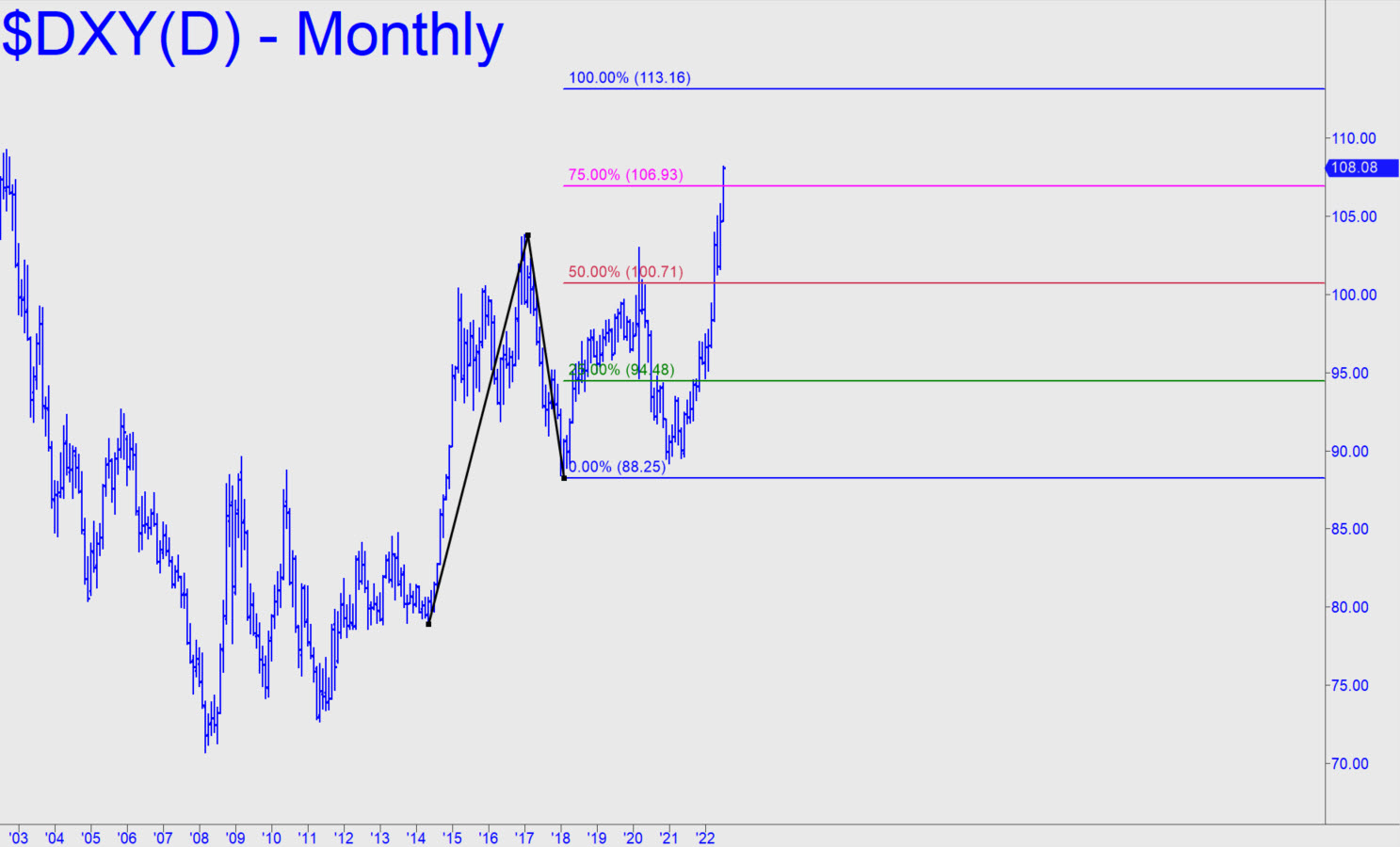

DXY has blown past a 107.57 rally target today that, although not minor, is less important than the one at 113.16 shown in the chart (inset). More immediately, however, there is this Hidden Pivot resistance to contend with at 108.62. It can serve as a minimum upside projection for the near term, and although we should expect a tradeable pullback from it, the higher target at 113.16 looks nearly as likely to be reached. To keep these middling price objectives in perspective, in interviews over the last 15 years I’ve predicted that the dollar eventually would test highs near 120 recorded as the new Millennium began. I’ve also suggested thinking like a deflationist if you want to make clear sense of the economy, Fed policy, the financial system and the ruinous deflation that has become all but inevitable for the U.S. and the world. _______ UPDATE (Jul 13, 9:35 p.m.): DXY turned wildly aerobatic after rallying to within a hair (four cents) of the 108.62 target. When the craziness subsides, expect the consolidation to give way to a renewed push toward 113.16. _______ UPDATE (Jul 24): The rally subsequently poked above 108.62, topping at 109.29, before a so-far moderate correction set in. The 113.16 target remains viable and presumably will be achieved when the pullback has run its course. Here’s a current chart.

DXY has blown past a 107.57 rally target today that, although not minor, is less important than the one at 113.16 shown in the chart (inset). More immediately, however, there is this Hidden Pivot resistance to contend with at 108.62. It can serve as a minimum upside projection for the near term, and although we should expect a tradeable pullback from it, the higher target at 113.16 looks nearly as likely to be reached. To keep these middling price objectives in perspective, in interviews over the last 15 years I’ve predicted that the dollar eventually would test highs near 120 recorded as the new Millennium began. I’ve also suggested thinking like a deflationist if you want to make clear sense of the economy, Fed policy, the financial system and the ruinous deflation that has become all but inevitable for the U.S. and the world. _______ UPDATE (Jul 13, 9:35 p.m.): DXY turned wildly aerobatic after rallying to within a hair (four cents) of the 108.62 target. When the craziness subsides, expect the consolidation to give way to a renewed push toward 113.16. _______ UPDATE (Jul 24): The rally subsequently poked above 108.62, topping at 109.29, before a so-far moderate correction set in. The 113.16 target remains viable and presumably will be achieved when the pullback has run its course. Here’s a current chart.

DXY – NYBOT Dollar Index (Last:106.58)

Posted on July 11, 2022, 2:10 pm EDT

Last Updated July 24, 2022, 10:58 am EDT

Posted on July 11, 2022, 2:10 pm EDT

Last Updated July 24, 2022, 10:58 am EDT