Will the 2013 holiday shopping season turn out to have been brick-and-mortar retail’s last stand in America? I’d say so, particularly if one considers Best Buy an accurate barometer of consumer trends. If they can’t turn things around, who can? I’ve tracked the sad decline of Best Buy for nearly two years, and even wrote a glowingly optimistic commentary when they took aggressive steps early in 2013 to radically revamp the way they did business. First, they hired a young marketing whiz who brought some terrific ideas to the job. A profile in Wired magazine made his appearance on the scene at Best Buy sound like the Second Coming. His plan was to upgrade the sales force by training experts for each department. Best Buy would also match the price of any online competitor item-for-item.

To better compete with Amazon’s two-day shipping, they would use their vast chain of retail stores to create a de facto network of warehouses – one that would allow customers to retrieve items from stores within a day or less of placing an order online. Finally, Best Buy would leverage its Geek Squad protection plan, a technical support option that I can say from experience is the best in the business and an unbeatable value. The service plan is available at a very reasonable cost and covers both hardware and software. It has helped separate Best Buy from competitors who would rather let customers freely exchange PCs, laptops and other electronic devices they have recently bought than have to provide support for such products.

To better compete with Amazon’s two-day shipping, they would use their vast chain of retail stores to create a de facto network of warehouses – one that would allow customers to retrieve items from stores within a day or less of placing an order online. Finally, Best Buy would leverage its Geek Squad protection plan, a technical support option that I can say from experience is the best in the business and an unbeatable value. The service plan is available at a very reasonable cost and covers both hardware and software. It has helped separate Best Buy from competitors who would rather let customers freely exchange PCs, laptops and other electronic devices they have recently bought than have to provide support for such products.

Great Ideas Fall Flat

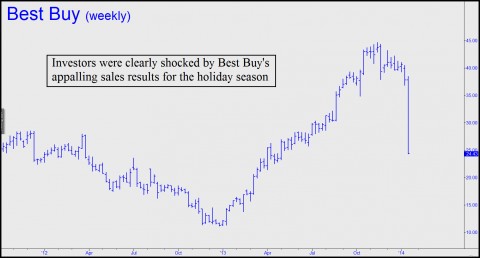

Although the hotshot bailed on the company just two months after taking the reins, Best Buy subsequently implemented all of his ideas. Unfortunately, the effect of this on the bottom line has been negligible. Holiday sales actually declined compared to a year ago – news that has caused BBY shares to plummet by nearly half since mid-November. The stock had peaked that month at $45 after more than nearly quadrupling during the previous ten months. Clearly, the disastrous sales results announced in January took investors by surprise.

Unfortunately, Best Buy’s plight is symptomatic of a death spiral that has been gaining momentum across the retail sector as a whole. For one, Walmart, Best Buy’s closest competitor besides Amazon, has reported steadily weakening sales, presumably because its customers have fared even worse during the Great Recession than those on higher rungs of the middle-class ladder. But even the well-heeled have evidently cut back, as evidenced by disappointing sales at Macy’s and other mid-tier stores. Overall, visits to retail stores have fallen by 50% since 2010, a period when the economy was ostensibly in recovery. The result is that most of the big chains – survivors that include J.C. Penney,

Mass Vacancies Ahead?

Target, Sears, Radio Shack and Barnes & Noble – are talking about closing less-profitable stores and cutting employees to bring costs down. (For a more comprehensive picture of a retail sector in precipitous decline, click here to access James Quinn’s trenchant assessment at The Market Oracle.)

Is this the future of retailing in America? Is the day not far off when we all of us will buy nearly everything from Amazon, even as shopping malls, big box stores and strip malls fall into a state of dereliction?

I see you did not post my questionnaire for you, re your hidden pivot method. who cares.

for I still think this current swift mini-drop will turn around, in the 14500-15000 dji area,

and then boom. rocket launch time. to near 20k dji. all the clowns happy. until—vacuum time.

so in this vein, I write now to suggest next week’s thread, so ‘el garo’ has a field day,

and even sillier laughable ever-‘peacemaker’, the chink’s top-ever ussa bootlicker, mariito,

on us ‘dah bears’, still 4-years awaiting, for mother of all -extremely deserved- stock crashes.

so how about if all ‘usual suspects’, starting with you ricky, spill their guts, of their opinion,

of HOW UNavoidable endgame will play out, in days, or weeks, and what will be the trigger,

and what will be END result, for decades to come. top suspect john jay’s vote is already in,

as he has repeatedly stated, no big crash, just slow penuried death, for most ussa citizens,

into perennial indentured servitude, to uber 1% world elite, that rule uber als. so, sig heil.

myself, I am already on record. a parabolic frothy manic happy silly easy insane fast climb.

then. boom. lights go out. overnight. a sucking sound. all vacuum. 0% buyers. 100% sellers.

as in eliot’s ‘hollow men’ (1925), 1 year before ’26 land crash, and 4 before ’29 stock crash–

“This is the way the world ends

This is the way the world ends

This is the way the world ends

Not with a bang but a whimper.”