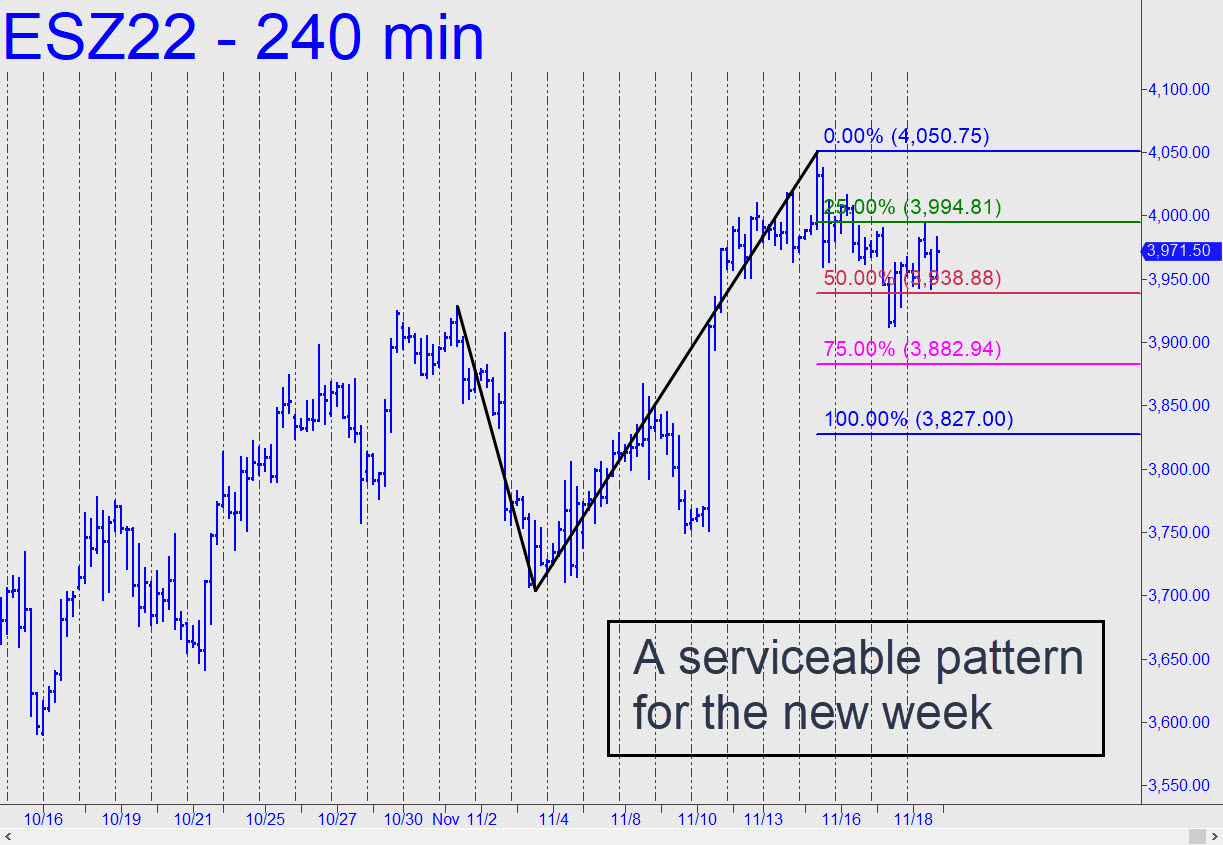

The corrective pattern shown was proffered by a keen-eyed subscriber in the chat room on Friday and should work well to keep us abreast of the trend as the new week begins. It triggered a ‘mechanical’ short in the first hour that could have been worth as much as $2,800 before the day ended. The way the downtrend penetrated p=3938 will slightly favor bears, but we’ll stay open-minded to the possibility that DaBoyz will blow out the reverse pattern’s ‘c’ high at 4050.75 Sunday night or Monday. If not, try bottom-fishing at D=3827.00 with as tight a stop-loss as you can craft. _______ UPDATE (Nov 22, 6:41 p.m.): The short at 3994.81, stop 4051.00, triggered at 1:45 p.m. EST. Those of us who swear by ‘mechanical’ trades are obliged to love this one, if only in theory, since who in their right mind would want to initiate a short at the tail end of a Tuesday before Thanksgiving? The implied $11,000 risk on four contracts argues for a bit of ‘camo’ on the entry. Depending on how things play out between now and tomorrow morning, I may get a chance to explain exactly how this trade might have been done at tomorrow’s tutorial session. In the meantime, do NOT short this rabid badger.

The corrective pattern shown was proffered by a keen-eyed subscriber in the chat room on Friday and should work well to keep us abreast of the trend as the new week begins. It triggered a ‘mechanical’ short in the first hour that could have been worth as much as $2,800 before the day ended. The way the downtrend penetrated p=3938 will slightly favor bears, but we’ll stay open-minded to the possibility that DaBoyz will blow out the reverse pattern’s ‘c’ high at 4050.75 Sunday night or Monday. If not, try bottom-fishing at D=3827.00 with as tight a stop-loss as you can craft. _______ UPDATE (Nov 22, 6:41 p.m.): The short at 3994.81, stop 4051.00, triggered at 1:45 p.m. EST. Those of us who swear by ‘mechanical’ trades are obliged to love this one, if only in theory, since who in their right mind would want to initiate a short at the tail end of a Tuesday before Thanksgiving? The implied $11,000 risk on four contracts argues for a bit of ‘camo’ on the entry. Depending on how things play out between now and tomorrow morning, I may get a chance to explain exactly how this trade might have been done at tomorrow’s tutorial session. In the meantime, do NOT short this rabid badger.

ESZ22 – Dec E-Mini S&Ps (Last:4010.25)

Posted on November 20, 2022, 5:20 pm EST

Last Updated November 22, 2022, 6:41 pm EST

Posted on November 20, 2022, 5:20 pm EST

Last Updated November 22, 2022, 6:41 pm EST