Bears may have been pleasantly surprised yesterday when stocks closed lower on a Tuesday for the first time since January. Has reality finally found a foothold in the fetid, bad-news-is-good-news precincts of Wall Street? We shouldn’t get our hopes too high about this, since the herd still seems to believe that the uglier the economic news, the more likely central banking’s feather merchants are to continue pumping fraudulent money into shares and real estate. Still, you have to wonder how much harder the central bank will need to push on the string in order to compensate for a growing list of economic woes that now includes deepening recession in Europe, signs of serious economic fatigue in China, sharply rising U.S. mortgage rates, a cooling in auto sales and, most recently, news that America’s manufacturing sector is in its steepest slump since the recession allegedly ended in 2009.

The Great Recession (upper case) continues nevertheless — if not statistically, then at least in anecdotes drawn from the day-to-day lives of our friends, neighbors and former co-workers. How ebullient could we be, given that statistical recovery has been far too feeble to have had much of an impact on jobs, wages or – here’s a concept seldom discussed any more — capital investment? In fact, the lion’s share of investable dollars has gone mainly into housing, stocks and Treasury debt, creating just enough of a wealth effect to distract us from the actual economy’s persistent miseries. But with home prices up 11% since last March, who cares about $5 gas, surreal increases in the cost of health insurance, the imminent bankruptcy of Detroit, and other trifling details of economic life in America?

Lowering Expectations

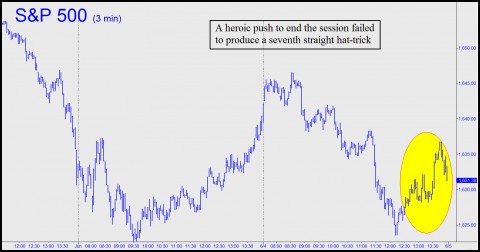

With Bernanke behind the curtain, and his lazy, economically ignorant lackeys in the news media ever eager to spin a bullish story, one could almost believe we’ll somehow muddle along indefinitely on sub-2% GDP growth. It helps that the creation of a mere 170,000 jobs in a month — mainly through statistical fraud — appears to have become the new benchmark for economic progress. In fact, the economy would need to generate 250,000 new jobs per month to make a dent in The Great Recession. It’ll be interesting to see how Friday’s made-up payroll data affects the stock market. Good or bad, this tidbit has rarely dampened investors’ spirits for long. Maybe this time, in a week that saw stocks actually fall on a Tuesday, it will be different?

Magus 12 Very late comment. I find Dorothy Parker’s variation on the adage as more applicable: ” You can lead a whore to culture,but you can’t make her (him) think”.