Stocks and index futures have shown a slavish devotion to our Hidden Pivot targets lately. Only trouble is, the vehicles that we ordinarily trade have barely budged. The E-Mini S&P futures, for instance. Yesterday we hung out a very bullish, 1477.50 target for subscribers, implying a 40-point rally equivalent to about 320 Dow points. This would have been no great 3-day feat during the supposed dog days of summer, when stocks stair-stepped steadily higher no matter what the news. Came mid-August, however, they went flat, taking a 20-day breather to recharge for two single-day spurts that temporarily alleviated the tedium. Blink and you missed the opportunity. Is the same thing about to happen again? If not, look out below. Three weeks ago,

the E-Mini went into a dirge after soaring for two days on the promise that Helicopter Ben was prepared — yet again — to do whatever it takes to keep the stock market afloat until after the election. Not to rain on anyone’s parade, but we would be remiss if we failed to point out that the broad averages have fallen back to where they were before Heli-Ben came galloping to the “rescue” for the umpteenth time.

Stocks Hovering Dangerously

Considering the foregoing, it feels like U.S. stocks are in a very dangerous place, hovering all-too-patiently as they wait for “something” to goose stocks again. We can’t imagine what would set them a-surge, even though we’re on record with a prediction of a 1400-point rally in the Dow, to 14969. Every time we think too hard about this forecast, however, it feels like we’ve gone too far out on the limb. Still, it’s based on purely technical factors, most particularly the Dow’s effortless push past a 13502 “Hidden Pivot midpoint” that is associated with the target itself. We really do trust our technical indicators, but, as we noted here earlier, it is with one leg on the fire escape that we do so now. In any case, we are no longer asserting that the rally will unfold by election time. The buying energy just doesn’t seem to be there. More likely is that stocks will continue to meander until after November 6.

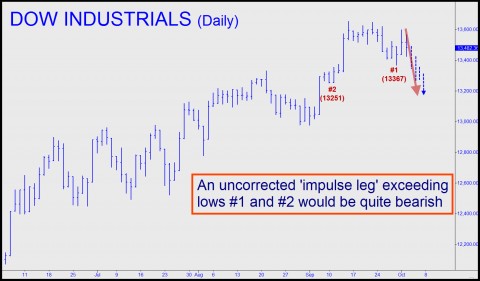

And then what? For us, at least, it’s beyond imagining that the re-election of Barack Obama would spark a big rally on Wall Street. Ditto for a Romney victory. What that implies is that stocks have nowhere to go but down. But perhaps to 14969 first? We’ll stick with that prediction, but we’ve also set a Dow alert at 13251. If the Indoos were to fall to that price within a day of breaching the 13367 low (#2) shown in the chart, that would generate a bearish “impulse leg” with potentially destructive power. Although the 14969 target would still be viable in theory, as a practical matter we would put it on the back burner and turn the flame to low.

***

Click here for a free trial subscription that includes not only access to two 24/7 chat rooms that draw veteran traders from around the world, but also real-time trading alerts via e-mail.

Mario Cavolo,

I was wondering about China’s monetary system. I would tend to believe that a communist government would have full control of it’s money and would not be in a situation similar to what is happening in capitalist countries. Not having to pay interest on mountains of debt certainly would permit a government to invest in more productive ventures. Could you, if you can, inform us on the banking situation in China?