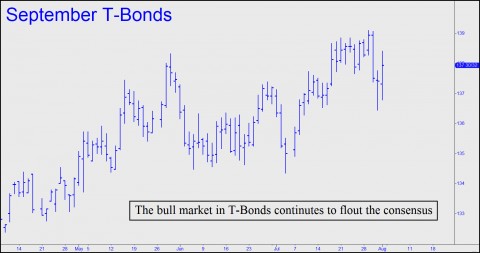

The one investment opportunity I regard as an absolute no-brainer also happens to be potentially among the most lucrative. How lucrative? Gains of up to 40% over the next 12 months are possible. More on that below. But before I divulge some further details, let me mention that this particular asset class has yielded well in excess of 20% in five of the last six years. You might think that such a terrific opportunity would have been discovered by now. In fact, the opposite is true. This particular investment has either been shunned or ignored by the crowd, mainly because it disdains the popular wisdom that Fed stimulus already in the pipeline is certain to produce serious inflation somewhere down the road.

Have you guessed what investable asset I’m talking about? The answer is long-term Treasury bonds – the longer-term, the better (explained below) — and the reason they have performed so well is not hard to fathom if you simply jettison the mistaken notion that inflation is inevitable. I owe a debt of thanks for this insight to my good friend Doug Behnfield, a Boulder, Colorado-based financial

advisor and fellow deflationist whose forte is building robust portfolios for high-net-worth individuals. I have featured Doug’s thoughts here many times over the years, mainly because he is, hands-down, the smartest investor I know. He is also one of the smartest guys I know, and his life outside the office reflects the same sort of Zen balance that he brings to portfolio management. Doug is a consummate do-it-yourselfer, an avid hobbyist and a perfectionist — as adept at landscaping a garden as restoring old Citroens or taking the helm of a sail-powered yacht.

Beating the Geniuses

Like all highly successful investors, Doug has the courage of his convictions and the fortitude to stick with winners even when they go against him for a spell. This was the case in 2013, when T-Bond prices plunged 15%. Even then, Doug and his clients – unlike those of such erstwhile financial geniuses as George Soros and Paul Tudor Jones — still made money, since Doug had wisely hedged his clients’ portfolios with some big winners, including a perfectly timed short against gold.

Like your editor, Doug thinks recession lies just ahead and that deflation will continue to rule the U.S. and global economies. If so, a stock market currently priced for perfection is primed to fall. That would necessarily cause portfolio managers to unwind their stock-heavy bets with a major shift into fixed-income assets such as T-Bonds. Thereafter, if long-term bond prices were to return to their 2012 highs within the next 12 months, Doug estimates that capital gains would be on the order of 40%. He notes that the further out the maturity date, the more leverage one will reap from a fall in yields.

The Herd’s Major Fallacy

One reason the vast majority of investors are on the wrong side of this bet is that with the Federal funds rate already at zero, they’ve incorrectly assumed yields can only go up. As Doug points out, however, those yields – an “irrelevant data point” — are being artificially suppressed, whereas T-Bonds yields will ultimately be driven by market forces. “The factors affecting bond market are completely different from the factors affecting fed funds-rate decisions by the Fed,” he notes. Thus, were recession to return, yields could only go lower, and bond prices higher, no matter what the Fed does with administered rates. As for the economy, you can judge for yourself whether we’re headed into a recession or worse. For what it’s worth, I regard the 4% GDP growth just reported as a brazen lie – one that can be confirmed by simply asking friends who own businesses how they’re doing. My friends – a group that includes Realtors, restaurateurs, a wine importer, a clothier, health insurance agents, tradesmen and croupiers, among others – say they’re working harder than ever just to stay afloat. Meanwhile, the case for economic recovery, such as it is, lies in housing and auto sales, the two sectors besides the stock market that have benefited most from easy credit.

Can the illusion of recovery be sustained indefinitely? If you think the answer is yes, then by all means bet the farm on higher interest rates. This is what the mindless herd effectively did last week on the announcement of supposedly booming GDP growth in Q2. But be aware that Doug’s against-the-consensus government-bond portfolio is already up 16% this year. He is mainly in Treasury “strips,” securities that are discounted from par and have maturity dates out to 2044. For high-bracket taxpayers, he especially likes zero-coupon, non-callable debt with durations as long as 40 years. An example of this would be certain California school bonds. Doug is confident that long-term yields will test their 2012 lows, implying a fall to 2.46% for the 30-year (currently around 3.30%) ; and to 1.46% for the ten-year (currently around 2.49%). As for closed-end munis, which high-bracket investors should favor, a retracement to 2012 yields over the next 12 months would produce a capital of about 28%. If interest rates were to fall more slowly, corresponding capital gains would be lower but still substantial.

My Low-Risk Strategy

At Rick’s Picks, I’ve been advising equity-based strategies such as purchasing bull calendar spreads on such vehicles as TLT, an Exchange Traded Fund (ETF) proxy for Treasury Bonds with durations of at least 20 years. My strategies are intended to make the bet nearly riskless by “rolling” the spreads forward from one week to the next using weekly expirations. Last week’s selloff in bonds, prompted by the absurd GDP datum, offered the kind of fat pitch we’ve been waiting for, since the calendar spreads got knocked down to fire-sale levels. If you’d like to know more about them, and gain access to my real-time trading strategies, analysis and daily, actionable “touts,” click here for a free two-week trial subscription. Head to the chat room first, since that’s where the action is, 24/7. The room draws veterans traders from around the world, and you will find them an unusually helpful and polite bunch. Quite a few of them have mastered the Hidden Pivot Method that is my coldly mechanical basis for forecasts and trading.

Gary,

Watch the 3 month T-bill rate to determine is rates are going up. The FED always follows the market.

http://www.booktrakker.com/Economy/MarketRate.jpg

T-Bill rate started declining in February, 2007, FED funds followed in August.

What is fascinating is how many people believe the opposite. I’m willing to bet that 95% of the population, investors included, believe the FED sets interest rates, ahead of the market.

It has never been so, and it never will be so.

Although we are getting what looks like good economic data it hides what is quite obviously the rot that is inside the figures. Especially when you factor in the declining spending from the boomers, which is only going to accelerate.

A slow motion train wreck.

Andy