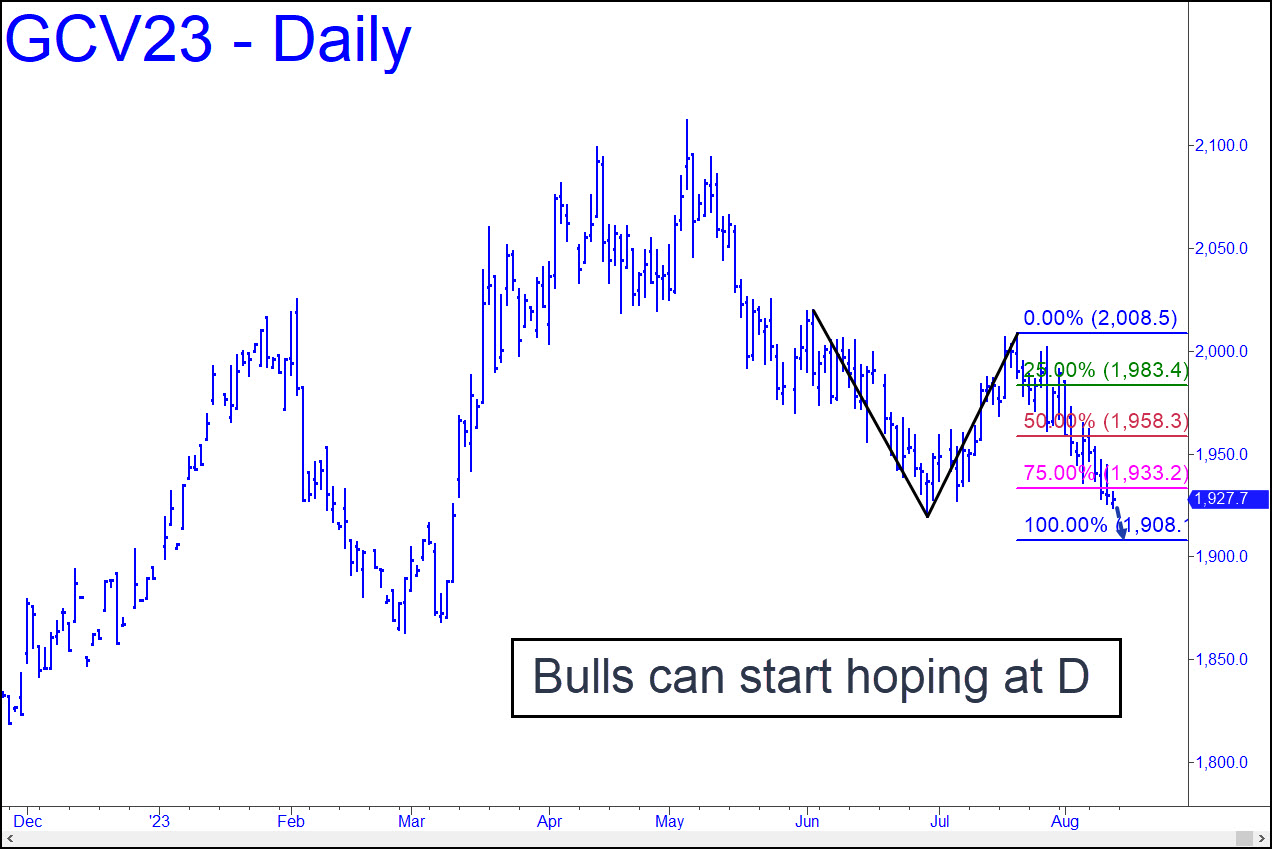

No change in my earlier forecast that October Gold would fall at least to D=1908.10 of the pattern shown. This ABCD is too obvious to yield a tradeable bounce precisely from the ‘hidden’ support, so we may need to let the rubes get stopped out once or twice before we attempt to bottom-fish there ourselves. Obviousness aside, the pattern is pretty ‘textbook’, and so a significant bounce would appear to be all but certain. A turbocharged one from no lower than 1921.00 or so would provide a technical rationale for getting ‘mechanically’ short at x=1983.40. However, somewhat more likely in my estimation is eventual slippage below 1908, presaging a test of spring’s lows near 1865. ______ UPDATE (Aug 15, 5:35 p.m.): Reversing a relentless plunge, gold bounced sharply from less than a point of the 1908.10 target today. However, because the 1910.10 target has been more than two months in coming, we might have expected more from the rebound. Let’s give it another day or two to develop, but trading should be with a moderately bullish bias in the meantime. Here’s the chart. _______ UPDATE (Aug 16, 7:25 p.m.): The next stop on the way to hell is 1895.60, a Hidden Pivot support sufficiently obscure that we can safely assume we own it. Bottom-fish there with a tightly stopped reverse-pattern trigger, but be aware that if the futures relapse and the support gives way easily, the October contract will be headed down to at least 1878.00. I am suggesting a reverse-pattern entry because gold tends to be most heavily manipulated in the early going. (Note: I will switch to the December contract when I update on Sunday. The equivalent downside targets lie, respectively, at 1915.20 and 1897.90.)

No change in my earlier forecast that October Gold would fall at least to D=1908.10 of the pattern shown. This ABCD is too obvious to yield a tradeable bounce precisely from the ‘hidden’ support, so we may need to let the rubes get stopped out once or twice before we attempt to bottom-fish there ourselves. Obviousness aside, the pattern is pretty ‘textbook’, and so a significant bounce would appear to be all but certain. A turbocharged one from no lower than 1921.00 or so would provide a technical rationale for getting ‘mechanically’ short at x=1983.40. However, somewhat more likely in my estimation is eventual slippage below 1908, presaging a test of spring’s lows near 1865. ______ UPDATE (Aug 15, 5:35 p.m.): Reversing a relentless plunge, gold bounced sharply from less than a point of the 1908.10 target today. However, because the 1910.10 target has been more than two months in coming, we might have expected more from the rebound. Let’s give it another day or two to develop, but trading should be with a moderately bullish bias in the meantime. Here’s the chart. _______ UPDATE (Aug 16, 7:25 p.m.): The next stop on the way to hell is 1895.60, a Hidden Pivot support sufficiently obscure that we can safely assume we own it. Bottom-fish there with a tightly stopped reverse-pattern trigger, but be aware that if the futures relapse and the support gives way easily, the October contract will be headed down to at least 1878.00. I am suggesting a reverse-pattern entry because gold tends to be most heavily manipulated in the early going. (Note: I will switch to the December contract when I update on Sunday. The equivalent downside targets lie, respectively, at 1915.20 and 1897.90.)

GCV23 – October Gold (Last:1904.50)

Posted on August 13, 2023, 5:16 pm EDT

Last Updated August 18, 2023, 11:14 pm EDT

Posted on August 13, 2023, 5:16 pm EDT

Last Updated August 18, 2023, 11:14 pm EDT

- August 15, 2023, 11:57 am

Is gold going to make a new high by the end of 2023. Many investors. are predicting it will. What do you see for the

last 4 months of 2023.