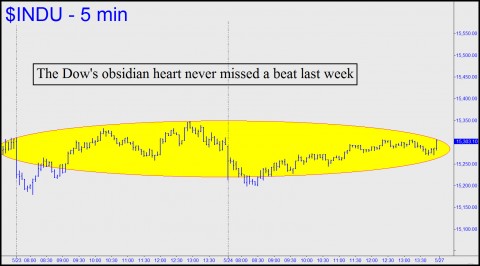

U.S. stocks barely flinched last week as shares trading elsewhere in the world got shellacked. The global selloff began with a 7% plunge in the Nikkei early Thursday. Asian markets dove in sympathy, then Europe followed suit with a 2.1% drop in the FTSE 100. But when it came time for Wall Street to show a little fear, bears were nowhere to be found. The Dow closed off just 12 points, demonstrating yet again the old adage that if you can keep a cool head while everyone around you is panicking, then perhaps you don’t understand the situation.

Then again, why should U.S. investors even care about Europe and Asia? Home prices are soaring, not only stimulating the all-important “wealth effect,” but also creating new collateral that presumably will help catalyze the next consumer-credit binge. That’s assuming one occurs. For it could happen only after Americans have dealt with a trillion dollar mountain of college loans, staggering increases in the cost of health care, stagnant incomes; punitive new taxes at the federal level; and in ultra-blue states like California, Minnesota, Massachusetts and New Jersey, tax increases implemented by lawmakers who evidently view the fraudulent economic recovery as a great opportunity to enlarge the scope of government.

T-Bond Blowoff Coming

Meanwhile, there seems to be a growing consensus among my fellow gurus that this market really is different. Indeed, nothing seems to make U.S. stocks go down — at least, not for longer than a day or so. Overnight selloffs reverse before the opening bell, and when there is weakness intraday, losses are recouped via short-squeeze buying in the final hour. If there is no good news to lift shares, then bad news is simply ignored. Europe’s deepening slide into intractable recession is no longer even talked about in U.S. newspapers, let alone making headlines. And China’s manufacturing growth has reversed, even as lending, particularly for real estate speculation, has surged. But so what? As far as Wall Streeet is concerned, all of it is unconnected to the brand new bubble developing in the U.S. housing market. At some point, however, investors are going to discover that there is indeed a connection, and the resulting epiphany seems all but certain to send U.S. Treasury paper into a blowoff rally, pushing long-term yields to the 2% threshold we’ve been expecting.

Our own forecast, against all instinct and logic, call for a blowoff rally in the Dow Industrials to 16800 – 1500 points above current levels. We’ll have one foot on the fire escape as this mania unfolds, but we don’t kid ourselves that there will be time to escape if things don’t go as predicted. More likely is that Asian and European markets will crash one night, taking U.S. shares with them. Thus will the worst crash in history be halfway to a bottom before Wall Street traders have arrived at their desks.

Margin debt just hit a nominal new high. It now exceeds 2.4% of GDP for the third time. First two times were at 2000 and 2007 market peaks. Read this today.