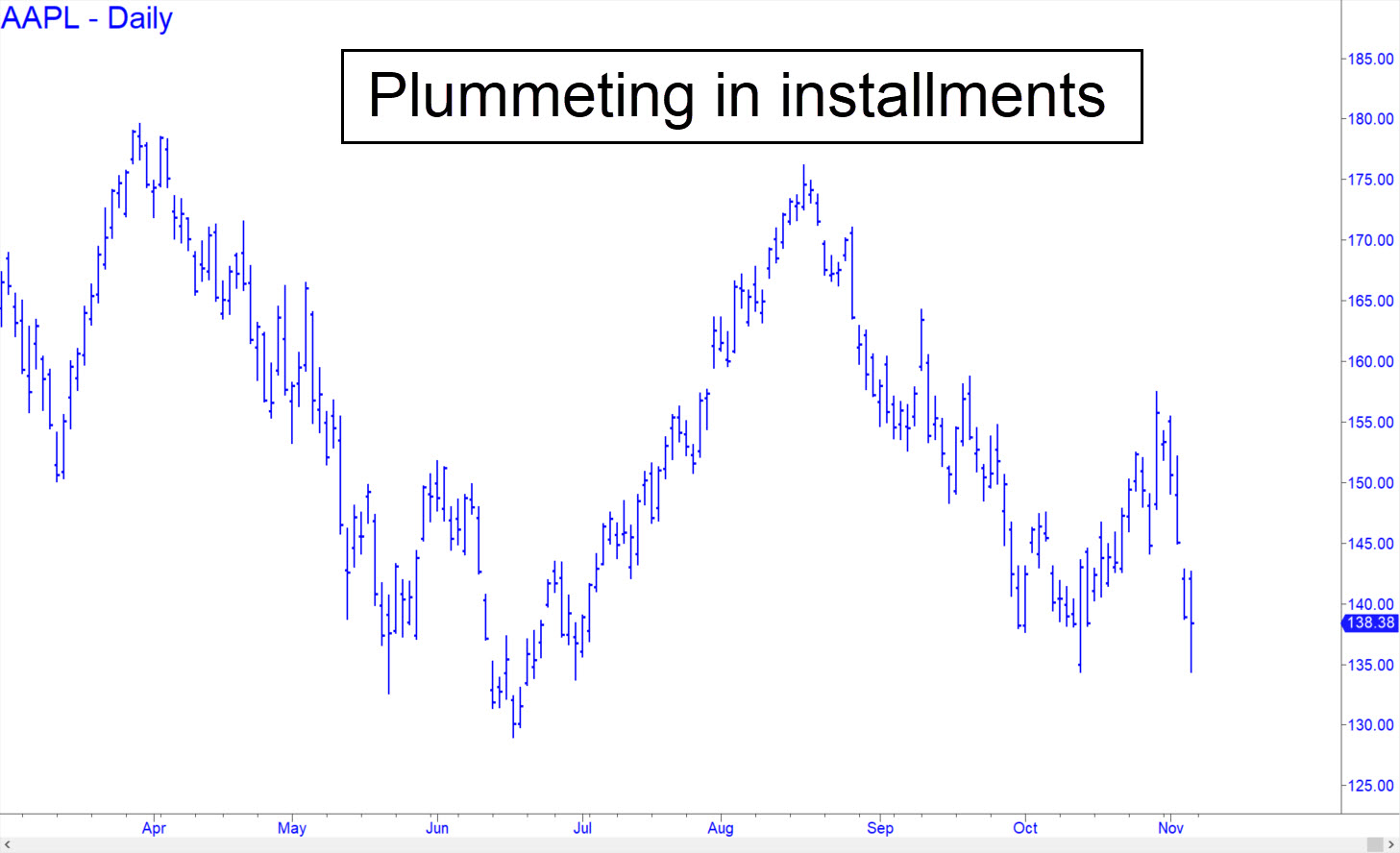

As forecast, AAPL has plunged into the mid-$130s, The prediction was unrelated to Hidden Pivot targets, but rather to the likelihood that there will be many visually compelling stops along the way down to $50 or lower. That’s where I see the stock headed, an outlook that I started drum-rolling months ago when the company bragged about how well sales were holding up. One of iPhone’s key markets, Europe, was already in the throes of a slowdown that threatens to be far worse than a garden-variety recession. At the same time, China was starting to slip into an abyss of its own, with the U.S. economy presumably not far behind. Under the circumstances, the shares of Apple, whose revenues come mainly from sales of the relatively pricey iPhone, have nowhere to go but down. Considering the company’s size, it is arguably the most vulnerable consumer goods company in the world with recession bearing down on us. From a technical standpoint, I expect the stock to bounce from one of my ‘voodoo numbers’ before falling to test last June’s $129 low. I’ll say nothing more about this, however, unless there is very strong interest in the chat room. Let me remind you nevertheless: As AAPL goes, so goes the stock market. Get the stock exactly right and you will get the bear market exactly right. _______ UPDATE (Nov 9, 6:43 p.m.): Bears have been struggling to crush this once-might stock, which is still capable of intimidating with doomed rallies. A test of mid-June’s low at 129.04 seems so obvious that I have not prepared a chart with Hidden Pivot levels to target the downtrend. Another reason is that the little p.o.s. has a habit of leaving sausage ‘B’ lows to terrorize and bamboozle erstwhile bottom-fishers. Such lows diminish the accuracy and reliability of Hidden Pivot patterns. Here’s a chart that shows the big picture. _______ UPDATE (Nov 10, 6:59 p.m.): I’ve set an alert at 158.75, a tick above the Sep 21 ‘external’ peak, to warn me if and when bulls have taken charge, even if only temporarily.

As forecast, AAPL has plunged into the mid-$130s, The prediction was unrelated to Hidden Pivot targets, but rather to the likelihood that there will be many visually compelling stops along the way down to $50 or lower. That’s where I see the stock headed, an outlook that I started drum-rolling months ago when the company bragged about how well sales were holding up. One of iPhone’s key markets, Europe, was already in the throes of a slowdown that threatens to be far worse than a garden-variety recession. At the same time, China was starting to slip into an abyss of its own, with the U.S. economy presumably not far behind. Under the circumstances, the shares of Apple, whose revenues come mainly from sales of the relatively pricey iPhone, have nowhere to go but down. Considering the company’s size, it is arguably the most vulnerable consumer goods company in the world with recession bearing down on us. From a technical standpoint, I expect the stock to bounce from one of my ‘voodoo numbers’ before falling to test last June’s $129 low. I’ll say nothing more about this, however, unless there is very strong interest in the chat room. Let me remind you nevertheless: As AAPL goes, so goes the stock market. Get the stock exactly right and you will get the bear market exactly right. _______ UPDATE (Nov 9, 6:43 p.m.): Bears have been struggling to crush this once-might stock, which is still capable of intimidating with doomed rallies. A test of mid-June’s low at 129.04 seems so obvious that I have not prepared a chart with Hidden Pivot levels to target the downtrend. Another reason is that the little p.o.s. has a habit of leaving sausage ‘B’ lows to terrorize and bamboozle erstwhile bottom-fishers. Such lows diminish the accuracy and reliability of Hidden Pivot patterns. Here’s a chart that shows the big picture. _______ UPDATE (Nov 10, 6:59 p.m.): I’ve set an alert at 158.75, a tick above the Sep 21 ‘external’ peak, to warn me if and when bulls have taken charge, even if only temporarily.

AAPL – Apple Computer (Last:146.87)

Posted on November 6, 2022, 5:18 pm EST

Last Updated November 10, 2022, 6:58 pm EST

Posted on November 6, 2022, 5:18 pm EST

Last Updated November 10, 2022, 6:58 pm EST