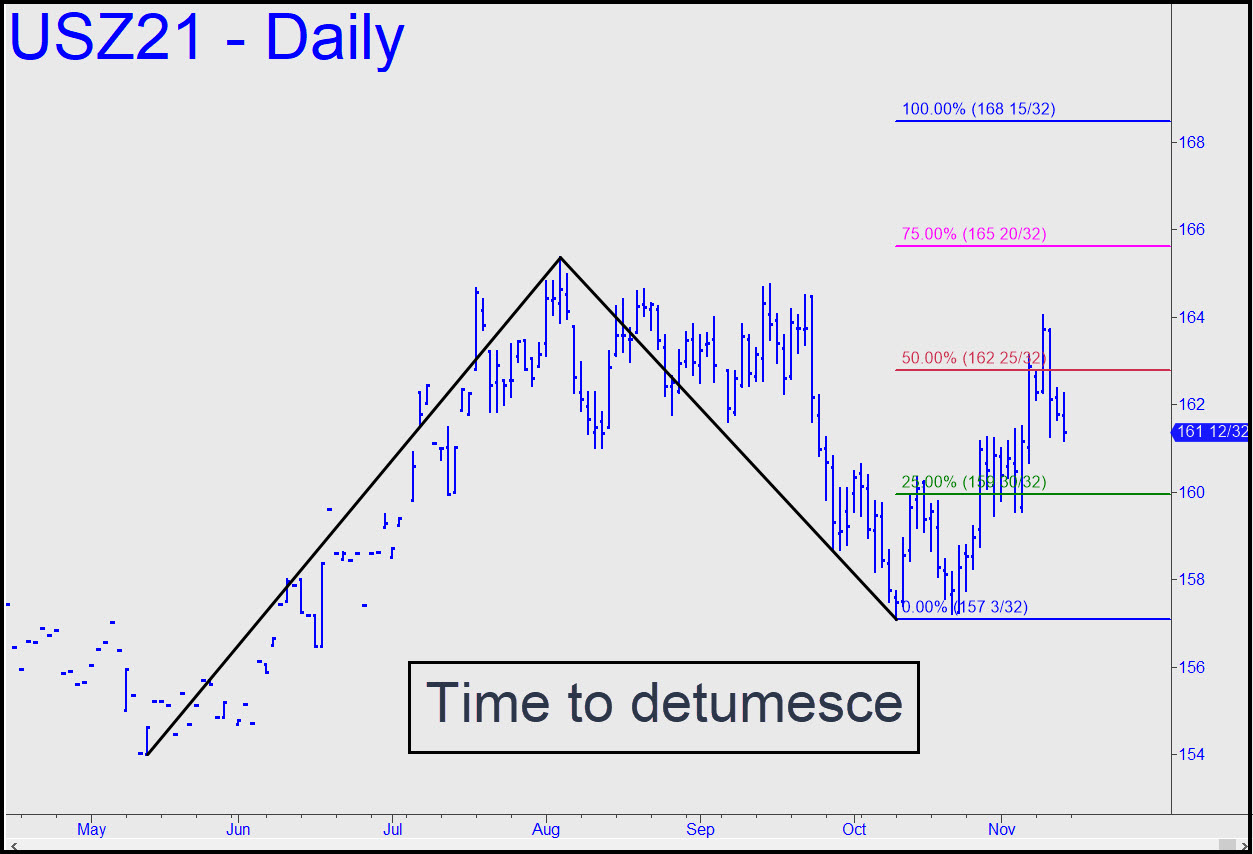

The chart is bullish, but not very. A strong rally from the 157^03 low recorded on October 22 looks spent without having taken out any old highs. This suggests the pullback begun last week will need to correct for perhaps another 4-7 days before the futures can attempt a new launch. If the selloff comes down to the green line (x=159^30), it would trigger a mildly appealing ‘mechanical’ buy, stop 157^03. The implied entry risk on four contracts would exceed $10,000, so check the Trading Room for guidance before you attempt this. _______ UPDATE (Nov 15, 6:52 p.m. ET): In a chat room post this morning, I ratcheted up my enthusiasm for the trade suggested above. I’d wait till the futures touch the green line (159^30) before fashioning a ‘camo’ entry trigger, but here’s an example with just $100 of theoretical entry risk per contract that triggered and is profitable at the moment. The purpose of these camo trades is not to make a pile of money, but to take advantage of bigger-picture opportunities with initial risk reduced to a practical minimum. ______UPDATE (Nov 16, 5:20 p.m.): The futures have tripped two profitable ‘camo’ trades off a big-picture ‘mechanical’ X at 159^30 that would be stopped at 157^02. Neither went the distance, but the goal is to hold 25% of the original ‘camo’ position for a swing at the fences. I will vet similar trades if there’s interest in the chat room. Our expectation is to make at least a little money even if the bigger trade doesn’t work out.

The chart is bullish, but not very. A strong rally from the 157^03 low recorded on October 22 looks spent without having taken out any old highs. This suggests the pullback begun last week will need to correct for perhaps another 4-7 days before the futures can attempt a new launch. If the selloff comes down to the green line (x=159^30), it would trigger a mildly appealing ‘mechanical’ buy, stop 157^03. The implied entry risk on four contracts would exceed $10,000, so check the Trading Room for guidance before you attempt this. _______ UPDATE (Nov 15, 6:52 p.m. ET): In a chat room post this morning, I ratcheted up my enthusiasm for the trade suggested above. I’d wait till the futures touch the green line (159^30) before fashioning a ‘camo’ entry trigger, but here’s an example with just $100 of theoretical entry risk per contract that triggered and is profitable at the moment. The purpose of these camo trades is not to make a pile of money, but to take advantage of bigger-picture opportunities with initial risk reduced to a practical minimum. ______UPDATE (Nov 16, 5:20 p.m.): The futures have tripped two profitable ‘camo’ trades off a big-picture ‘mechanical’ X at 159^30 that would be stopped at 157^02. Neither went the distance, but the goal is to hold 25% of the original ‘camo’ position for a swing at the fences. I will vet similar trades if there’s interest in the chat room. Our expectation is to make at least a little money even if the bigger trade doesn’t work out.

USZ21 – December T-Bonds (Last:159^29)

Posted on November 14, 2021, 5:12 pm EST

Last Updated November 16, 2021, 5:24 pm EST

Posted on November 14, 2021, 5:12 pm EST

Last Updated November 16, 2021, 5:24 pm EST