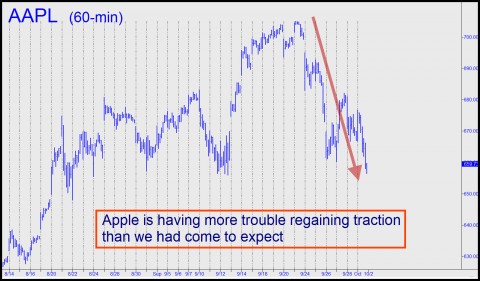

We dodged a bullet yesterday, exiting a bull calendar spread in Apple for a nice theoretical gain just before the stock tanked. AAPL was up about $7 in the early going, trading for around 674.00, when we put out a bulletin to sell for $8 some Nov-Oct 730 call spreads we’d purchased earlier for $7. The spread was trading for around $8.30 with Apple near its intraday highs, but we’ve recorded a 7.90 sale officially — for a theoretical gain of $720 on the trade– because it is our practice to use the worst price actually reported by a subscriber.

Apple finished the day at 659.51, down $7.46 — a nearly $25 reversal from high to low. But even when it was buoyant in the early going it felt like the stock was being distributed, and that’s why we decided to ditch. Our position was initiated when Apple looked like it would blow past $700 a couple of weeks ago. Playing the 730 strike for an October expiration seemed like a good bet at the time. However, when the stock wasted five precious days of would-be “rally time” in a power dive last week, it was time to bail.

From a technical standpoint, AAPL became an odds-on bet yesterday to continue lower to at least 649.74. If it gets there, we’ll put out an intraday guidance to help subscribers stake out yet another bull calendar spread, possibly buying December 700 calls and shorting October 700 calls against them. But we’ll have a better idea of how much to pay for the position if and when the stock approaches the target. (Want to join us in real time? Click here for a free trial subscription.)

Why So Punk?

So why has Apple looked so punk lately? Perhaps because the stock could never have lived up to the hype and hubris that preceded the debut of iPhone5. However, putting aside the inevitable fawning reviews from mainstream critics like the WSJ’s Walter Mossberg, the worst thing we’ve heard said of Apple’s latest phone is that only the power cord has been improved. Even if true, that wouldn’t have stopped buyers from lining up outside Apple stores to buy iPhone5 the day it hit the shelves.

Power cord aside, here’s another factor that could weigh on Apple shares in the months ahead: the company is going to have a far more difficult time negotiating lucrative deals with the television industry than it did when Steve Jobs used a take-no-prisoners approach to soften up an already moribund record industry.

Given its #1 bellwether status, if Apple were to slog lower in the weeks ahead, or merely even churn sideways, it would surely exert a drag on the stock market as a whole. If Google shares were to turn mushy as well – heaven forbid! — it would add even more weight to the possibility that U.S. shares have made an important top. Regardless, the 14969 Dow high we’d projected here just a short while ago looks like a non-starter. We’d thought the Indoos could reach that price as soon as November, just ahead of the election, but it now seems more likely that stocks at best will meander until then. The target remains viable nonetheless as a longer-term play, but the odds could change for the worse if the broad averages start to trace out downward retracement patterns that exceed ‘d’ targets identified via Hidden Pivot Analysis. We’ll keep you posted!

Hi JJ and all,

….I haven’t chimed in for awhile, needed to recharge and shift for a few weeks….

“We are fresh out of bubbles it seems.”

That’s a nice statement to chew on and extend. First of all, you hit it well that there is a “what’s the next bubble” kind of mentality in the air, not to mention in the planning of the elite masters in charge.

Yet, there is a much bigger bubble which has emerged, thankfully, a bubble which is going to continue for decades. It is not a bubble that has emerged from direct manipulation by the elite self-serving bastards in charge, but has become its own monster, and a monster of unprecedente proportions; that is the bubble of the entire risig Asia-Pacific rim and Latin America, all primarily led by China’s rise.

The reason I think most Westerners including many here don’t grasp its expansionary implications is that their thinking is too short-term “wall street style” and too linear, rather than exponential. I am recently reminded by some reading of Ray Kurzweil that expansion and development is often exponential, not linear, easily proven by many historical charts.

Rick recently referred to a “6 billion dollar” deal most likely finalizing between China Mobile and Apple. It mention seemed like nothing more than a passing phrase, rather than understanding the raw power of reality behind it.

I have consistently acknowledged and recognizd the negatives which exist in the system; one would have to be truly ignorant or delusional not to. Yet, I will stick to the same being true for those who refuse to recognize the unprecedented good stuff happening too, seen as expansion across the world, the power of a supertrend like China-driven reverse globalization. While just the thought of such points makes most Americans cringe with anti-Chinese bias and fear. Understandable.

Whether China/Asia, U.S. or Europe, the wealthy are all far too self-serving. It is disgusting, and its already a done deal, not a future problem. The raping is pretty much complete at this point in the global economic system. But now there is a rising tide of upper class wealth AND middle class expansion outside of Europe and the U.S. which I BEG everyone to recognize as not being linear in its progress. It is also, as I think most here agree, one of the only positive things happening that may prevent the disasters often well spoke of here at Rick’s site.

We are NOT fresh out of bubbles. We are fresh out of the typical manipulated bubbles that GS and friends have conjured up. Yes, we are out of those types of bubbles. But I am telling you all, point blank, with 100% certainty of fact, the hugest bubble of all acrossthe economic globe is just getting started, it is ONLY ten years old and it already is unprecedented.

The entire population of the U.S. is 300M, of which, let’s say 100 million are truly struggling, 150 million are middle class and doing ok and the top 50 million are doing better than ever.

Contrast that to China, a place where GS, the United Nations, the IMF and myself, expect the current rising DEBT FREE HOME OWNING middle class of 200M people to QUADRUPLE in size to 800M over the next 40 years.

You don’t understand. Hundreds of millions of Chinese families OWN their homes, 90% of them have always owned their homes and since they were owned more than ten years ago at a purchase price of $15,000, they are obviously mortgage free. They are all now on average worth $100,000 and there is nothing on this earth inside Cia that will ever cause their price to go down from this level. Flat for a few years, sure, but down severely? NEVER, simply because there is no downward pressure on hundreds of millions of mortgage free homes in an expanding society. It is a similar story across Latin America, driven by China’s reverse-globalization.

The West screwed everybody, screwed their own society, and in the process they created the economic monster that now exists far more powerful far more quickly than anyone had ever imagined. Yet these facts are real and easy to see and measure.

Couple this scenario I’ve tried to laid out here with a persistent atmosphere of low interest rates and govt monetary expansion and you have a recipe for continued expansion exactly as Indra Nooyi and Robert Fogel expect, a world GDP growing in the next generation of 200 Trillion from today’s 40 Trillion.

And where do we think the various stock market index #’s are going to be in that future? Gold? Oil? Commodities? 50% of S&P500 company earnings today are international. In that future, which is already here today, Rick is right when he recently suggested that older, traditional indicators and technical analysis are now useless; they don’t mean or indicate what they used to; not even close.

Cheers, Mario