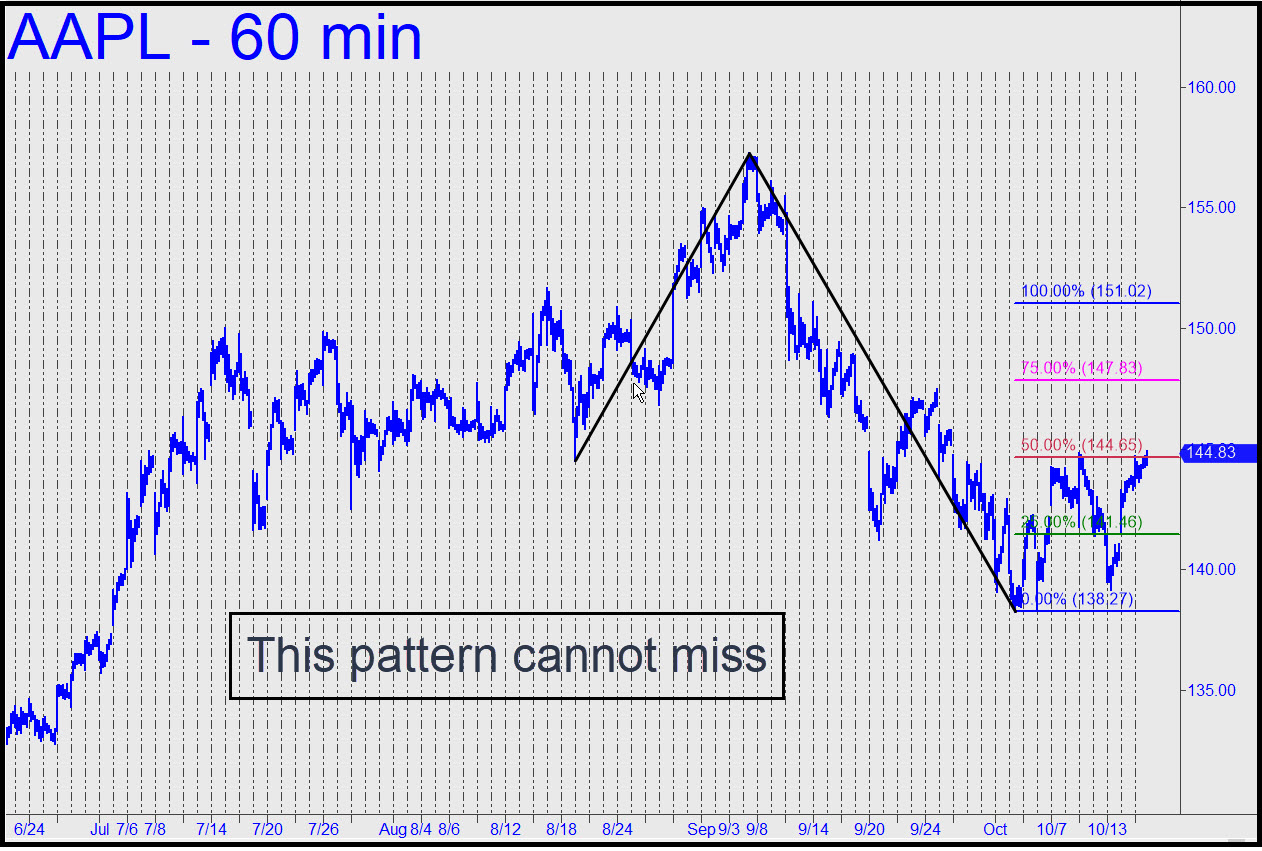

Considering that AAPL is the most dependable bellwether we could have imagined for a bull market that has been powered by virtually unlimited quantities of money and unprecedented hubris, we should be most gratified to see it tracking a pattern that absolutely, positively cannot miss. By that I mean that the 151.02 target when reached will produce a precisely shortable peak, and that a decisive push past p on Monday or Tuesday will all but guarantee that ‘D’ will be achieved. The pattern has also produced a juicy ‘mechanical’ buy that would have yielded a $1,280 gain on four round lots. Moreover, it seems likely that any more such signals would work equally well. The only uncertainty in the picture is the precise stall Friday at the midpoint Hidden Pivot, 144.65. This is the second stall there in a week, and for all we know it could mark the end of the bull market. I mention this because the very suggestion sounds so ridiculous. To be sure, AAPL is taking its sweet old time pushing past p=144.65. But we shouldn’t mistake this for weakness; it is deception, really, and that is why the bearish buzz that permeated the Rick’s Picks chat room on Friday seemed so odd. Are bears seeing what I am seeing? Evidently not.

Considering that AAPL is the most dependable bellwether we could have imagined for a bull market that has been powered by virtually unlimited quantities of money and unprecedented hubris, we should be most gratified to see it tracking a pattern that absolutely, positively cannot miss. By that I mean that the 151.02 target when reached will produce a precisely shortable peak, and that a decisive push past p on Monday or Tuesday will all but guarantee that ‘D’ will be achieved. The pattern has also produced a juicy ‘mechanical’ buy that would have yielded a $1,280 gain on four round lots. Moreover, it seems likely that any more such signals would work equally well. The only uncertainty in the picture is the precise stall Friday at the midpoint Hidden Pivot, 144.65. This is the second stall there in a week, and for all we know it could mark the end of the bull market. I mention this because the very suggestion sounds so ridiculous. To be sure, AAPL is taking its sweet old time pushing past p=144.65. But we shouldn’t mistake this for weakness; it is deception, really, and that is why the bearish buzz that permeated the Rick’s Picks chat room on Friday seemed so odd. Are bears seeing what I am seeing? Evidently not.

AAPL – Apple Computer (Last:144.83)

Posted on October 17, 2021, 5:20 pm EDT

Last Updated October 21, 2021, 6:00 pm EDT

Posted on October 17, 2021, 5:20 pm EDT

Last Updated October 21, 2021, 6:00 pm EDT