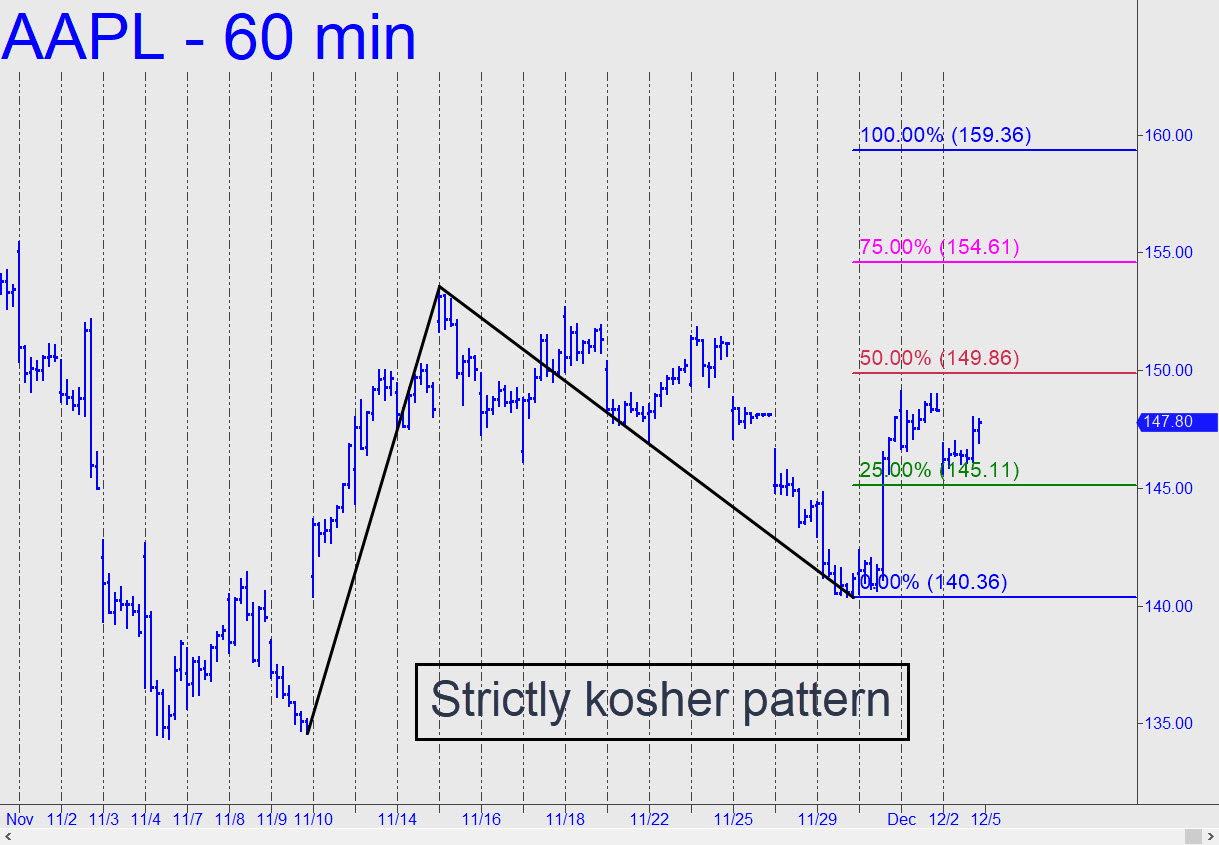

The bullish pattern shown, which projects an 8% rally to 159.36 over the near term, lacks only a fist-pump through the midpoint pivot at 149.86 to make the finishing stroke n odds-on bet. AAPL’s timidity is understandable, since the stock hasn’t been strong enough to lead the broad averages higher when they are tired. That’s because sales of pricey iPhones are facing simultaneous recessions in China, Europe and the U.S. Even so, as my quite bullish outlook for the S&Ps implies, AAPL is headed higher come hell or high water. The pattern shown looks promising for risk-averse trading on the way up, particularly on a pullback to the green line from our sweet spot just above 152. ______ UPDATE (Dec 5, 4:51 p.m.): AAPL did in fact thrust above 149.86, albeit only fleetingly in a move criminally engineered by the Ivy-educated thugs who control the stock. The equally sharp pullback has so far missed touching the green line by 26 cents, but when this happens, the stock would become a ‘mechanical’ buy, stop 140.35. _______ UPDATE (Dec 6, 8:14 p.m.): The ‘mechanical’ trade triggered, then proceeded to go underwater for the rest of the session. The pattern was a good one to gamble on, but if it fails to make money, I’d have to conclude the stock is in more trouble than I’d imagined. It’s going to be increasingly challenging for its handlers to distribute to suckers as recession begins to tighten on iPhone sales around the world.

The bullish pattern shown, which projects an 8% rally to 159.36 over the near term, lacks only a fist-pump through the midpoint pivot at 149.86 to make the finishing stroke n odds-on bet. AAPL’s timidity is understandable, since the stock hasn’t been strong enough to lead the broad averages higher when they are tired. That’s because sales of pricey iPhones are facing simultaneous recessions in China, Europe and the U.S. Even so, as my quite bullish outlook for the S&Ps implies, AAPL is headed higher come hell or high water. The pattern shown looks promising for risk-averse trading on the way up, particularly on a pullback to the green line from our sweet spot just above 152. ______ UPDATE (Dec 5, 4:51 p.m.): AAPL did in fact thrust above 149.86, albeit only fleetingly in a move criminally engineered by the Ivy-educated thugs who control the stock. The equally sharp pullback has so far missed touching the green line by 26 cents, but when this happens, the stock would become a ‘mechanical’ buy, stop 140.35. _______ UPDATE (Dec 6, 8:14 p.m.): The ‘mechanical’ trade triggered, then proceeded to go underwater for the rest of the session. The pattern was a good one to gamble on, but if it fails to make money, I’d have to conclude the stock is in more trouble than I’d imagined. It’s going to be increasingly challenging for its handlers to distribute to suckers as recession begins to tighten on iPhone sales around the world.

AAPL – Apple Computer (Last:142.92)

Posted on December 4, 2022, 5:15 pm EST

Last Updated December 6, 2022, 8:14 pm EST

Posted on December 4, 2022, 5:15 pm EST

Last Updated December 6, 2022, 8:14 pm EST