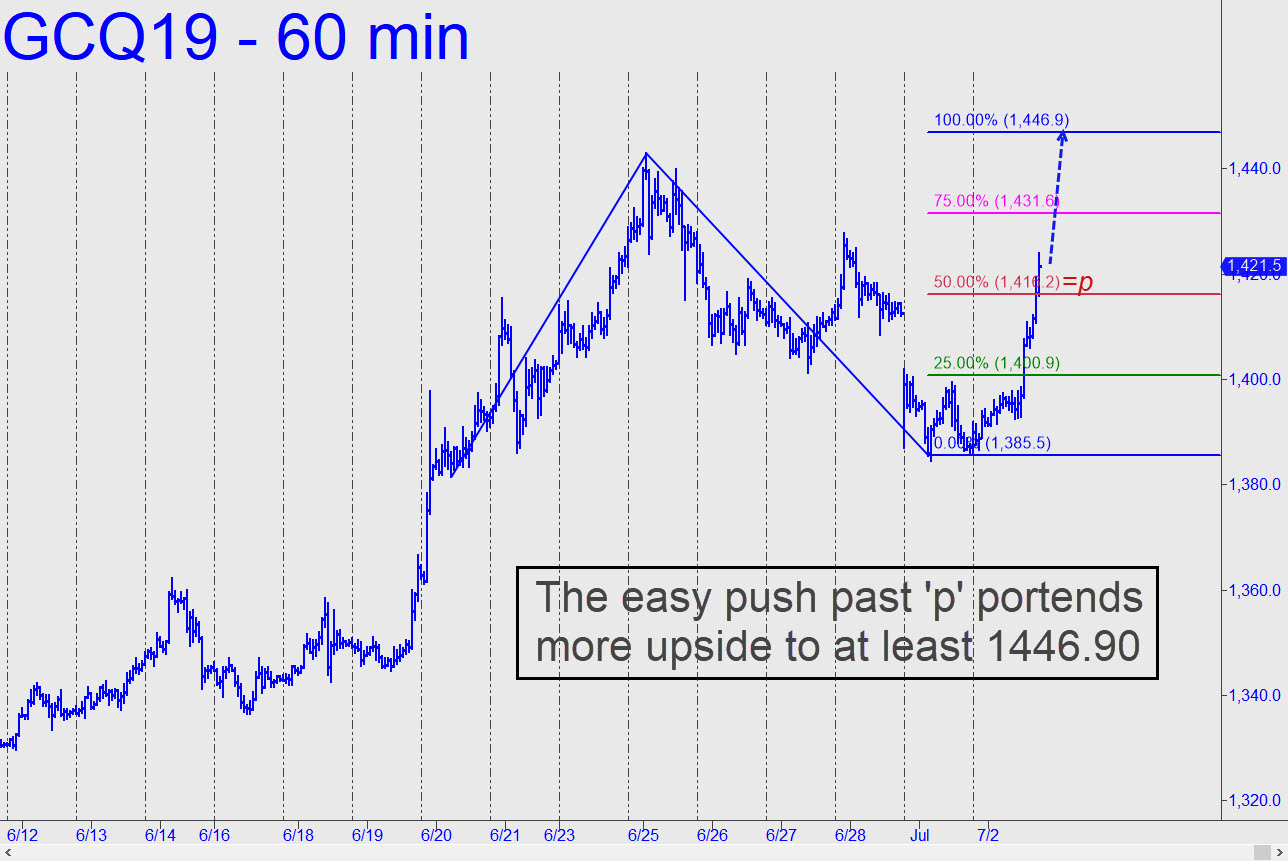

August Gold pulled a Pearl Harbor on bears and skeptics Tuesday, reversing early morning weakness with a surprisingly sharp rally. I’d expected another two weeks of corrective action myself after bullion’s impressive run-up in June. However, the chart (inset) shows the futures to be bound most immediately for at least 1446.90. If so, that would be a new recovery high and an encouraging sign that even bigger things lie ahead. Specifically, a 1504.00 target would be in play if the August contract closes for two consecutive days above 1444.40 or trades more than $12 above that price intraday. Please note as well that a $150 plunge from around 1460 would not be the disaster it might seem at the time; rather, it would set up a textbook buying opportunity according to the proprietary rules Rick’s Picks subscribers follow for ‘mechanical’ trades. ______ UPDATE (Jul 7, 5:05 p.m. ET): Last week’s surge peaked just shy of the 1444.40 midpoint resistance, implying that bulls have run out of steam for the moment. Here’s a chart that shows it. The futures will still need to close above 1440,.00 for two straight days, or trade more than $12 above this Hidden Pivot intraday, in order to clinch a follow-through to 1504.00. In the meantime, there is no ‘mechanical buy’ set-up to use on the daily chart, since the rally topped well below our sweet spot before the pullback. _______ UPDATE (Jul 10, 9:29 p.m.): The futures are in the third week of the correction I’d forecast above, seemingly eager to break out of a 60-point consolidation range. The pivot at 1444.40 remains crucial to the completion of this task.

August Gold pulled a Pearl Harbor on bears and skeptics Tuesday, reversing early morning weakness with a surprisingly sharp rally. I’d expected another two weeks of corrective action myself after bullion’s impressive run-up in June. However, the chart (inset) shows the futures to be bound most immediately for at least 1446.90. If so, that would be a new recovery high and an encouraging sign that even bigger things lie ahead. Specifically, a 1504.00 target would be in play if the August contract closes for two consecutive days above 1444.40 or trades more than $12 above that price intraday. Please note as well that a $150 plunge from around 1460 would not be the disaster it might seem at the time; rather, it would set up a textbook buying opportunity according to the proprietary rules Rick’s Picks subscribers follow for ‘mechanical’ trades. ______ UPDATE (Jul 7, 5:05 p.m. ET): Last week’s surge peaked just shy of the 1444.40 midpoint resistance, implying that bulls have run out of steam for the moment. Here’s a chart that shows it. The futures will still need to close above 1440,.00 for two straight days, or trade more than $12 above this Hidden Pivot intraday, in order to clinch a follow-through to 1504.00. In the meantime, there is no ‘mechanical buy’ set-up to use on the daily chart, since the rally topped well below our sweet spot before the pullback. _______ UPDATE (Jul 10, 9:29 p.m.): The futures are in the third week of the correction I’d forecast above, seemingly eager to break out of a 60-point consolidation range. The pivot at 1444.40 remains crucial to the completion of this task.

GCQ18 – August Gold (Last:1426.30)

Posted on July 5, 2019, 5:33 pm EDT

Last Updated July 18, 2019, 9:50 pm EDT

Posted on July 5, 2019, 5:33 pm EDT

Last Updated July 18, 2019, 9:50 pm EDT