H.L. Mencken famously wrote that no one ever went broke underestimating the intelligence of the American public. With kids lining up at Apple stores last week to buy the latest iPhone, mightn’t that be a timely cue to short Apple shares for around $700? To us, at least, it seems pretty stupid to pay Apple’s inflated prices when one can get a perfectly good, discounted Android phone from Samsung for half the price. And speaking of Samsung, we think Apple may have darkened its own karma when they sued their Korean competitor over a few trivial patents, extracting a billion dollar settlement (and never mind that, on appeal, Apple is seeking yet another $700 million from the same lawsuit). World-beating companies that pride themselves on innovation shouldn’t have to sue the competition for billions of dollars over design features that any Carnegie Mellon or Pratt sophomore would have incorporated in a phone-display schemata.

So are we shorting Apple shares? Quite the contrary, actually. On Friday, even as we advised subscribers to cash out of a winning AAPL bull calendar spread initiated well below current prices, we were attempting to replace it with some Nov 730 -Oct 730 calendar spreads legged on for $8 or less. The spread would yield terrific odds if Apple shares were to rise by another $30 over the next few months. (Click here for a free trial subscription that will get you real-time notifications.) Apple looks like a shoe-in to go at least somewhat higher in the days ahead, having finished last week above $700 for the first time.

And yes, we are well aware that the company has embarrassed itself by releasing a map application with the new iPhone that totally sucks compared to Google Maps. Of course, the kids who are lining up to buy iPhone5 would probably line up even if there were reports that the phone melts when exposed to sunlight. Like the latest Hermes handbag, the new iPhone is a must-have – and not just for a few thousand women who can afford such things, but for a cult of millions.

Ignore the Screw-Ups

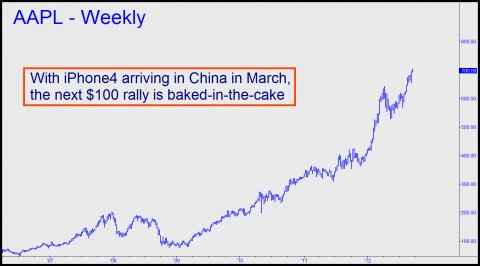

There are other reasons not to short Apple, no matter how badly the company screws up. For one, bears will be bucking the stock’s 80% institutional ownership. These are shareholders who would sooner cut off their left arm than sell their stake in Apple, and they have effectively reduced the “float” of the world’s largest company to a fraction of total capitalization. For two, there’s the deal with China Telecom that will be worth perhaps $6 billion in instant new revenues. Ba-da-bing! On that one alone, AAPL stands to rise by perhaps $100 before Chinese iPhone4’s go on sale in March. There’s also the seeming inevitability that Apple hardware and billing software will eventually find its way into your television’s circuitry. For now, Comcast is resisting providing set-top access to Apple, since they are well aware that the music industry’s Faustian bargain with Steve Jobs cost producers not just an arm and a leg, but a gallon of blood and a bunch of vital organs. But how, you ask, will Comcast or perhaps another cable provider be able to resist the kind of cash flow that a deal with Apple would bring? Answer: They cannot. And will not.

Under the circumstances, we’ll short Apple only tactically at Hidden Pivot rally targets, with the goal of getting a step ahead of the take-no-prisoners downdrafts that the stock’s sponsors use occasionally to shake the tree. Otherwise, warts and all, AAPL will remain a no-brainer “buy” presumably until the trumpets sound from on high.

At least Rick didn’t need to use LSD to become enlightened as Steve Jobs did.

http://www.wired.com/cloudline/wp-content/uploads/2012/03/apple-think-different.jpg (??)