Well, that’s two straight Tuesdays that U.S. stocks have fallen. Has Wall Street finally noticed that the real estate sector – the only big winner in American’s sham “recovery” besides the stock market itself – is starting to deteriorate? Hard to say, although lately we’ve had our doubts that yield-crazed U.S. investors would lose a beat even if an epidemic were to wipe out half of the world’s population. They barely flinched a couple of weeks ago when Japan’s stock market was freefalling. And if deepening recession in Europe and a steep drop in China’s output bode trouble head for the global economy, neither factor has yet to have a significant impact on U.S. stocks, which touched record highs as recently as two weeks ago.

Now, however, comes a worry that will literally hit investors where they live: a steep increase in long-term yields that has pushed 30-year mortgage rates up by 56 basis points in just the last five weeks. As our colleague Michael Belkin notes, this is equivalent to two rate hikes by the Federal Reserve. An immediately visible result, he says, is that mortgage applications dropped 11% last week and mortgage lenders are starting to lay off brokers. If home sales start to cool even slightly, we wouldn’t be surprised if the “wealth effect” mirage that the Fed has struggled so hard to create over the last five years vanishes in a trice, since Americans have precious few things these days, other than inflated home values, to make them feel wealthier. (Certainly not higher real incomes, which have stagnated since the 1970s.)

From a technical standpoint, T-Bond futures still have a little room to fall before they hit our red zone. That would imply a drop to around 137-7/32, basis the September contract. (Note: yesterday’s low was 137-25/32.) In recent years, the Fed has moved aggressively to reverse the bearish tide when it reached or slightly exceeded our proprietary “Hidden Pivot” targets. Although the futures got a strong bounce yesterday off the lows, we still expect a relapse that will bring them even closer to the danger zone. Market-watchers should pay close attention if and when 137-7/32 is approached, since a decisive breach of that price – implying a move below 137 – could imply that market forces are beginning to push back against Fed stimulus. (Click here for a free trial subscription to Rick’s Picks that would allow you to follow these trends in real time.)

End Easing? Get Real!

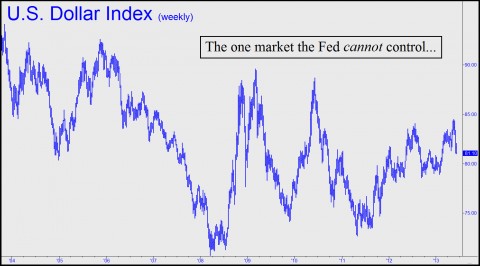

We have repeatedly emphasized here that worries about the central bank tapering off its quantitative easing program are way overblown, since even a mere hint that the Fed would be willing to seriously consider such an option has sent stocks into violent swoons and spasms. However, if market forces were to cause long-term yields to rise even another 50 basis points, that could jolt the markets severely. What might give rise to such “market forces”? Most obviously, weakness in the U.S. dollar. The greenback has been leaden over the last two weeks, raising doubts about whether its status as the world’s safe-haven currency can endure indefinitely. Probably not, but our hunch is that the current bull market will resume once investors get over their misplaced fear that Japan is done trashing its own currency. In any case, the ICEUS Dollar Index, currently trading for around 81.11, still has further to fall before reaching our correction target. If this forecast is correct, you should look for the bull market in the dollar to regain traction from 80.66, or if any lower, 80.19.

Secular bull markets all end with the consistent and unilateral viewpoint that the market being run by the bull can NEVER go back down.

Sentiment, moreso than technical parabolic chart moves, is what actually ends secular bull markets.

And we are witnessing it right here, right now.

“The Fed can not allow rates to rise”

“The government can not fund itself without issuing more bonds”

“Bill Gross tweets to sell bonds, but Pimco is buying”

“The Primary Dealers are appealing to the Fed to instantiate officially sanctioned negative yield policies on US debt”

This is only my opinion, people, but I’m gonna throw it out there, anyway…

The smart money is already net short the US bond market. If you are still riding this bull, then you are perfectly positioned, with empty bag in hand.

Just hold on to that bag for a while longer- maybe a month, maybe a year… But we NEED you to keep holding that bag…

Got it?