What a difference a week makes! Last Monday, with the Dow Industrials approaching the nadir of a nearly 1200-point slide, one might have thought the world was about to end. In just one issue of The Wall Street Journal, we read about a nascent slump in housing and auto sales; a deflationary trend in pricing power for a wide swath of U.S. businesses, particularly mid-tier retailers; a shift toward defensive stocks by portfolio managers; and, alarming growth in the debts of emerging nations. It didn’t help that the neutron bomb called Obamacare continued to emit deadly toxins, threatening to consume what remains of middle-class households’ meager after-tax savings. There was even talk in some quarters of reversing the Fed taper and perhaps even increasing the amount of funny money injected into the banking system each month above the original $85 billion.

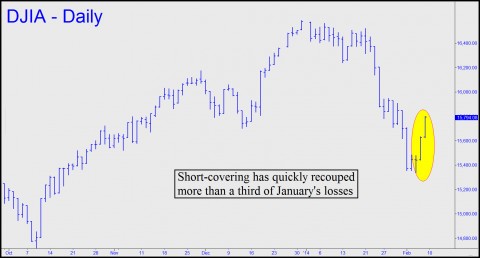

By late Friday afternoon, however, the Dow had rallied 450 points from its lows and all was seemingly right with the world. The Indoos closed on the high of the week with a 165 point gain, Wall Street’s obsidian heart melted, and all was sunshine, roses and lollipops. Would it be churlish of us to mention that the entire rally over the course of the week was driven solely by short-covering rather than investors betting on America’s future? This was very obviously the case, even if business reporters were reluctant to acknowledge it. Granted, there were no celebratory headlines. But this was probably because of the daunting news that the U.S. economy had generated only a measly 113,000 new jobs in January – barely better than the previous month , when 75,000 jobs were added. Regardless, the mere fact that the stock market had recouped in just three days more than a third of 2014’s losses must surely have planted the seeds of hope on which Wall Street’s brazen con-game thrives.

Self-Mutilation

Concerning the short-covering, we described it here earlier as an act of self-mutilation by bears. Although they need only sit back and watch the global economy crumble while stocks continue to cascade, they couldn’t wait to cover their bets last week as stocks defied gravity. Five years of relentlessly higher share prices have undoubtedly made the bears so skittish that they cannot believe things are finally going their way. Under the circumstances, they will likely remain a stubborn force in propping up a market that has flouted rationality for too long. For our part, before stocks opened we advised subscribers to cover a bearish position that had racked up a theoretical gain of around $1920 when stocks were falling hard in January. By day’s end, however, the temptation was too great to jump back in. This subscribers did by way of a new put position in the Diamonds, a proxy for the Dow Industrials. A stop-loss was suggested to limit losses to a theoretical $180 if the short-squeeze continues into this week.

Meanwhile, assuming Chechnyan terrorists are held at bay, we’ll have the Sochi Olympics to take our minds off the world’s troubles in the weeks ahead. The news media have focused thus far on the boondoggle aspects of this $51 billion production, but once the events are under way and the athletes take center stage, the political stories and niggling criticisms will quickly recede into the background. (Late-breaking note: The opening ceremony was spectacular, notwithstanding the failure of one of the five Olympic rings to light up properly to open the show. With the news media focused, as is their habit, on the faulty ring, I found myself rooting for Putin.)

rick, I see you erased my strongly reinforced dji BEAR call from yesterday,

BEAR call I’ve over 2 weeks previously stated herein,

that 16,200 dji area,

would contain current bullish over exuberance, as last big BEAR market stand;

yet no one believes this now, but, dji is about to take cliff dive, IMO, from all I see.

I am dead serious. cliff dive trouble straight ahead, IMO to 14700 dji, and–maybe more.

cliff dive. before end of february. 1,500 dji points. and after that, I don’t know. you tell me.

maybe up to your 17,600 dji, or further. however, if my rubicon 14,500 dji breaks–party over.

and I will add this, if my 14,700 dji BEAR call does not hold up, over next two weeks,

I will never comment again herein, regarding anything predictive, re stockmarket.

IMO, there will be last h&s shoulder, occurring next week, with mega swift skydive drop.

beyond 14700 dji, don’t know. but february ‘14 will bring a 1.5k dji drop. bet on it. IMO.

and if this does not occur, and I’m wrong, I leave all stockmarket matters, to genius gary.

then I only comment on fundamentals, backstory matters, and leave dji lead, to el garo.

&&&&&&

You’ve repeated your forecast so often, Vlad, that I assumed everyone knows where you stand. With the broad averages at or new record highs, I have summarized my own outlook in the current commentary. RA