Trading profitably can be harder than it looks. Many who have struggled toward this goal think that just because they’ve figured out a way to hold losses down to $30 of $40 a day, that only a small improvement is needed to turn those losses into steady, daily profits. This is in fact a deception, like the carnival midway game where one gets three pitches to knock down some milk cartons. Lots of players manage to scatter one or two of the cartons with the first pitch. But try knocking down the last and you’re likely to come away thinking that a Category 5 hurricane couldn’t do the job. So it goes with trading. Anyone with even rudimentary risk management skills can find a way to lose “only” $50 a day. But making $50 on average? That’s quite a trick.

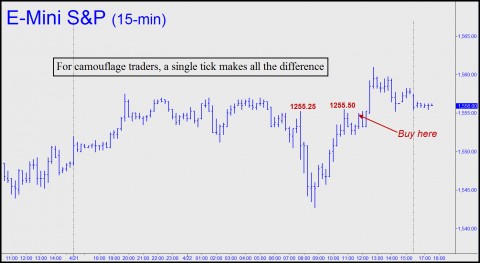

So how do we get our students over the hump? Since 2001, more than a thousand traders have learned the Hidden Pivot Method, currently taught in a six-hour webinar over two consecutive evenings. (Click here for details concerning the next. Or here for a free trial subscription to Rick’s Picks so that you can ask webinar grads for yourself.) We tell each student up front that it will take patience, diligence and practice to achieve consistent profits. Immediately after taking the course, most students, even novices, are capable of trading stocks, options or futures without getting hurt too badly. Mainly, it is a matter managing risk with “impulse legs” rather than with conventional stop-losses, and of initiating trades using a “camouflage” strategy that’s designed to reduce the stress of trading. Of course, not getting hurt too badly is hardly succeeding. That takes considerable practice, and the best way to get it is by attending the online tutorial sessions offered each and every Wednesday morning during trading hours. We tell students to be ready to pull the trigger when they come to these sessions, since we typically try to find and exploit actual trading opportunities in real time. There are about 230 of these sessions in our recorded archive, constituting a sort of graduate studies course for “Pivoteers.”

Free Remedial Sessions

A new and popular addition to the Hidden Pivot Course is our No Trader Left Behind program. Everyone who has taken the course can attend these sessions at no cost. The classes are limited to four students so that each will have a chance to get some one-on-one remedial time. The session can also bring webinar grads up to speed if they took the course before the secrets of “camouflage trading” were introduced into the curriculum about three years ago Here’s what one student who attended a recent No Trader Left Behind session had to say about it: “What was different today was the opportunity to speak with you directly and get an immediate response to a question. I am now confident that I’ll be able to not only recognize the relevant patterns, but to profit from them more consistently. I can say without reservation that today was one of my finest educational experiences. Thank you.”

Have you taken a trading course but struggled to make it work? Click here if you’re ready to try a radically different approach. The course has never been advertised, and everyone who has taken it has done so on the strength of word-of-mouth referrals. Incidentally, in the decade the course has been taught, only two students have asked for their money back. One turned out to have been a competitor; the other returned two years later and repaid for a second try.

And yet there is this nagging question about what is happening with Japan and money flows into US equities that is giving me cause to perhaps modify my own outlook on the markets, Gary. I am not sure this is yet being factored into price going forward despite the fact earnings are in decline. If anyone is wondering what is holding up the S&P right now I think that we might have found part of the answer in what is happening with the Yen.

Great work on gold this year Rick! In the end it overshot your downside projection a little but your assessment was very solid and you gave good tradeable advice to your readers. Right now I can only name two other guys who even came close. The other 99% were all pushing everyone to buy, buy, buy which as it turns out was a very costly error.

As always…I will stick with your site for the great insights you offer.