Although Apple shares have gyrated wildly this week, soaring $27 on Monday and then plummeting $18 the day after, the stock is probably just warming up for the big event later this week. Our guess is that the company will announce stellar earnings after the bell on Thursday, but that attempts to rally the stock will be overwhelmed by the bearish tide of Q3 earnings reported to date. Earlier in the week, we had raised the prospect of a resurgent Apple pulling the broad averages higher. However, given the relentless drumbeat of misses, warnings and dismal numbers from the likes of Google, IBM, Microsoft, GE, Caterpillar and a few other corporate biggies, it is evidently not just an earnings hiccup that investors have been discounting via two big selloffs in three days, but the onslaught of a potentially deep recession that has been in gestation since late summer. Under the circumstances, it is probably asking too much of Apple to single-handedly buoy investors’ hopes for the remainder of the year.

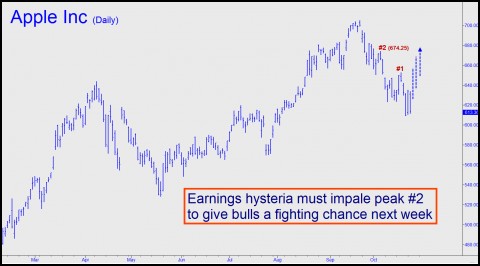

So what, then, of our prediction that AAPL’s performance this week will set the tone for the stock market in the months ahead? As things stand, and notwithstanding the prospect that monster earnings will be announced, we’d be surprised if Apple shares end the week significantly higher than where they are now. The stock settled near $613 yesterday after topping at $634 intraday, but unless more such gyrations vault peaks #1 and #2 in the chart above by Friday, it’ll be a rapidly deteriorating technical picture that Apple shareholders face next week.

2500-Point Dow Plunge

In an earlier commentary, we said the Dow could drop 2500 points quickly when the delusions that have long sustained the blue chip average finally gave way. Short of the appearance of some horrific black swan, nothing we can imagine would quash investors’ hopes more swiftly or unforgivingly than the lurking epiphany of a Fed with no more cards to play. At that point, all of the statistical lies and hubris that have sustained the bull market will be seen for what they were: mass folly. Our prediction of a 2500-point plunge in the Dow saw it occurring over several months. However, we should be prepared for the avalanche to play out in mere weeks or even days, since a whole constellation of markets equally steeped in folly – most significantly, bonds and currencies – will at that point be without the absolutely crucial psychological crutch that the bull market in stocks has provided.

Obviously, institutional investors have built a trap from which they cannot possibly escape. As for the individual investor, only insanity would explain a bet by him right now that upside potential outweighs downside risk.

***

[Click here for a free trial subscription to Rick’s Picks that includes access to a 24/7 chat room and the recently launched ‘Harry’s Place’.]

10 years ago Apple was at 3$. It is not a monopoly and eventually someone else will invent a cooler piece of electronic crap. Nokia was 40$ a couple of years ago and it was only blue sky ahead. So was Research in Motion. Today both are bust. Its a religion. Keep God out of investing.