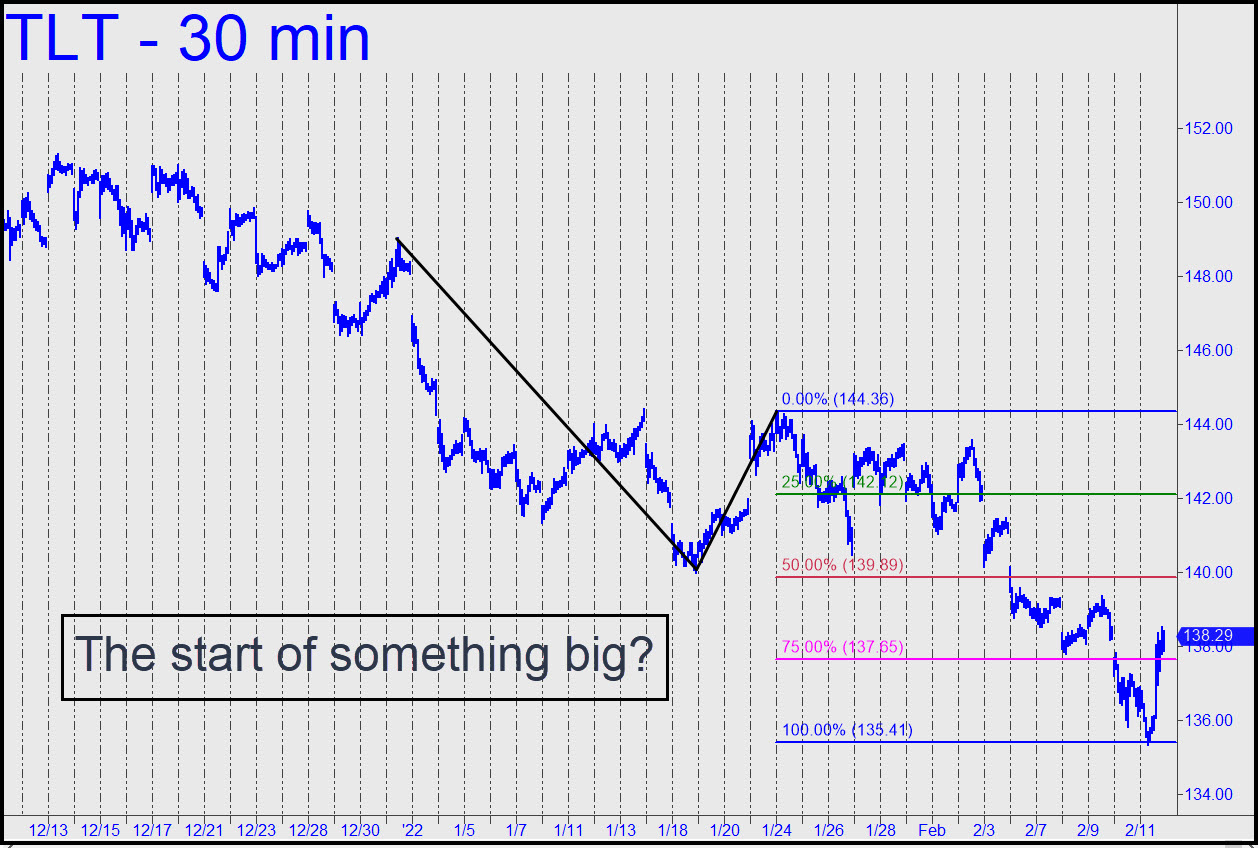

The chart raises the question of whether Friday’s sharp bounce precisely from the ‘D’ target of a fairly large, bearish pattern is the start of a major rally. We’ll keep an open mind rather than speculate, trading this vehicle as opportunities present themselves. Subscribers who bottom-fished as I suggested would be cushioned by partial profits booked after TLT reversed with a powerful leap. The run-up caused Feb 22 138 calls to more than quadruple in value, but whichever options you used, gains already booked should be sufficient to put your mind at ease about holding onto a few for a swing at the fences. You can rotate them into the future with calendar spreads, but in any case please let me know in the chat room if you need further guidance. ______ UPDATE (Feb 15, 11:15 p.m. EST): The resumption today of TLT’s death spiral should serve to renew our focus on the 3.01% rate I’ve projected for the long bond. It currently sits at 2.36%, up from 1.70% in early December.

The chart raises the question of whether Friday’s sharp bounce precisely from the ‘D’ target of a fairly large, bearish pattern is the start of a major rally. We’ll keep an open mind rather than speculate, trading this vehicle as opportunities present themselves. Subscribers who bottom-fished as I suggested would be cushioned by partial profits booked after TLT reversed with a powerful leap. The run-up caused Feb 22 138 calls to more than quadruple in value, but whichever options you used, gains already booked should be sufficient to put your mind at ease about holding onto a few for a swing at the fences. You can rotate them into the future with calendar spreads, but in any case please let me know in the chat room if you need further guidance. ______ UPDATE (Feb 15, 11:15 p.m. EST): The resumption today of TLT’s death spiral should serve to renew our focus on the 3.01% rate I’ve projected for the long bond. It currently sits at 2.36%, up from 1.70% in early December.

TLT – Lehman Bond ETF (Last:134.97)

Posted on February 13, 2022, 5:15 pm EST

Last Updated February 16, 2022, 1:42 pm EST

Posted on February 13, 2022, 5:15 pm EST

Last Updated February 16, 2022, 1:42 pm EST