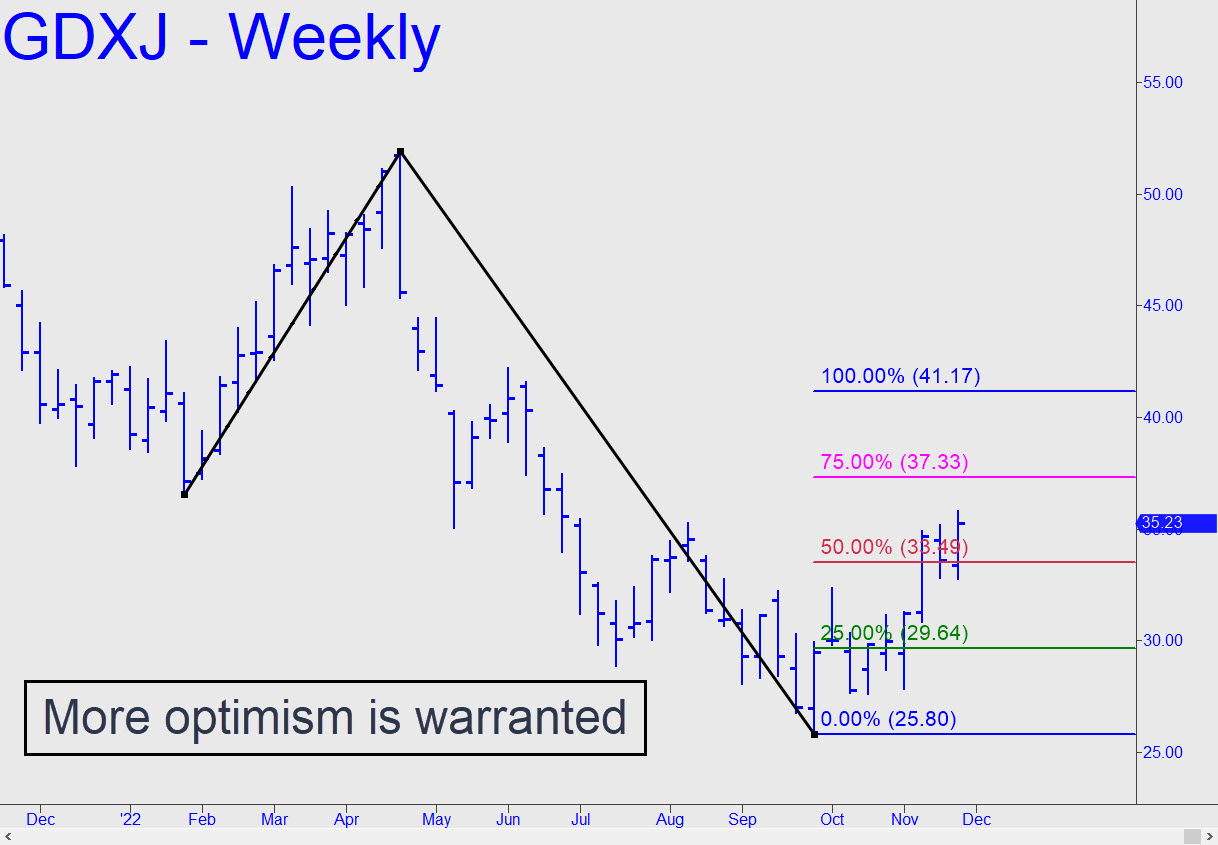

The reverse pattern shown is the most ambitious I’ve used for this vehicle in a long while, with a D target at 41.17 that lies 17% above. It seems well warranted, however, given the way the C-D leg has closed above p=33.49 for a third consecutive week after the initial push past it. Another plus is that the A-B impulse leg has yet to correct, and retracements on the daily chart have been short-lived. Actually, a more punitive pullback may be needed to set up the next big thrust, so don’t be surprised to see a swoon take out last week’s low at 32.77. That would be a buying opportunity, for sure.

The reverse pattern shown is the most ambitious I’ve used for this vehicle in a long while, with a D target at 41.17 that lies 17% above. It seems well warranted, however, given the way the C-D leg has closed above p=33.49 for a third consecutive week after the initial push past it. Another plus is that the A-B impulse leg has yet to correct, and retracements on the daily chart have been short-lived. Actually, a more punitive pullback may be needed to set up the next big thrust, so don’t be surprised to see a swoon take out last week’s low at 32.77. That would be a buying opportunity, for sure.

GDXJ – Junior Gold Miner ETF (Last:35.23)

Posted on November 27, 2022, 5:13 pm EST

Last Updated November 27, 2022, 7:41 pm EST

Posted on November 27, 2022, 5:13 pm EST

Last Updated November 27, 2022, 7:41 pm EST