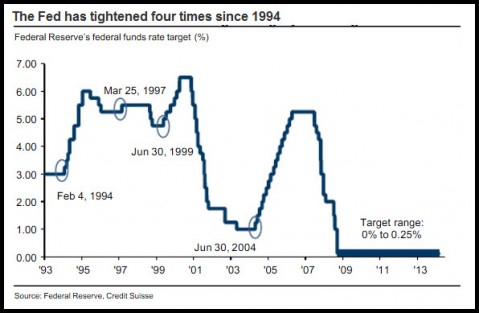

When will the Fed raise interest rates? My stock answer has been “never,” and the record shows that this prediction has held up pretty well. The last time the Fed actually raised rates was in June 2006, so my “read” on Fed policy has been essentially correct for the better part of a decade. This is notwithstanding the fact that whenever the Fed is not tightening, it drives eggheads, economists and op-ed hacks nuts. Lately, they appear to have been emboldened by the prospect of finally being right. Some of their newfound bravado has undoubtedly been inspired by emanations from the Fed itself. Just last week, the central bank, trying to sound hawkish, leaked that it’s considering changing the wording of its monthly hint about when tightening will come. For years, they’ve been saying over and over again that credit would be kept loose more or less indefinitely. Despite this, the markets have never failed to react like a headless chicken to each and every mote of dogs-bites-man “news”. Now, the nervous Nellies may have to stoke their angst with a new policy that would translate thus: Don’t expect money to stay loose forever.

This is the sort of claptrap that an ignorant, self-absorbed and habitually lazy news media have seized on to unwittingly help the Fed manage our expectations. Yellen and the banksters would have us believe the economy is sufficiently robust to stand on its own, and that inflation could break out at any moment. In reality, more than half of U.S. workers polled think the Great Recession never ended. And they would know. Wages have fallen in real terms since the recession officially ended in 2009, and the economy has failed miserably to create the kind of jobs that might help raise the standard of living for the broad middle class. All of which is lost on economists, a benighted class of navel-gazers who evidently can’t see beyond the statistical veneer of a debt-financed boom in dubious financial assets and auto sales.

Buy T-Bonds Hand-Over-Fist!

Although I’m being facetious in maintaining that the Fed will never raise rates, I strongly doubt it will happen by mid-2015, as we are being encouraged to think, or that it will occur by way of a sustained increase in the federal funds rate. Although the Fed, believing its own hubris, could conceivably be stupid enough to nudge administered rates higher by, say, 25 basis points, it would be economic suicide to go any further just to demonstrate they are capable of walking the walk. The headwinds of global deflation are already far too powerful to risk any real tightening, especially with the ongoing collapse in oil prices. Factor in Europe’s inexorable slide toward the deflationary abyss, as well as the threat of recession in China, and you can understand how just a single turn of the monetary screw could topple the fragile global economy, bringing down the entire commodities complex, as well as a derivatives edifice whose notional value is perhaps five to ten times the size of global GDP.

As a practical matter, investors should tune out the “tightening” drumbeat and buy long-term Treasurys hand-over-fist. T-Bonds don’t need support from the Fed to keep on rising; they will continue to gain support from the mere idea that flight capital will pour into U.S. paper when the global economy starts to implode. Because of this, the bull market in long-term Treasurys and the dollar are just warming up. T-Bonds are not only the best place for investors to be in 2015, they may be the only place that can provide both safety and the prospect of solid capital gains.

Rates will not rise until the world has become saturated with US debt. The Fed has put into place the means to obfuscate their lever pulling by outright telling us that they will not use something as obvious as public QE but instead will begin using “forward guidance” to inform the public of what they are doing.

So pay no attention to the man behind the curtain and what he is doing, instead just listen to the voices and believe what they are saying. Nothing like a world where the majority of people fall for “who are you going to believe, me or your lying eyes?”