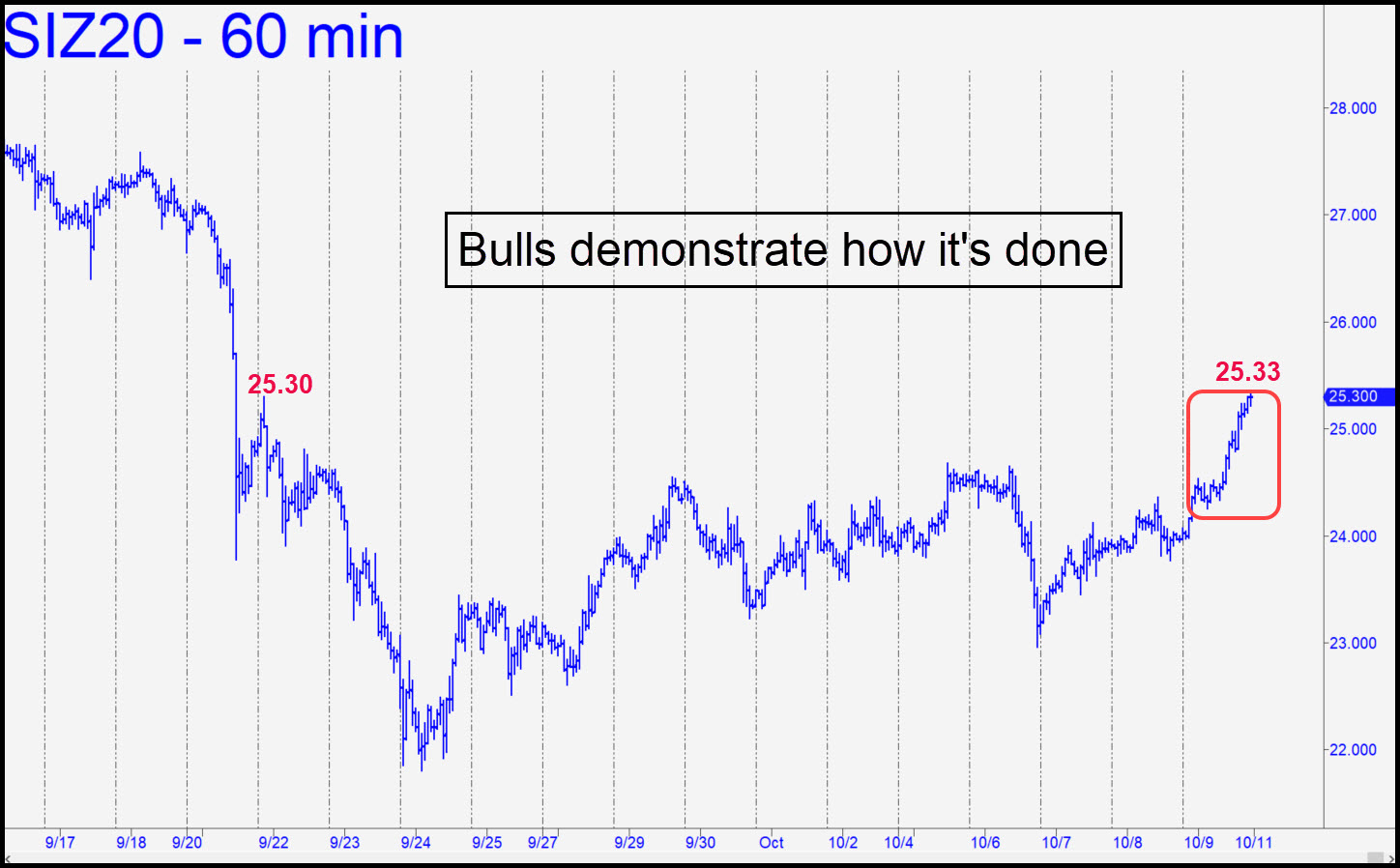

December Silver performed beautifully on Friday, gaining some tough yardage at the end of the day that put it just above an ‘external’ peak at 25.30 recorded on September 21. This subtle but technically significant feat, which created an impulse leg on the hourly chart, adds to the likelihood that gold will duplicate it shortly. It also implies that the current rally will be stronger than the one which lifted the futures off a deeply oversold bottom at 21.81 recorded on September 24. Stay tuned to the chat room for trading guidance, since getting aboard a rally this steep will require deft use of a ‘mechanical’ set-up on a lesser chart. ______ UPDATE (Oct 13, 1:57 p.m.): So very delicately attuned to the dollar’s ups and downs have silver and gold become that today’s strong rally in the former has caused quotes in the latter to plunge. This has not undone the bullish impulse leg noted above, it has merely brought bulls another all-too-familiar day of disappointment. ______ UPDATE (Oct 14, 7:47 p.m.): With a point ‘B’ low that is pure sausage, the downtrend shown in this chart lacks the legitimacy and authority of the one I’ve suggested bottom-fishing in gold. Be that as it may, Silver’s ABC looks good enough for government work, implying you can try bottom-fishing anyway at p=24.08. This assumes you know how to minimize the entry risk with a small-interval rABC set-up or some method or your own. ______ UPDATE (Oct 15, 9:13 a.m.): The trade worked almost as well as the one suggested in December Gold, producing a theoretical gain of as much as $1100 per contract overnight. The futures have since relapsed and appear bound for the pattern’s 23.43 ‘D’ target. _______ UPDATE (Oct 15, 5:56 p.m.): Although the futures fell overnight, a 28-cent rally on the way down from 24.05 would have racked up a gain of around $1100 for anyone who followed my recommendation. Now, as I’ve done in gold, I’m reversing my focus to the upside. This implies a move to at least p=25.023 of this pattern.

December Silver performed beautifully on Friday, gaining some tough yardage at the end of the day that put it just above an ‘external’ peak at 25.30 recorded on September 21. This subtle but technically significant feat, which created an impulse leg on the hourly chart, adds to the likelihood that gold will duplicate it shortly. It also implies that the current rally will be stronger than the one which lifted the futures off a deeply oversold bottom at 21.81 recorded on September 24. Stay tuned to the chat room for trading guidance, since getting aboard a rally this steep will require deft use of a ‘mechanical’ set-up on a lesser chart. ______ UPDATE (Oct 13, 1:57 p.m.): So very delicately attuned to the dollar’s ups and downs have silver and gold become that today’s strong rally in the former has caused quotes in the latter to plunge. This has not undone the bullish impulse leg noted above, it has merely brought bulls another all-too-familiar day of disappointment. ______ UPDATE (Oct 14, 7:47 p.m.): With a point ‘B’ low that is pure sausage, the downtrend shown in this chart lacks the legitimacy and authority of the one I’ve suggested bottom-fishing in gold. Be that as it may, Silver’s ABC looks good enough for government work, implying you can try bottom-fishing anyway at p=24.08. This assumes you know how to minimize the entry risk with a small-interval rABC set-up or some method or your own. ______ UPDATE (Oct 15, 9:13 a.m.): The trade worked almost as well as the one suggested in December Gold, producing a theoretical gain of as much as $1100 per contract overnight. The futures have since relapsed and appear bound for the pattern’s 23.43 ‘D’ target. _______ UPDATE (Oct 15, 5:56 p.m.): Although the futures fell overnight, a 28-cent rally on the way down from 24.05 would have racked up a gain of around $1100 for anyone who followed my recommendation. Now, as I’ve done in gold, I’m reversing my focus to the upside. This implies a move to at least p=25.023 of this pattern.

SIZ20 – December Silver (Last:24.43)

Posted on October 11, 2020, 5:07 pm EDT

Last Updated October 15, 2020, 10:42 pm EDT

Posted on October 11, 2020, 5:07 pm EDT

Last Updated October 15, 2020, 10:42 pm EDT