There’s probably a trillion dollars or more parked in T-Bonds that could soon be looking urgently for a new home. As such, it’s probably a good time to revisit our technical forecast calling for a Dow rally to 16800 — an 11 percent premium over current prices. Where else can all that money go? Regardless, we have to assume that a wild plunge into shares right now would be a dream come true for Bernanke & Company, since it would help sustain the meticulously crafted illusion of a recovering economy even as steeply rising mortgage rates asphyxiate the U.S. real estate market.

Whatever happens, it’s safe to assume that a new investment paradigm is in effect globally, since anyone holding Treasury paper these days must feel like a dead duck. How dead? Our technical runes suggest that even after the sharp selloff of the last three weeks T-Bond futures still have quite a ways to go before they could attempt to get traction, never mind put in a solid floor. Specifically, we’re looking for the September contract to fall to at least 129^03 – a 3-1/2–point plunge from here – before they would become an attractive buy. Thirty-year mortgages would be headed north of 4% at that point, which, when combined with the stringent lending standards already in place, would virtually eliminate first-time buyers from the housing market. That in turn would weaken sales upstream, since homeowners looking to trade up would be frozen in place.

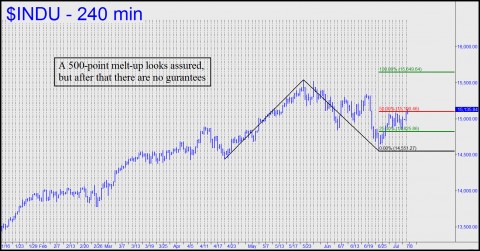

A Blowoff?

As for the Industrial Average, the chart above suggests a push is imminent to a lesser “Hidden Pivot” target at 15649. That would be a relatively modest thrust, amounting to 549 points, but the additional 1151 points needed to reach 16,800 would by no means be assured. From our technical standpoint, odds of getting to 16800 would depend on how the rally interacts with the 15649 resistance. If buyers were to blow past it within a day or two of first touching it, that would make a further push to 16800 more likely. Would that be the blowoff top needed to usher in a bear market? Perhaps. But we’ll need to wait and see how quickly it’s reached, assuming it is reached at all. In the meantime, traders should plan on staying long to 15649 while preparing to short there aggressively with tight stops if the opportunity arises. This is a game of chicken at 110 mph, as far as we’re concerned, and although the flight-to-safety argument may seem persuasive when money from around the world is flowing into U.S. Treasurys, there should be no illusions about the “safety” of money pouring into U.S. stocks at these levels or higher.

Uranium stocks staged a huge melt-up today. 30% – 90%. This is the big breakout. There should be some backing and filling ahead, but the baby-bull uranium bull market kicked off with a bang today.