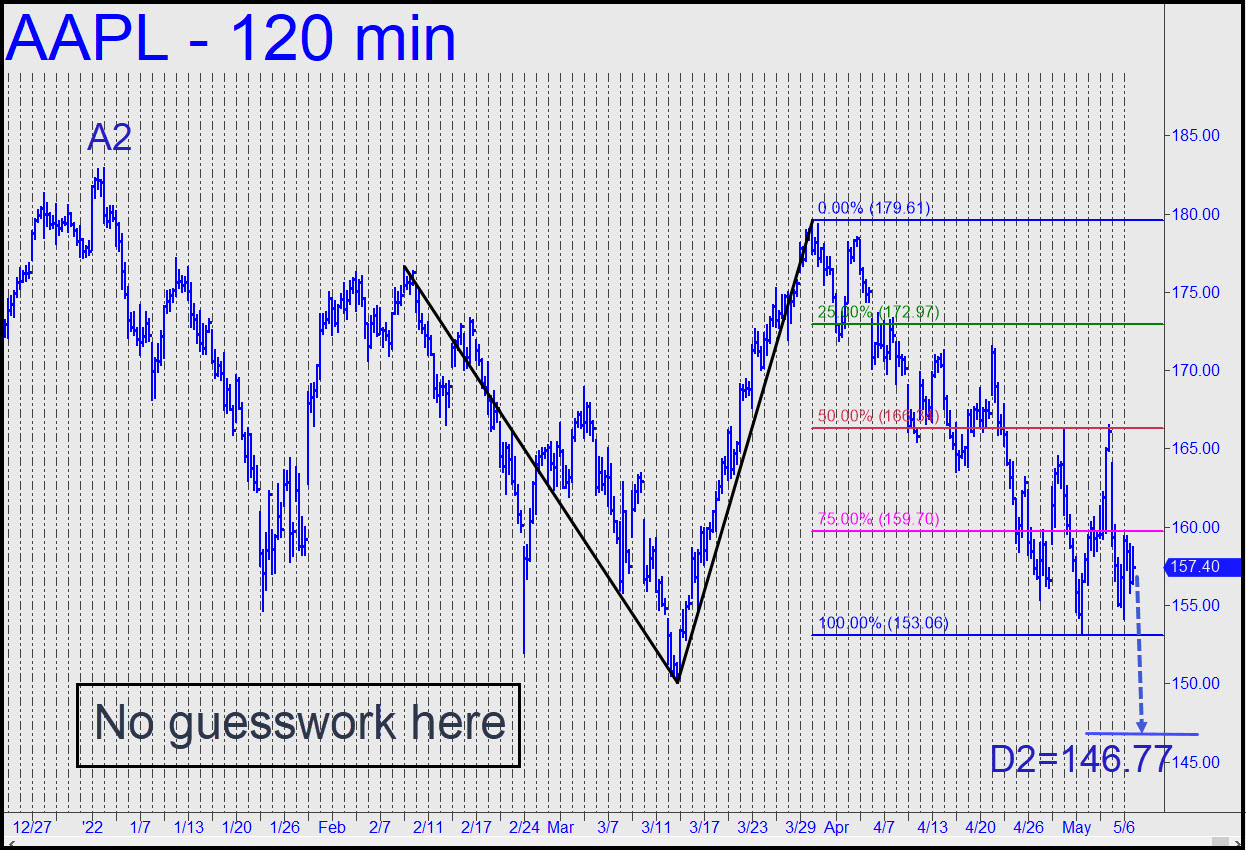

The bearish, big-picture pattern shown was validated last week by the powerful short-squeeze rally precisely from its D target at 153.00. I did not feature this picture earlier because I was focused on an even bigger one, but I’m somewhat relieved to see that it would not have gotten us short ‘mechanically’ in any event. That’s because the downtrend until this week did not produce any corrective bounces sufficient to trip a short-sale signal. Looking ahead, we can rely confidently on the new pattern, starting at A2, to give us a juicy trading opportunity at D2=146.77. That is where AAPL is going, and I won’t queer the usefulness of the target by discussing it any further, including in the chat room. I have not put it in boldface green as I usually do, I have not put a $ sign next to the symbol to indicate this tout is actionable, and I will bury it toward the bottom of the list so that the tout will have a better chance of being “our little secret.” Keep in mind something I have repeated here many times: AAPL is the only stock that matters. Get it right, and you get the market right. _______ UPDATE (May 11, 10:54 p.m. EDT): I expect my targets to work very precisely when they are derived from patterns as clear as the one shown in the chart. The so-far 66-cent overshoot of 146.77 has left the stock straddling the bull/bear divide, but my bias is bearish nonetheless and will become moreso if the grifters and pederasts who control AAPL open it on Thursday with a weak short-squeeze. _______ UPDATE (May 12, 10:20 p.m.): Sellers have trashed every ‘D’ Hidden Pivot, major and minor, leaving only last October’s low at 138.27 to break the stock’s fall. I aired this information in the chat room after AAPL pulped the Hidden Pivot support at 146.77, although few seem to be trading the stock. In any event, I expect the low to be tested since it came in such an obvious spot.

The bearish, big-picture pattern shown was validated last week by the powerful short-squeeze rally precisely from its D target at 153.00. I did not feature this picture earlier because I was focused on an even bigger one, but I’m somewhat relieved to see that it would not have gotten us short ‘mechanically’ in any event. That’s because the downtrend until this week did not produce any corrective bounces sufficient to trip a short-sale signal. Looking ahead, we can rely confidently on the new pattern, starting at A2, to give us a juicy trading opportunity at D2=146.77. That is where AAPL is going, and I won’t queer the usefulness of the target by discussing it any further, including in the chat room. I have not put it in boldface green as I usually do, I have not put a $ sign next to the symbol to indicate this tout is actionable, and I will bury it toward the bottom of the list so that the tout will have a better chance of being “our little secret.” Keep in mind something I have repeated here many times: AAPL is the only stock that matters. Get it right, and you get the market right. _______ UPDATE (May 11, 10:54 p.m. EDT): I expect my targets to work very precisely when they are derived from patterns as clear as the one shown in the chart. The so-far 66-cent overshoot of 146.77 has left the stock straddling the bull/bear divide, but my bias is bearish nonetheless and will become moreso if the grifters and pederasts who control AAPL open it on Thursday with a weak short-squeeze. _______ UPDATE (May 12, 10:20 p.m.): Sellers have trashed every ‘D’ Hidden Pivot, major and minor, leaving only last October’s low at 138.27 to break the stock’s fall. I aired this information in the chat room after AAPL pulped the Hidden Pivot support at 146.77, although few seem to be trading the stock. In any event, I expect the low to be tested since it came in such an obvious spot.

AAPL – Apple Computer (Last:142.56)

Posted on May 8, 2022, 5:05 pm EDT

Last Updated May 12, 2022, 10:22 pm EDT

Posted on May 8, 2022, 5:05 pm EDT

Last Updated May 12, 2022, 10:22 pm EDT