The financial system’s interminable endgame continued last week with a hiccup in global markets that was attributed to liquidity problems at a Portuguese bank. Some might have hoped Europe’s problems were behind us, especially with the spate of ginned-up stories concerning Spain’s miraculous economic recovery – if not in statistical fact, then speculatively in the shrinking spread between yields on Spanish paper and the debt of countries whose economies remain a few more steps distant from eclipse. Most of us, however, recognizing that any country with 30%+ unemployment among college graduates cannot in fact be recovering, view the news from Spain as patently false. Europe’s ongoing economic implosion has merely been masked by yet another, increasingly faint, upswing in the mood of investors with memories so short they evidently cannot recall the Great Financial Crash of 2007-08.

In the U.S., a different kind of story, just as false, has sustained the upward trajectory of the stock market. The economy has been creating more than 250,000 new McJobs jobs per month lately, supposedly recouping all of the positions lost in the 2007-08 crash. With unemployment now running at a dubious 6.1%, the Fed is finding it easier to pretend that the recovery is sufficiently robust to stand on its own. To drive home this point, which no one actually believes, and to further “manage” our “expectations,” quantitative easing is scheduled to be phased out in November.

Fed Pretends to Dither

We read furthermore that the Fed has been dithering more intensely than ever over the question of when it should tighten. I remain quite certain that this will never occur, at least not deliberately, since subjecting a quadrillion-dollar derivatives bubble to even a small turn of the screw could trigger the collapse of the entire shoddy edifice. How many of us believe the recovery story even now? Certainly not those on the lower-to-middle rungs of the economic ladder. Working-class Americans appear to have dropped off the ladder entirely with reports of a spiraling collapse in sales at Walmart, Target and Kohl’s. By contrast, Rolls Royce is having its best year ever, and $10,000 wrist watches are practically flying off the shelves. Will the erosion of spending power that has laid waste to much of the middle class eventually trickle up to the super-rich? Probably not to any significant degree. Regardless, as someone pointed out in the Rick’s Picks forum last week, the uppermost 0.1% cannot sustain the broad U.S. economy for long, let alone forever. This fact holds particular significance for the residential real estate market, where sales and prices remain buoyant only in the $1 million-and-above category — which is to say, in the category in which buyers pay cash, much of it drawn on margin from their brokerage accounts.

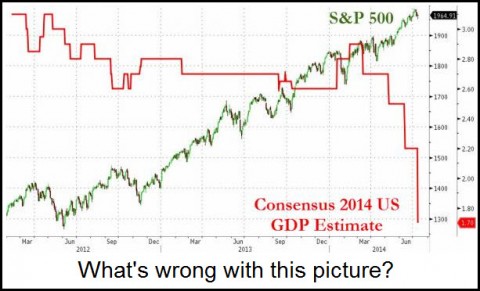

Regarding the stock market, although most investors recognize by now that the spectacular rise of shares has been driven by money from trees, the question grows as to how long this can continue. Bulls can be forgiven for tuning out those of us who have been shrilly predicting the Mother of All Tops for, um, years. At the risk of making yet one more errant prediction, we’ll state for the record that an epic top appears imminent, and that the subsequent crash will come with such speed as to leave permabulls and bears alike gaping in awe. Before you dismiss this forecast out-of-hand, check out the chart above from ZeroHedge, which never tires of pointing out that the Emperor is wearing no clothes. It shows an S&P 500 Index priced for perfection and still rising, even as GDP estimates continue to fall sharply. Keep in mind as well that actual GDP growth for the last quarter was minus 2.9%, and that no number even remotely that bad has ever been reported when the U.S. was not in recession. Under the circumstances, we should look for a feeble bounce in Q2 earnings at best, and for the statistical resumption of a Great Recession that for tens of millions of Americans never ended.

$6 Billion for the Wall Street Wizards and D**ck for the middle class…welcome to America…

“….But Levin and McCain both said the use of so-called basket options deprived the Treasury and was unfair to U.S. taxpayers. “These banks and hedge funds used dubious structured financial products in a giant game of ‘let’s pretend,’ costing the Treasury billions and bypassing safeguards that protect the economy from excessive bank lending for stock speculation,” Levin said. McCain said hedge funds “cannot be allowed to have an unfair tax advantage over ordinary citizens.”

Oh yea said daddy! “bad boys, you cannot watch Elmo if you don’t eat your vegetables..! Its unfair!…Slap!….um, but what about that $6 billion…oh well…its, er um…

The report said the banks and hedge funds used the basket option structure to open trading accounts in the banks’ names, creating the “fiction” that banks owned the account assets. But in fact the hedge funds exercised total control over the assets and executed all the trades. The funds often exercised the options shortly after the one-year mark and claimed profits were eligible for the lower income tax rate.

In Renaissance Technologies’ case, the subcommittee said using basket options to treat short-term gains as long-term gains allowed the hedge fund to avoid more than $6 billion in taxes between 2000 and 2013. The subcommittee did not give an estimate for George Weiss Associates.

Jonathan Gasthalter, a spokesman for Renaissance Technologies, said in an emailed statement that the fund believes it followed tax laws.

“We believe that the tax treatment for the option transactions being reviewing by the [subcommittee] is appropriate under current law,” he said. “These options provide Renaissance with substantial business benefits regardless of their duration.” Renaissance has cooperated fully with an Internal Revenue Service review of the transactions, he added.

Deutsche Bank DB -0.86% spokeswoman Renee Calabro said the options offered by the bank “were at all times fully compliant with applicable laws, regulations and guidance.”

I just loathe the fact that they are all a bunch of grand-standing a-holes who talk to look good but are going to DO absolutely NOTHING to shut down the schemes costing the country billions, taking billions a day out of the hands of citizens while the FED keeps propping up the billionaire bankers…

Cheers, Mario