The World’s Most Valuable Company (TWMVC) got the stuffing knocked out of it again on Monday and there may be more. Which is to say, things are likely to get worse before they get better. For now, use the 182.88 target shown as a minimum downside objective. Please note, however, that if that Hidden Pivot support gets crushed, or the stock closes for two consecutive days beneath it, that would augur a bloodbath to as low as 170.78 over the near term. At that point TWMVC will have given up a little more than 28% of its value since October 3, when shares peaked at a record $233.

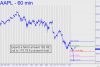

The World’s Most Valuable Company (TWMVC) got the stuffing knocked out of it again on Monday and there may be more. Which is to say, things are likely to get worse before they get better. For now, use the 182.88 target shown as a minimum downside objective. Please note, however, that if that Hidden Pivot support gets crushed, or the stock closes for two consecutive days beneath it, that would augur a bloodbath to as low as 170.78 over the near term. At that point TWMVC will have given up a little more than 28% of its value since October 3, when shares peaked at a record $233.

Under $100 Eventually?

Isn’t it remarkable how quickly the first phase of a bear market can unfold? Looking well ahead, it could take six to twelve months or longer for the stock to grind out an additional 25% loss. But don’t be surprised if the final capitulation takes AAPL well below $100. The company will be far more vulnerable than most retailers in an economic downturn because its main product, the iPhone, is so pricey. If strapped customers should need to delay a trade-in for an additional 2-3 years, they will, no matter what kind of “new-and-improved” hubris accompanies future product launches.

One more caveat — for bears: Every portfolio manager on Earth owns this stock, and they are not about to go quietly into the night. It is therefore 100% predictable that the short-covering rallies will be spectacular, buttressed by planted news stories explaining why the stock is such a great bet to achieve new record highs. Don’t believe them. But neither should you stand too stubbornly in the way when AAPL test bears’ resolve._______ UPDATE (Nov 20, 9:42 p.m.): The stock began the day with a 10-point plunge to 175.51, $5 from the still-valid target at 170.78 given above. The low got re-tested at the end of the day and held, but we’ll need to see a rally to at least 183.80 before bulls could breathe even a small sigh of relief. _______ UPDATE (Nov 25, 5:08 p.m.): The stock sold off hard again Friday, coming within 1.10 of the 170.78 target we’ve been using to keep from turning prematurely bullish — not only on AAPL, but also on the broad averages. You can bottom-fish using near-the-money, near-term-expiration calls when the stock gets within a dime or so of the target, but be ready to bail out quickly if this ‘hidden’ support gives way. The chart shows why: Any significant slippage beneath 170.78 — especially a two-day close below that number — will put a 162.43 target in play._______ UPDATE (Nov 26, 1:544 p.m.): The stock has trampolined $2.50 so far today off a presumably important low at 170.28. It did so while I was conducting an impromptu ‘requests’ session with about 40 subscribers in the room. I suggest bidding 1.18 for some 175 calls, but the guidance came a crucial minute too late. Nevertheless, if you were able to get long at the time, please let me know in the chat room and I’ll establish a tracking position.