Beneath a façade of tedious price action, U.S. stocks appear to be weakening by the hour. On Thursday, for instance, the Dow couldn’t even muster a 100-point pop on news that jobless claims had fallen by 30,000 for the week ended October 6. Earlier this year, before our perennially recovering economy encountered stiff and persistent recessionary headwinds, that stat would have been worth at least 150 Dow points on the opening. This time around, though, DaBoyz could extract only a paltry 84-point short squeeze from it. When a second-wind flurry of buying failed to drive the blue chip average any higher, it was time to unload. We said so in the Rick’s Picks chat room at the time, noting that the rally felt “doomed,” as it indeed was. Have investors finally figured out that virtually all employment-related statistics, especially with the election less than a month away, are economically meaningless at best and brazen lies at worst? Even if they have, it would hardly have mattered. Since early 2009 and up until recently, any economic datum from the Labor Department that was less than catastrophic has been seized on by institutional traders as a catalyst to stampede bears into covering short positions. As we’ve noted here before, that’s the only kind of buying powerful enough to drive stocks past levels of supply or jolt them from doldrums. Now this effect appears to be dead, or at least dying.

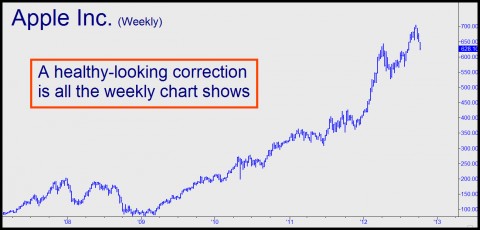

From a technical standpoint, there are disquieting signs of distribution as the Industrial Average and the S&P 500 Index hover within striking distance of new all-time highs. With breadth deteriorating on rallies and S&P insider selling at flood tide, leadership has gone flaccid as well. Several key bellwethers that we monitor very closely and trade, notably Apple, IBM and GE, have turned lower without having achieved their respective “Hidden Pivot” rally targets. We had been looking to short GE at 23.70 by buying put options, but the stock went no higher than 23.18 before turning south. With IBM appearing to home in on a similarly important rally target at exactly 215.59, our short offers became temporarily widowed when the stock dove $7 after getting no higher than 211.79. Apple, meanwhile, has become a drag on the averages rather than leading them higher. Is the stock just taking a breather? It’s possible, since the long-term charts suggest that the AAPL’s 10% selloff in recent weeks might be nothing more than a healthy correction. Even so, because bells are unlikely to ring when the long-term bear emerges from a by-now 43-month hibernation, we are trading with a bearish bias and monitoring the lesser charts closely for signs of stepped-up selling. When investors finally rush for the exits, we expect the Dow to shed 2500 points in three months or less (perhaps much less). Bulls will get what they deserve, but there’s no reason why bears who understandably have been bored to complacency need suffer the same fate. Want to receive real-time alerts when opportunities are ripe or danger signals flash? Click here for a free trial subscription.

News from the Inflation Front:

Zacky Farms, the big California poultry supplier to supermarkets has gone bankrupt.

http://tinyurl.com/8fjnsf9

It seems the price of proverbial “chicken feed” is now too expensive.

Drought related inflation of livestock feed has also driven cattle ranchers and hog farmers to liquidate their herds, causing a glut for the time being.

“It is a strain that has been felt across the nation’s livestock industry, as this summer’s drought led to a disappointing corn harvest. Larger producers are scouring the Midwest to snap up whatever feed they can find, or are sinking tens of millions of dollars into importing corn from Brazil.”

At long last, some inflation that does not have the fingerprints of the Fed all over it.

Never a dull moment in the markets!