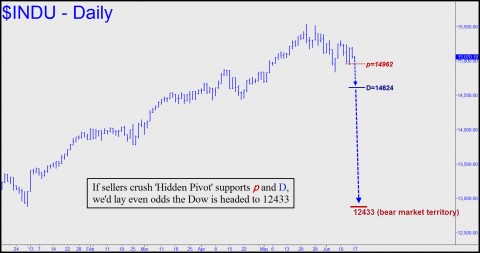

Are U.S. stocks in a bear market? Although we don’t pretend to have a crystal ball, the chart below could soon give us enough information to quote odds on it. From a technical standpoint, using our proprietary method of analysis, the key feature is the 14953 low made last week. Thursday’s swoon to that number overshot an important “Hidden Pivot” correction target at 14962 (aka ‘p’) by a hair – i.e., nine points, or 0.10 percent. That’s not enough to regard the support as having been violated, nor to provide a solid basis for predicting the direction of the next big move. It the move is higher, however, then a 16800 bull-market target broached here earlier will be back on the marquee. Alternatively, if the Indoos decisively breach last week’s low, we would expect the sell-off to continue to at least 14624, a three percent decline from Friday’s settlement price and a 6% fall from mid-May’s all-time high at 15542.

That would be little more than a stumble, of course, since it would fall well shy of the 20 percent threshold needed to signal a bear market. A 20-percent decline would imply a 3108-point selloff to 12433. Again, Hidden Pivot Analysis should be helpful in determining whether an initially mild selloff to 14624 – what bulls will undoubtedly regard as a healthy correction – is likely to snowball into an avalanche to 12433 or lower. How will we be able to predict this in advance? Very simply, by closely monitoring price action at the two numbers given above: 14962 and 14624. If the first is exceeded by more than 10 points intraday, then the second will become an odds-on bet. And if the second is exceeded on a closing basis for two consecutive days, then look out below. At that point we’d rate the bear-market scenario no worse than a 50-50 bet. That would be the best odds bears have gotten since the stock market left the launching pad in March of 2009.

The chart summarizes at a glimpse everything noted above. Keep in mind, however, that the more easily sellers obliterate Hidden Pivot supports ‘p’ and ‘D’, if indeed they do, the greater the odds a bear market has commenced.

And now we have a roundup of some of the more distressing details coming out of China by a guy whose opinion I really respect.

Mish Shedlock writes the following disturbing post (see link below) and one where I wish he had added more commentary on the crisis that is set to befall corporate China.

I want to again reiterate that it is my opinion a credit crisis in China will lead to supply chain difficulties across the globe.

We cannot discount the risk these conditions entail and all US Companies relying upon Chinese based production for manufactured components need to get up and pay attention now.

For reference as to the difficulties that business face against the headwinds of an inability to acquire short term financing and credit we need only look to the past for an appreciation of the drama that is likely to unfold there in the future.

The recent (massive) Free-Trade agreement brought forward during this weeks G8 summit between Europe and the US is adding further ammunition to my belief that it is already well understood Chinese manufactures (or the lack of them), pose a genuine risk to global trade fluidity.

We can all appreciate that an over-reliance on one single country for critical supplies is not in our interests when that country is verging on an epic credit meltdown that could potentially freeze production for weeks if not months or more.

Here is Mish with his recent analysis:

Cash Squeeze in China, Interest Rate Swaps Rise Most in 22 Months; China’s Credit Bubble About to Pop; Shadow Banking Crackdown…… http://globaleconomicanalysis.blogspot.com/#GgEQ7DBgBxSD5yUm.99

http://globaleconomicanalysis.blogspot.com/