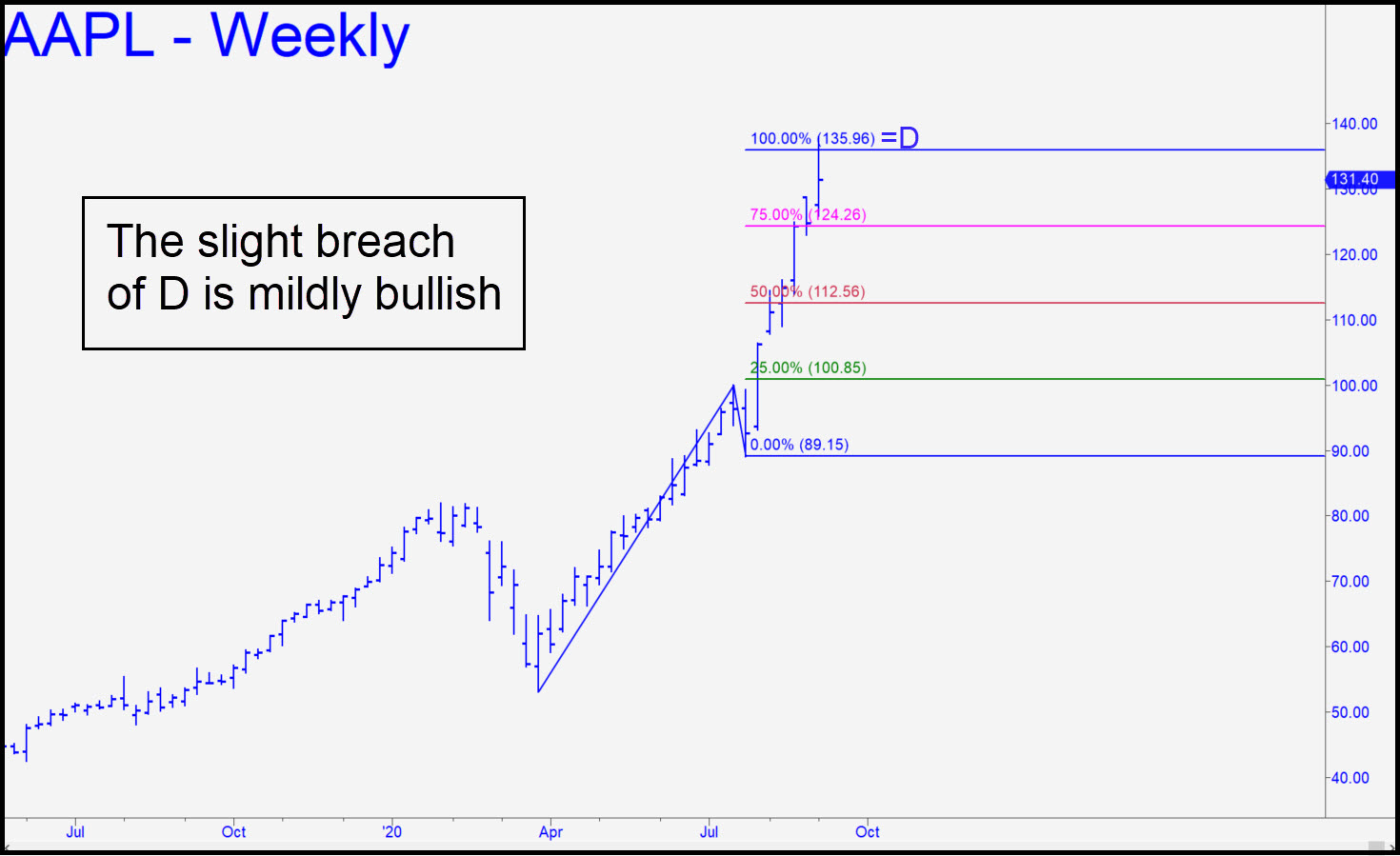

AAPL went all spastic on Wednesday, apparently because the quasi-criminal monopoly of its app store is drawing intense scrutiny from eurolands’s notoriously zealous regulators. They’ve proven time and again that they can be bought off, but there is understandable concern that any bribe paid these extortionists will be in painful proportion to AAPL’s $2 trillion-plus valuation. The wack-jobs powering Apple shares higher, famously including the central bank of Switzerland, will shrug it off in a day or two if not sooner so that AAPL can return in earnest to the urgent mission chosen for it by the U.S. Government: making all the pension funds that hold the stock appear solvent for as long as possible. From a technical standpoint, it is mildly bullish that the top of Wednesday’s schizoid spike slightly exceeded a very clear Hidden Pivot target at 135.96. Let’s see how long the correction lasts before we bull up with gusto for the next stab higher.

AAPL went all spastic on Wednesday, apparently because the quasi-criminal monopoly of its app store is drawing intense scrutiny from eurolands’s notoriously zealous regulators. They’ve proven time and again that they can be bought off, but there is understandable concern that any bribe paid these extortionists will be in painful proportion to AAPL’s $2 trillion-plus valuation. The wack-jobs powering Apple shares higher, famously including the central bank of Switzerland, will shrug it off in a day or two if not sooner so that AAPL can return in earnest to the urgent mission chosen for it by the U.S. Government: making all the pension funds that hold the stock appear solvent for as long as possible. From a technical standpoint, it is mildly bullish that the top of Wednesday’s schizoid spike slightly exceeded a very clear Hidden Pivot target at 135.96. Let’s see how long the correction lasts before we bull up with gusto for the next stab higher.

AAPL – Apple Computer (Last:131.40)

Posted on September 2, 2020, 9:24 pm EDT

Last Updated September 3, 2020, 9:58 am EDT

Posted on September 2, 2020, 9:24 pm EDT

Last Updated September 3, 2020, 9:58 am EDT