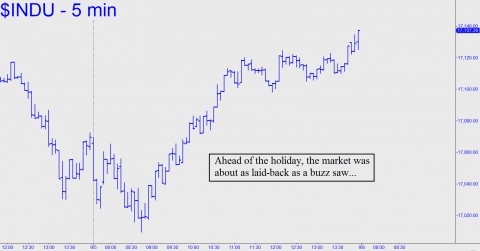

Even rigged markets are entitled to a little rest now and then, wouldn’t you say? If so, they passed up the opportunity to do so on Friday ahead of a three-day holiday weekend. Instead, while nearly everyone in America was fixing to usher out summer in whatever way might retain its savor best , stocks were ratcheting higher with a cheerless determination that was about as laid back as a buzz saw. You can see this in the chart below. The Dow Industrials bottomed a little more than an hour into the session; then they forged ceaselessly higher until the closing bell imposed a mandatory time-out. If buyers are acting this aggressively in the lazy, hazy, waning days of summer, just imagine what they are capable of between now and Thanksgiving, when the country traditionally gets back to work with a vengeance.

Whatever happens, and no matter how convinced we are that the stock market is forming a broad top, we’ve grown weary of trying to short it. Some would say we’re crazy to even try to get in the way of a bull that has been rampaging for 65 months. The Dow is on its way to 20,000, permabulls insist, so why try to swim against the tide? Maybe they’re right. Although we can think of a dozen great reasons why the Dow shouldn’t keep rising in the months ahead, the arguments would be the same ones we’ve made all along. The simplest and most compelling of them is that the stock market’s stellar performance has gotten way ahead of an economy that can’t seem to get off the launching pad. But that’s been true for years, and it’s difficult to imagine what might change this dynamic, no matter how perverse it may seem. As for the spurt in GDP growth alleged by the spinmeisters, we’re simply not buying it. What we see is stagnant wages, a housing recovery that is completely spent, budget tightening at all levels of government save federal, a manufacturing sector so out-of-practice that it’s unable to reap the full benefit of lower energy costs, and job creation that is egregiously sub-par in both quantity and quality. What’s left? As far as we can tell, only a car-leasing boom that has probably reached the saturation point.

Why We Like T-Bonds

What about easy money? On that score, we should be as bullish on stocks as anyone out there, since we’re in a very small minority that thinks the central bank wouldn’t dare tighten (no matter what Yellen says). In fact, we are not bullish at all – except on T-bonds; and, with some reservations, on gold. Meanwhile, all the easing we can conceive of is not going to cause inflation. Rather, it will merely postpone America’s inevitable slide into the deflationary sinkhole that is about to snuff Europe’s faint recovery. Our investment advice is unchanged in any event: buy assets that are leveraged to long-term Treasury prices, and start bottom-fishing gold in earnest. Concerning Treasurys, the capital gains potential is enormous. If there is no outbreak of inflation, or if the bull market in stocks ends, or if the U.S. economy relapses into recession, the unwind out of stocks could push long-term yields back down to their 2012 lows. If that were to occur over the next 12 months, T-Bond investors could see capital gains approaching 40%, and muni portfolios could appreciate by nearly 30%. FYI, Rick’s Picks has been playing the bull market in T-Bonds aggressively with a calendar-spread strategy designed to make it a very low-risk bet. For real-time guidance, try a free trial subscription that will give you access to the 24/7 chat room and to Rick’s detailed trading “touts”.

My argument against using bias with a technical system is that you can always find a pattern that will fit. If you discard the bias it probably wouldn’t even be on the radar. Gold’s bias is for a breakout. If that expectation wasn’t baked in, you wouldn’t be looking for a reason to go long. Same is true on treasures. Equities expectation is so one-sided for so long that those long-shots for a crash is wasted money.

On all 3 picks, short term, I am going against Ricks bets.

Sorry Rick. Believe it or not it is rare that I bet against your system. On the SPX I am actually expecting a small rise followed by a test of recent lows, in the 1970 area. From there, if it holds, I expect a surge of some 100 points. Will change my position if 1970 doesn’t hold. Gold looks to be breaking down and yields seem to have a decent push behind this move.