Friday’s nasty stock-market reversal was the most interesting we’ve seen in a long while. The ostensible cause of the selloff was mounting anxiety over the spread of the deadly coronavirus from China to the U.S. and elsewhere. Three cases have been reported so far in the U.S. and 2,000 worldwide, and although no one seems to expect a major outbreak in North America, it’s not hard to imagine a mere handful of new cases hobbling, for starters, the airline industry and an import/export sector that was expected to revive because of the recent trade deal. The spread of the disease in China may already have derailed the country’s tepid economic recovery, with a corresponding impact on energy markets that took a beating last week.

Friday’s nasty stock-market reversal was the most interesting we’ve seen in a long while. The ostensible cause of the selloff was mounting anxiety over the spread of the deadly coronavirus from China to the U.S. and elsewhere. Three cases have been reported so far in the U.S. and 2,000 worldwide, and although no one seems to expect a major outbreak in North America, it’s not hard to imagine a mere handful of new cases hobbling, for starters, the airline industry and an import/export sector that was expected to revive because of the recent trade deal. The spread of the disease in China may already have derailed the country’s tepid economic recovery, with a corresponding impact on energy markets that took a beating last week.

Heedless Buyers

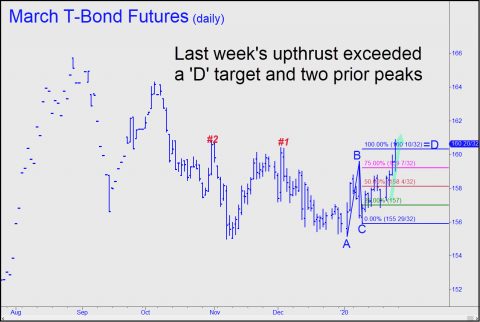

I’d written here on Friday that it would take a lot more than a virus to kill a U.S. bull market that has been powered by reckless buying. But we shouldn’t dismiss the possibility that coronavirus could turn out to be the black-swan event that investors knew would arrive eventually. The heavy selling that ended the week was noteworthy because it was accompanied by bullish breakouts in the Dollar Index and T-Bonds. Although it is difficult to predict exactly what this may portend, it is safe to say that if the respective uptrends in these massive markets gain momentum over the next week or two, a major tone change for financial markets and the global economy could lie in the offing.

Regarding the coronavirus… I’m not one for apocalyptic “prepper porn”, but this time around I’m more than a bit worried. What we have here is a virus that spreads by human contact, though the infected doesn’t have to be showing any symptoms. And, as it stands right now, there’s 80 dead and 54 that have survived, for a fatality rate of just under 60%.

This is all before any shred of speculation and hearsay is taken into account. But I’ll stop here. That’s enough bad news for now.