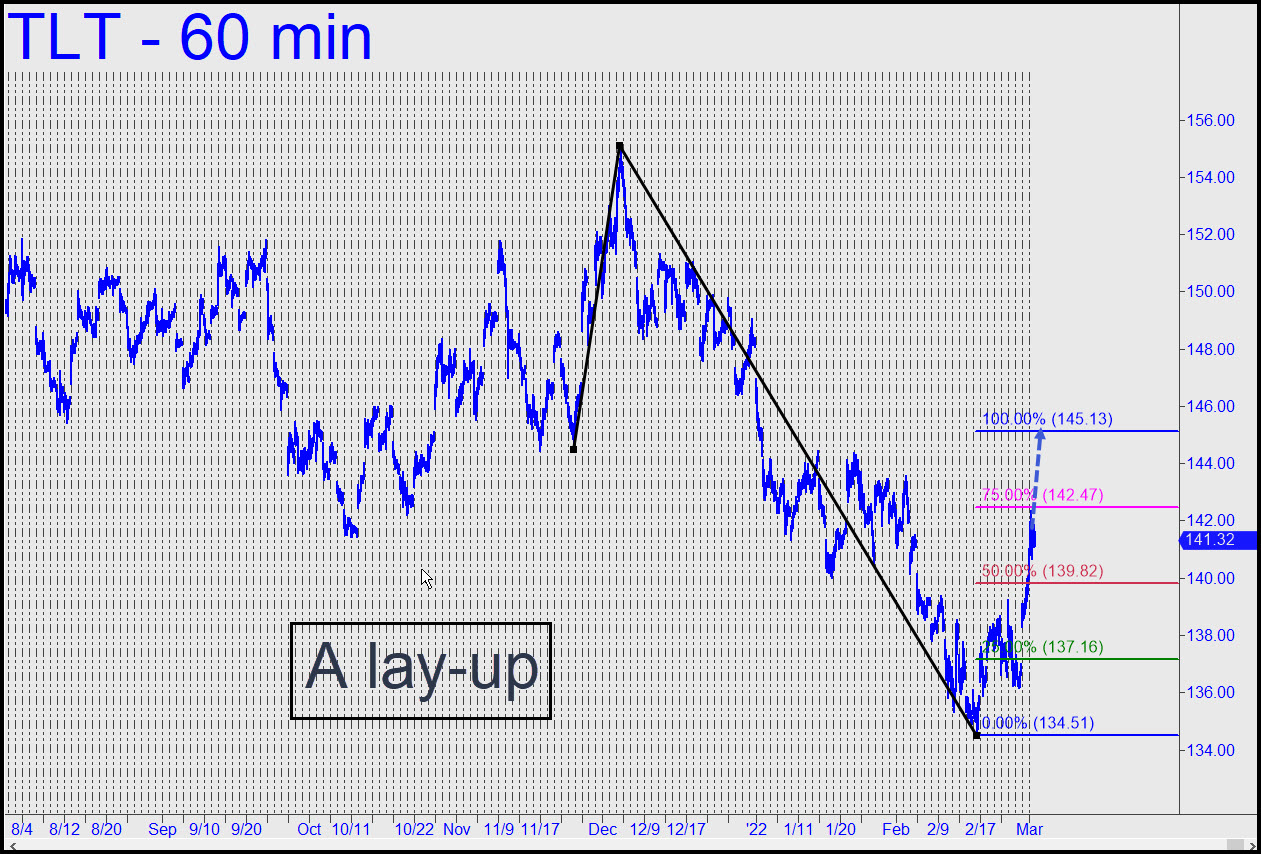

TLT has bounced from a place that is obvious only to us — the swaddling bosom, as it were, of a visually defined ‘discomfort zone’. That means the rally has been endowed with enough mystery and surprise to juice it pretty good. Will bulls seize the advantage ? Rather than try to predict, we’ll simply keep an eye on it and trade TLT with a bullish bias. Bring your timely ideas to the chat room if you’re interested and I will gladly vet and score them using Morning Line odds. _______ UPDATE (Mar 2, 12:10 a.m.): The rally looks certain to hit a minimum D=145.13, given the way buyers obliterated midpoint resistance today at p=139.82. Here’s the chart. ______ UPDATE (Mar 2, 8:05): The worst selloff in recent memory triggered a ‘mechanical’ buy at x=137.19, stop 134.50. No one mentioned this opportunity, but I’ll track it as a paper-trade nonetheless. We’re looking to exit at least half at p=139.82. _______ UPDATE (Mar 3, 10:52 p.m.): Once again, a ‘mechanical’ trade has caught the low of a scary dive to produce a quick and relatively painless winner. T-Bonds’ sharp reversal this evening has pushed TLT up to the 139.82 midpoint pivot where I’d advised selling half. If you used expiring, near-the-money calls, they should have more than tripled in value. Selling TLT against the calls tonight would hedge the profit with a backspread. Here’s the chart, with the elongated green bar representing night-session price action.

TLT has bounced from a place that is obvious only to us — the swaddling bosom, as it were, of a visually defined ‘discomfort zone’. That means the rally has been endowed with enough mystery and surprise to juice it pretty good. Will bulls seize the advantage ? Rather than try to predict, we’ll simply keep an eye on it and trade TLT with a bullish bias. Bring your timely ideas to the chat room if you’re interested and I will gladly vet and score them using Morning Line odds. _______ UPDATE (Mar 2, 12:10 a.m.): The rally looks certain to hit a minimum D=145.13, given the way buyers obliterated midpoint resistance today at p=139.82. Here’s the chart. ______ UPDATE (Mar 2, 8:05): The worst selloff in recent memory triggered a ‘mechanical’ buy at x=137.19, stop 134.50. No one mentioned this opportunity, but I’ll track it as a paper-trade nonetheless. We’re looking to exit at least half at p=139.82. _______ UPDATE (Mar 3, 10:52 p.m.): Once again, a ‘mechanical’ trade has caught the low of a scary dive to produce a quick and relatively painless winner. T-Bonds’ sharp reversal this evening has pushed TLT up to the 139.82 midpoint pivot where I’d advised selling half. If you used expiring, near-the-money calls, they should have more than tripled in value. Selling TLT against the calls tonight would hedge the profit with a backspread. Here’s the chart, with the elongated green bar representing night-session price action.

TLT – Lehman Bond ETF (Last:136.41)

Posted on February 20, 2022, 5:08 pm EST

Last Updated March 3, 2022, 10:52 pm EST

Posted on February 20, 2022, 5:08 pm EST

Last Updated March 3, 2022, 10:52 pm EST