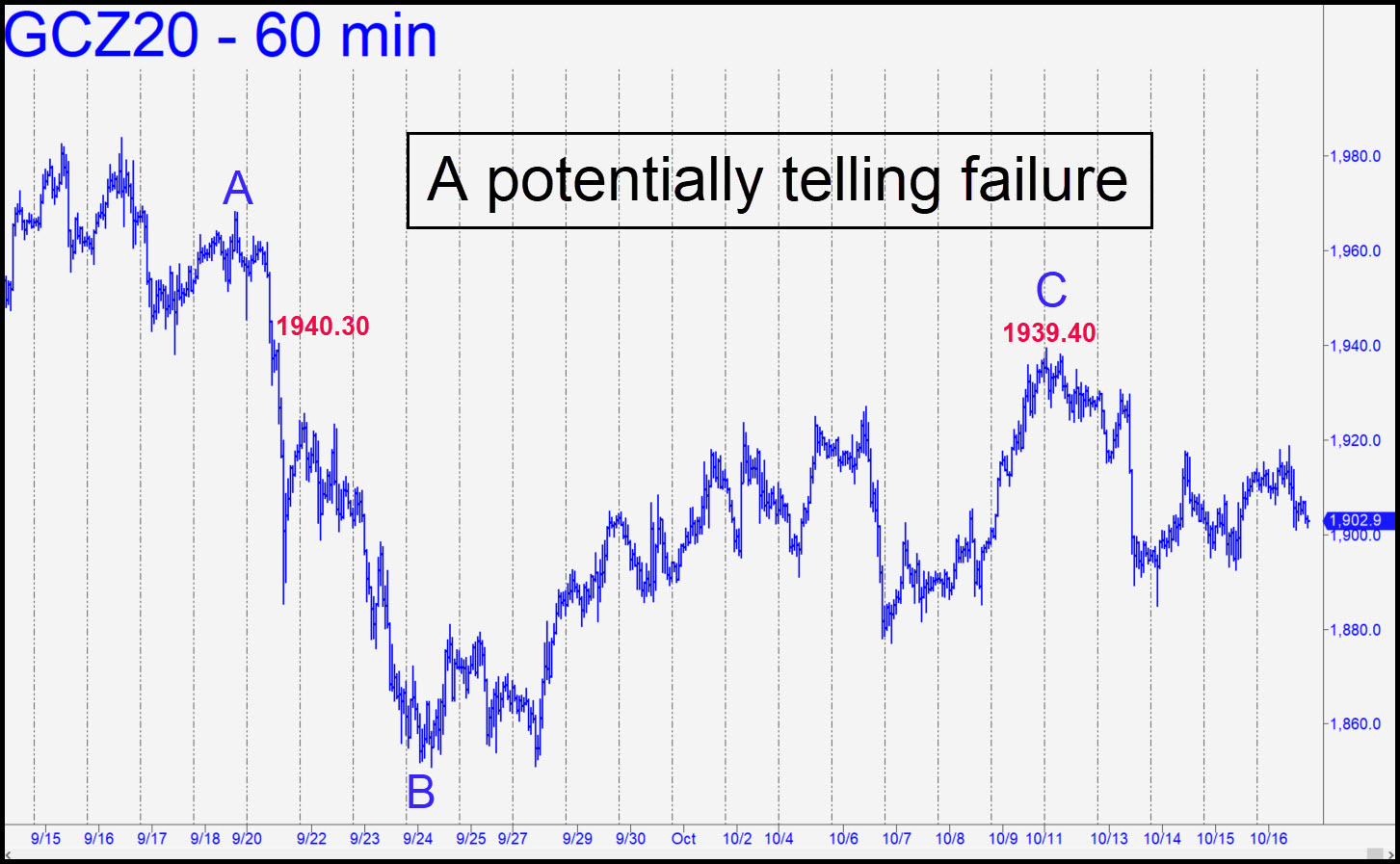

Gold traders have been beating themselves bloody for nearly a month, creating innumerable price reversals slightly above or below prior highs and lows. This kind of price action reveals that the algos, whom I sometimes refer to as droolers, are so hooked on what we call ‘impulse legs’ that their supercomputers will often be a step behind traders who think like traders and can second-guess dumb machines. The chart reveals a particular telling instance of trend failure — one implying that we should favor the bears at the moment even if their edge is slight. The bearish pattern shown has a midpoint pivot at 1880.80 that can serve as a minimum downside target for now; and a D target at 1822.20. (p2=1851.50). _______ UPDATE (Oct 21, 11:53 p.m.): Price action has become extremely tiresome. Here’s a bullish alternative to what I’ve written above, but I offer it without enthusiasm or encouragement; it is strictly informational.

Gold traders have been beating themselves bloody for nearly a month, creating innumerable price reversals slightly above or below prior highs and lows. This kind of price action reveals that the algos, whom I sometimes refer to as droolers, are so hooked on what we call ‘impulse legs’ that their supercomputers will often be a step behind traders who think like traders and can second-guess dumb machines. The chart reveals a particular telling instance of trend failure — one implying that we should favor the bears at the moment even if their edge is slight. The bearish pattern shown has a midpoint pivot at 1880.80 that can serve as a minimum downside target for now; and a D target at 1822.20. (p2=1851.50). _______ UPDATE (Oct 21, 11:53 p.m.): Price action has become extremely tiresome. Here’s a bullish alternative to what I’ve written above, but I offer it without enthusiasm or encouragement; it is strictly informational.

GCZ20 – December Gold (Last:1916.70)

Posted on October 18, 2020, 5:08 pm EDT

Last Updated October 21, 2020, 11:53 pm EDT

Posted on October 18, 2020, 5:08 pm EDT

Last Updated October 21, 2020, 11:53 pm EDT