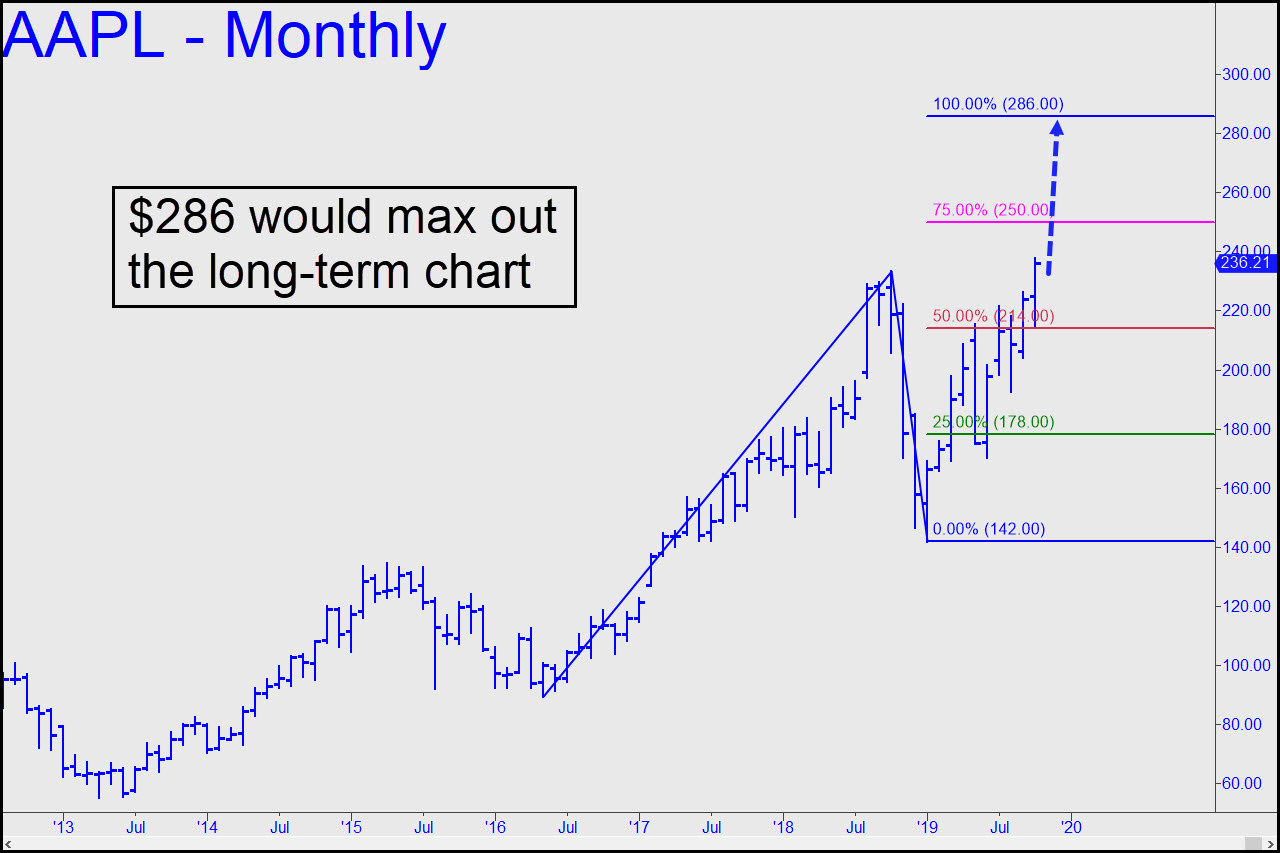

A ‘high-confidence’ target at 243.68 has allowed us to go calmly and confidently with the trend, even when the stock was swooning $45 in June and $30 in August. The target, a Hidden Pivot resistance drawn from the daily chart, has been my minimum upside objective since around early April. This implies the stock could go significantly higher if it blows past 243.68. Specifically, and just in case, we should keep the 286.00 target shown (inset) in mind. It is important to be objective about this, since we are using AAPL as a bellwether to tell us when the bull market, which just entered its 92nd month, might be fixing to draw its last breath.

A ‘high-confidence’ target at 243.68 has allowed us to go calmly and confidently with the trend, even when the stock was swooning $45 in June and $30 in August. The target, a Hidden Pivot resistance drawn from the daily chart, has been my minimum upside objective since around early April. This implies the stock could go significantly higher if it blows past 243.68. Specifically, and just in case, we should keep the 286.00 target shown (inset) in mind. It is important to be objective about this, since we are using AAPL as a bellwether to tell us when the bull market, which just entered its 92nd month, might be fixing to draw its last breath.

Because AAPL is the most valuable company in the world (having recently surpassed MSFT) and a must-own stock for portfolio managers, it stands to reason that the broad averages won’t top out until AAPL does. I’d be surprised if we do not see a tradeable pullback from 243.68, and I am therefore still recommending that you go short there using options purchased for $1.00 or less with perhaps two weeks left on them. You can buy a quantity of them provided you do so against a tight stop-loss. Specifically, if the stock were to trade $246 or higher, or close for two consecutive days above 243.68, we should infer it’s on its way to at least p2=250.00 of the new pattern, but more likely to D=286.00. ______ UPDATE (Oct 16, 12:28 a.m.): A 238.15 target that caught this week’s so-far high within two cents must be respected. It differs from the one at 243.68 given above in that it uses a point C low recorded overnight that lies $5 below the regular session low I used. My thanks to ‘Ovcactus,’ a relatively new Pivoteer, for pointing this out. I’ll be curious myself to see whether it works, since we don’t have a hard-and-fast rule about whether to use overnight highs and low for coordinates. Generally speaking, if it differs significantly from the regular session high or low it should be used. That is certainly the case here. Here’s the graph. _______ UPDATE (Oct 21, 7:40 p.m.): A short-covering panic shredded the 238.15 ‘hidden’ resistance, putting AAPL on course for a romp to the 243.68 target given earlier. If it gets there today or Wednesday, buy four puts expiring November 1 at the first strike selling for under 0.80. _______ UPDATE (Oct 22, 10:33 p.m.): AAPL dropped sharply after getting no higher than 242.20, so the yellow flag is out. The sell-off points to a minimum 239.00, but if that Hidden Pivot support gets demolished, it would increase the odds that a top of at least short-term importance is in.