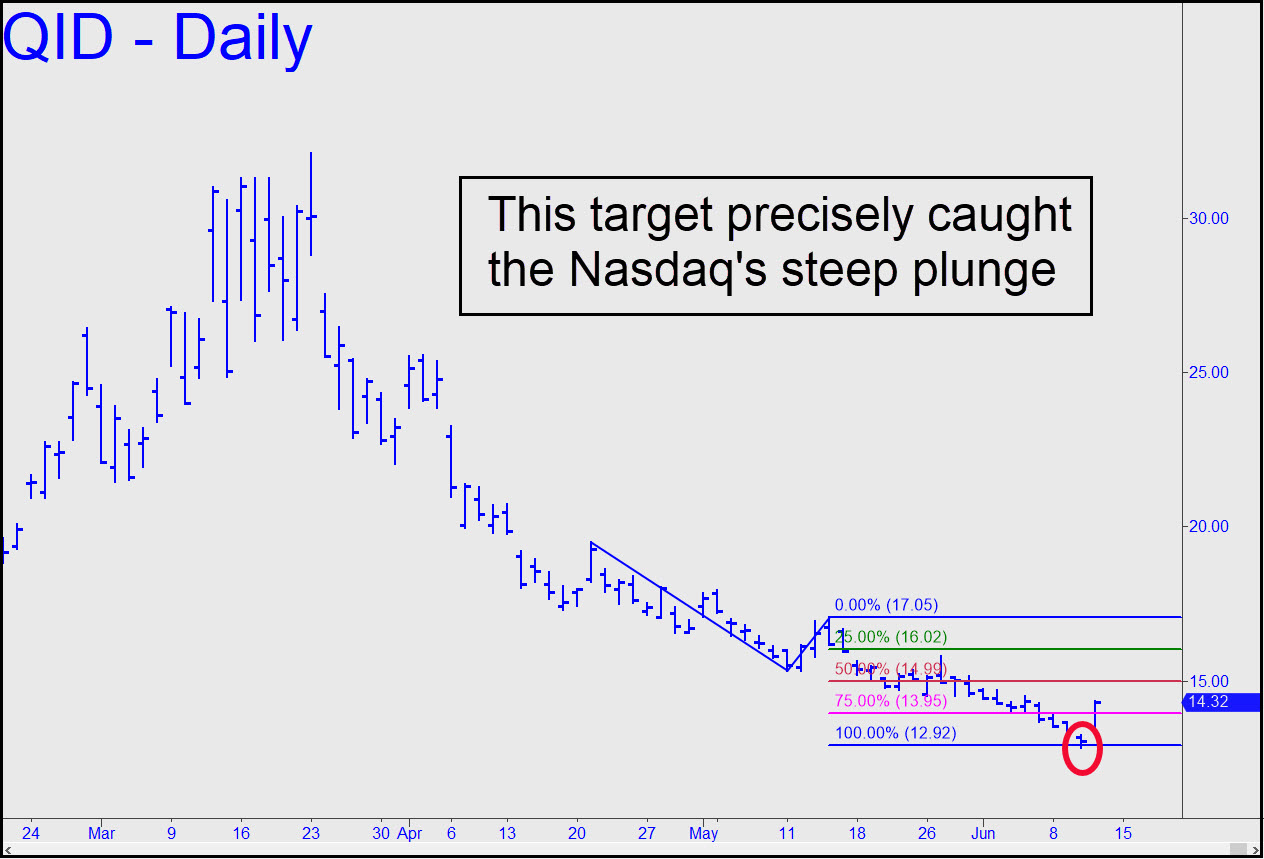

Subscribers used a 12.92 target posted in the Trading Room Wednesday morning to get long just a few ticks off the bottom before the Nasdaq index plunged. Many reported jumping on the trade in order to take advantage of the 2x leverage QID provides for shorting the Nasdaq 100. Although I left it up to individual subscribers to decide how to manage the ongoing risk, I am establishing a tracking position because some reported still being short at the close. Assuming profits were taken on half the position when QID was up $1.00 would leave 200 shares an adjusted cost basis of 11.92. Offer a round lot to close at 16.10, o-c-o with a stop-loss on 200 shares at 13.27. [Note: I erroneously gave 14.35 earlier. That was close to the intraday high. RA] Be sure to check back intraday, since I will likely trail the stop. _______ UPDATE (June 14, 10:55 p.m.): Lower the 16.10 offer for 100 shares to 15.05, but save the last round lot for a shot at 16.10. The stop-loss should be raised to 13.53. _______ UPDATE (June 16, 10:31 p.m.): The remainder of the position was closed out Tuesday night at 13.53, producing a final profit of $322.

Subscribers used a 12.92 target posted in the Trading Room Wednesday morning to get long just a few ticks off the bottom before the Nasdaq index plunged. Many reported jumping on the trade in order to take advantage of the 2x leverage QID provides for shorting the Nasdaq 100. Although I left it up to individual subscribers to decide how to manage the ongoing risk, I am establishing a tracking position because some reported still being short at the close. Assuming profits were taken on half the position when QID was up $1.00 would leave 200 shares an adjusted cost basis of 11.92. Offer a round lot to close at 16.10, o-c-o with a stop-loss on 200 shares at 13.27. [Note: I erroneously gave 14.35 earlier. That was close to the intraday high. RA] Be sure to check back intraday, since I will likely trail the stop. _______ UPDATE (June 14, 10:55 p.m.): Lower the 16.10 offer for 100 shares to 15.05, but save the last round lot for a shot at 16.10. The stop-loss should be raised to 13.53. _______ UPDATE (June 16, 10:31 p.m.): The remainder of the position was closed out Tuesday night at 13.53, producing a final profit of $322.

QID – UltraShort QQQ (Last:13.15)

Posted on June 11, 2020, 5:57 pm EDT

Last Updated June 17, 2020, 9:31 pm EDT

Posted on June 11, 2020, 5:57 pm EDT

Last Updated June 17, 2020, 9:31 pm EDT