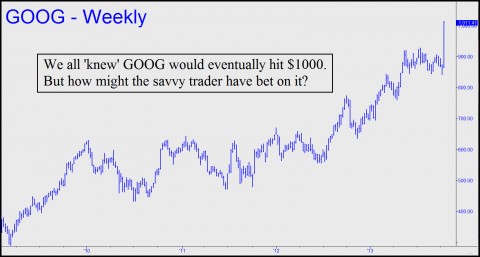

In June, when Google was trading for around $880, the village idiot could have told you the stock would eventually trade for $1000. But how to play it without losing one’s shirt if wrong? The strategy we devised entailed legging into free “butterfly” call spreads targeted on the 1010 strike. This implied buying bull spreads when the stock was weak, then selling bear spreads against them for at least the same amount when the stock turned strong. Using this tactic, even if GOOG fell to zero, subscribers would lose nothing; but if it rallied to exceed $1000, they’d reap gains of as much as $1000 per spread. On Friday, the stock easily bettered our expectations, leaping a mind-blowing $126, to $1015, on very good earnings. As a result, one subscriber who’d bought some cheap option spreads reported doubling his trading account overnight. Another said he cashed out of spreads for 4.80 that he’d bought for a small fraction of that price.

How We Lucked Out

Luck played a role. That’s because the stock exploded higher before subscribers were able to leg into the second half of the butterfly – the bearish half. The bullish part of our bet – buying eight November 1000-1010 call spreads for 0.47 apiece – was completed weeks ago, and we were waiting for a rally in order to short eight November 1010-1020 spreads for the same amount. But with Friday’s blast, the short spread could have fetched as much as 5.00 intraday – more than ten times what we’d hoped to get for it. At that price, the resulting butterfly, done for a net credit of $5, would have locked in a profit of at least $500 and as much as $1500, with no possible loss. In the actual event, subscribers reported cashing out the original bull spread rather than turning it into a butterfly that could conceivably double or even triple in value between now and November expiration.

Back from the Dead

We were lucky in Amazon as well, since Friday’s $21 short-squeeze rally brought a call spread we’d given up for dead roaring back to life. Based on a Hidden Pivot rally target at 327.15, subscribers were told in mid-September to buy eight October 330-335 call spreads for 0.26 when the stock briefly dipped below $300. A subsequent rally allowed us to cash out of half of them for 0.80 per, giving us a guaranteed profit of $112 on the position come hell or high water. The spread deflated to near-zero when the government shutdown sent stocks reeling. But on Friday, with our spread just hours from expiring, Amazon staged one of the most spectacular rallies in recent memory, vaulting to a $331.89 high that made our remaining call spreads an easy sale for around $1.50. The profit for anyone who followed our advice exactly would have been around $400.

The strategies detailed above might sound complicated, but a goal of Rick’s Picks is to offer option plays that are easy enough for even novices to attempt and that require very little capital – hundreds of dollars, rather than thousands. Even the relatively sophisticated butterfly plays that we sometimes advise can be reckoned as a combination of simple bull and bear spreads done in a 1:1 ratio. When each side of such positions are executed with proper timing and the successful use of precise Hidden Pivot targets, it’s possible to leg into bullish or bearish bets that have zero risk. For the record, we have attempted this once again in Facebook, using a 54.51 target that came within 32 cents of nailing the top of the FB’s $2.62 spike rally on Friday.

Click for a Detailed Explanation

For a more detailed explanation of our theoretically riskless spreading strategies, click here to access an article we wrote for Stock, Futures & Options magazine a while back. The option game as so heavily stacked against retail customers that it is easier to win a giant panda on the carnival midway than to make money on directional hunches with puts and calls. As you will see in the article, however, there are ways to help level the playing field so that amateurs don’t get ripped off by pros.

Rick,

Regarding your email based alerts/touts, I am nowhere near as well versed or as informed as many here, but I’ve noticed dozens of insiders claiming a top is forming; in the very near term.

Does 1/1/14 mark a change of the tides?

Perhaps I am reading a little too much into this, but considering we aren’t very far removed from 2007 (much worse in my opinion actually), a top here would be disastrous.

Also, http://enenews.com has been reporting some horrifying information regarding Fukushima.

These are interesting times indeed.