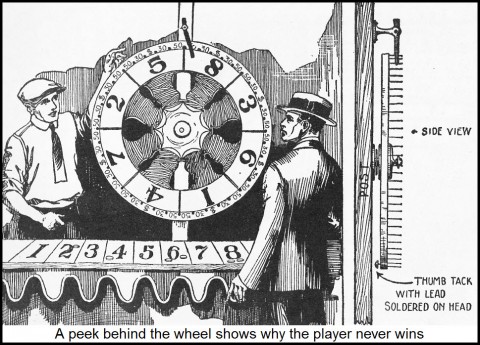

No one ever looks back with nostalgia on Wall Street’s good old days; for in fact, there never were any “good old days.” The stock market was always the same sleazy carnival game that it is today, a hoop-toss rigged to make the rubes think that winning is easy. Of course, the easier it looks, the harder it is. So it goes for investors sauntering along the global midway. You’d think that with equity shares in their fifth year of the most powerful bull market in history, every Tom, Dick and Harry would be a winner by now. What we find instead is that the individual investor has yet to recover from the dot-com crash, and that some of the savviest players in the game have left it, unable to beat the averages. Soros folds Quantum fund, embarrassed by his failure to deliver even modest returns. Buffett sinks $23 billion into…the food chain. Jimmy Rogers kisses off the American Dream and relocates to Singapore, while Steve Wynn heads to Macao. Don Trump and Jim Cramer seek, not wealth from investing, but ego gratification from over-exposing themselves on television.

Meanwhile, the trading pros who have elected to stay behind lead the lives of wild dogs, fighting for scraps as they nip at each other’s hinds. Dreaming of hell, they snarl in their sleep, eyelids open just a slit. They dare not drift off, since the partially eaten carcass next to which they lie would surely be gone by morning, stolen by even wilier predators.

Such primal fears must have entered the minds of prop desk traders last Tuesday, after the Associated Press reported on Twitter that there had been an explosion in the White House. In literally the blink of an eye, stocks plunged violently on the news. Moments later, however, they recovered almost as quickly when it was made known that no such explosion had occurred. The AP’s server had been hacked, was all. Within the hour, it was back to business-as-usual. Hair triggers were re-set and frayed nerves soothed by two-martini lunches while the news media, ever clueless, was left to sort things out.

Who Were They?

This is what Wall Street has come to: stock and futures markets have become a nervous system’s ganglions, hard-wired to the Internet. The result is that even the sleaziest, cleverest operators now live in fear that they will be ripped off by thieves even sleazier and cleverer than they. At this point, no one even knows whether the hacker or hackers who momentarily commandeered AP’s Twitter feed did so in order to reap a windfall from the stock market. We’ll probably never know, since there are a thousand ways the perpetrator(s) could have cashed out. Suffice it to say, in mere seconds tens of billions of dollars changed hands in reaction to an utter falsehood. Is Wall Street troubled by this? Evidently not. Instead of addressing the fact that securities markets are now ruled by speed-of-light edge-seekers, and therefore prone to catastrophic seizures and fleeting episodes of dementia, the traders have instead instructed quants, simply, to do better the next time. Who cares any longer whether the news is good, bad or a hoax, they are saying. As long as the trade desk can exploit it profitably by getting in and out first, what’s the problem?

And therein lies the problem. When the only edge left in the game is reckoned in nanoseconds rather than in knowledge, it is clear that the game cannot go on for much longer.

Manipulation by the dominant players? Never happened before? No one addresses more restrictions and enforced punishment. Look at the air traffic controller situation. The Dems and Repubs got that fixed real fast. Look at the cooperation. When it comes to any inconvenience for those esteemed members of congress they know how to get the job done.

As for the big banks and another price fixing scandal, what is new about that? BTW, has those same banks become rich over it? And I thought they were deep dodo under water. Crooks that still manage to stay in debt. Not good ones are they?

As for Gold, I am pretty darn sure the top of 2011 will not be seen for a long time. The real fireworks will be from 2016 to 2019.

The expected washout for stocks should also coincide with 2019.

As for this current rally, I am still waiting for Godot. In fact I am now inclined to believe there will be no further correction and that a 7th wave will commence. We should know very soon.

Anyone waiting for some sort of justice with a wash out (a purging) where stocks fall to oblivion will have to wait a lot longer than you have the patience for.