. Beneath it lies an abyss that portends a rise in long-term rates to at least 5.5% (as noted here earlier) from a current 4.27%. If there is a bright side to this scenario, it lies in the implication that an all-but-certain debt deflation much more destructive than any consumer inflation we are likely to experience is going to be yet a while longer in coming.

We continue to be amazed Rick how divergent market technologies can come to similar conclusions.

Our Point and Figure plus various others have a TLT target matching yours, better than government work.

We are reminded former Fed Chair Alan Greenspan used gold as a proxy for treasury yields. By that, both would appear to have higher moves with stock markets that apparently refuse to die.

As First Kings 18:44 tells us, After the seventh time the servant said, “A little cloud like a man’s hand is coming from the sea.” Elijah said, “Go and tell Ahab, ‘Prepare your chariot, and leave before the rain delays you.’ ”

It may become obvious in retrospect we have seen the equity highs for 2023 and then some.

Dow Jones Industrials fell – 73 % from Jan 1973 to Jun 1982 at our last serious market turning point accompanied by the resignation of Richard Nixon and Election of Ronald Reagan.

Could we be any more blessed now ?