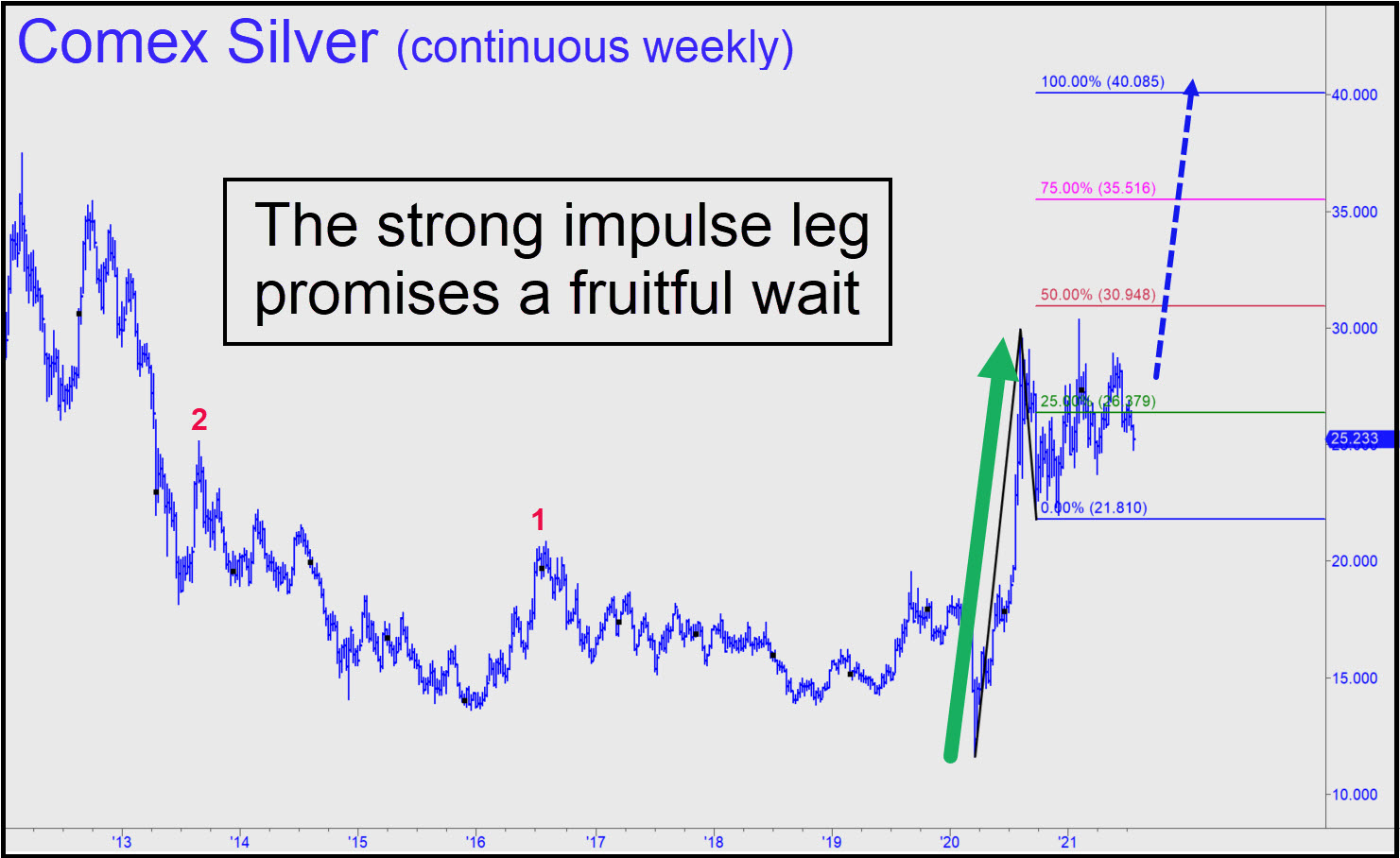

The steep rally that occurred between March 2020 and August created an impulse leg with sufficient power that the likelihood of a second rally leg to as high as 40.085 should not be doubted. However, buyers’ digestion pains have rankled us for nearly a year, and there can be no guarantees they will end any time soon. There is still a presumption nevertheless that the futures will achieve a minimum 30.95 (p) without stopping out the ‘c’ low of the bullish pattern. In the meantime, the best we can do is stake out a long position on the lesser charts when a good opportunity arises. That would allow us to keep half for a swing at the fences. _______ UPDATE (Jul 27, 9:17 p.m. ET): The gnarly pattern shown in this chart predicted the low precisely. But how long will it last? It took the futures six weeks to get there, so the bounce should be more than just an overnighter. If not, then the next logical step-down would be to 24.04, a Hidden Pivot support that can be bottom-fished in any of the usual ways, including with a bid and a very tight stop-loss.

The steep rally that occurred between March 2020 and August created an impulse leg with sufficient power that the likelihood of a second rally leg to as high as 40.085 should not be doubted. However, buyers’ digestion pains have rankled us for nearly a year, and there can be no guarantees they will end any time soon. There is still a presumption nevertheless that the futures will achieve a minimum 30.95 (p) without stopping out the ‘c’ low of the bullish pattern. In the meantime, the best we can do is stake out a long position on the lesser charts when a good opportunity arises. That would allow us to keep half for a swing at the fences. _______ UPDATE (Jul 27, 9:17 p.m. ET): The gnarly pattern shown in this chart predicted the low precisely. But how long will it last? It took the futures six weeks to get there, so the bounce should be more than just an overnighter. If not, then the next logical step-down would be to 24.04, a Hidden Pivot support that can be bottom-fished in any of the usual ways, including with a bid and a very tight stop-loss.

SIU21 – September Silver (Last:24.77)

Posted on July 25, 2021, 5:06 pm EDT

Last Updated July 27, 2021, 9:18 pm EDT

Posted on July 25, 2021, 5:06 pm EDT

Last Updated July 27, 2021, 9:18 pm EDT