[Our good friend Doug Behnfield, easily the smartest financial advisor we know, thinks it’s possible the Fed will do nothing today even though the whole world is expecting QE3. America’s economic problems have grown considerably since Operation Twist was implemented, says Doug, and the Fed may be reluctant to risk revealing to the world that it has no more bullets. In the guest essay below, he explains why it may be better for the central bank to do little or nothing this time, especially with the stock market so strong, than to be perceived as powerless when the economy fails to respond to yet another dose of monetary voodoo. RA ]

Much has been written about The Wonderful Wizard of Oz by L. Frank Baum as an allegory for monetary policy. At the time it was written in the late 1890s, the country had been ravaged by deflation and William Jennings Bryan was running for President on a platform that, among other things, advocated “free silver” or bimetallism as a method of stimulating economic growth. Back then there was no Federal Reserve and we were on the gold standard. The Treasury could increase the amount of official silver coinage as a powerful and unconventional way to juice the money supply. How quaint. According to the scholarly literary criticism, Dorothy represents the “America-honest everyman” , the Kingdom of Oz is Washington D.C. and the Wizard is the President. Dorothy must travel the Yellow Brick Road, signifying gold and have an audience with the Wiz who supposedly has the power to get her back to Kansas.

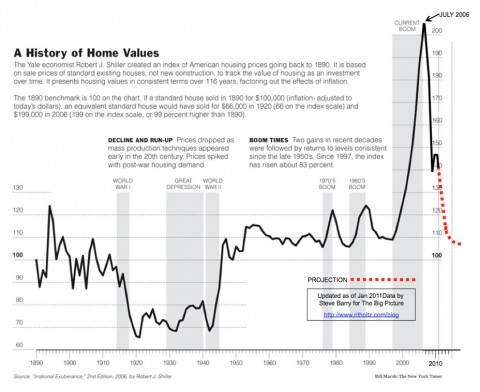

Deflation was hardest on the farmers in the late 1900s. In the book, the slippers she snags from the Wicked Witch of the East in Munchkin Land are silver (they were replaced with ruby ones for Technicolor in the movie version). The Emerald Palace is an illusion, representing paper currency and the Land of Oz is, you guessed it, the land of money since money was denominated in ounces of gold. Today we are once again suffering a lack of economic growth and we have just been through a severe bout of asset deflation (i.e. housing and equities). The call has come out from Wall Street for more monetary stimulus in the form of Quantitative Easing by the Fed in the belief that making more credit available to the system will result in our economy taking flight. Pay no attention to the man behind the curtain!

Damn the Monkeys

The focus in today’s global economic condition is on the Central Bankers. Perhaps that is why The Wizard of Oz is a prime example of life imitating Art. Damn the Flying Monkeys. Lions and Tigers and Bears, who cares?! If we can just coax the Wiz into some unconventional monetary policy, our problems will be solved. 2007 marked the beginning of the first downturn in the post WWII period that did not respond to extreme conventional monetary policy, i.e. lower interest rates. That is because we are in a secular credit contraction for the first time since the Great Depression. The Fed took short rates to 0% in 2008 and nothing happened. Everything just kept imploding. Four years and several rounds of unconventional policy actions and coordinations later, we still appear to be at risk of another severe economic contraction phase, and this next one is likely to be even more global in scope than the first leg down, which ended in 2009. Many pundits believe that the Fed is running out of policy options that are strong enough to make a difference. I am one of them.

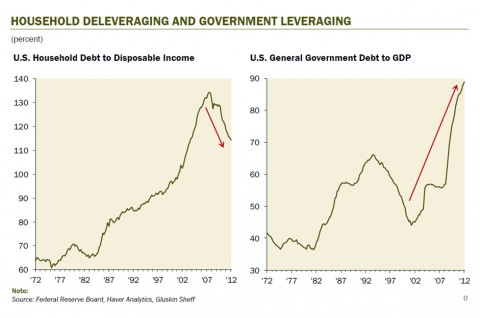

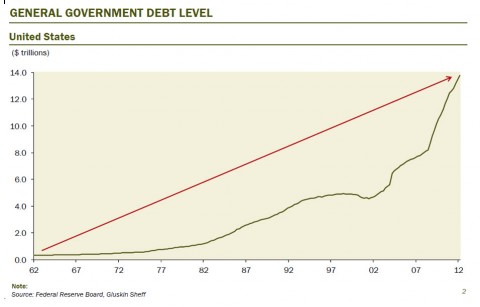

The reasons seem simple enough. The society as a whole is way too indebted to want to expand their consumption via more debt. On the contrary, a large segment of society is powerfully focused on balance sheet rebuilding (and they make up most of the households that are creditworthy). The last 10 years of the prior credit cycle turned into a world-class bubble because it included a populist real estate mania. Practically the entire society embraced the house as a linear path to wealth and, as a result they did everything they could to maximize their exposure. Primarily, this meant adding the home in as a primary investment class for asset allocation purposes and using as much leverage as possible to load up the portfolio. In order to understand what comes next, I prefer to lean heavily on “Bob Farrell’s Market Rules to Remember (see below),” particularly Rules 1-4, and the Case-Shiller Home Price Index. In addition, it helps to be able to visualize the trajectory of Household Debt to Disposable Income and Government Debt.

MARKET RULES TO REMEMBER

1. Markets tend to return to the mean over time.

2. Excesses in one direction will lead to an opposite excess in the other direction.

3. There are no new eras – excesses are never permanent.

4. Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

5. The public buys the most at the top and the least at the bottom.

6. Fear and greed are stronger than long-term resolve.

7. Markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names.

8. Bear markets have three stages – sharp down – reflexive rebound – a drawn-out fundamental downtrend.

9. When all the experts and forecasts agree – something else is going to happen.

10. Bull markets are more fun than bear markets.

It is my firm opinion that Bob Farrell’s Rules should be taken as gospel in all matters involving prices. Rule #2 states that mean reversion requires two extremes. That implies that calling the bottom of the mean reverting decline in house prices will be just as daunting as calling the previous bubble peak. What will not happen is that the decline phase will be short or mild. The intellectual argument for endless price appreciation for housing was practically unanimous at the top and intoxicated in retrospect. The recent consensus that housing has bottomed is probably way off the mark too.

An understanding of the housing mania and its aftermath are critical because the housing mania was the most powerful excess in this credit cycle and possibly in human history. First of all, investment in owner-occupied housing beyond the most Spartan shelter requirements is not “productive investment”. Rather, it is consumption on a monumental scale. Unlike investing in a railroad boom or an oil boom, money spent on primary housing does not create revenue for the investor. To the contrary, houses, as we all know, are money pits. For this reason, the housing mania has left our society saddled with demands on our cash flow that reduce our ability to afford new consumption or to save and invest. Second of all, tapping home equity during the bubble has left many households depressed from the hangover of a spending spree that was funded by seemingly almost free money.

Blowing One’s Inheritance

An appropriate analogy would be the household that receives a $250,000 inheritance while earning $100,000 in household income. Statistics indicate that an inheritance of this magnitude is spent very quickly. Typically, the household’s life style doubles to about $200,000 per year for a couple of years and then everyone has to go back to mowing their own lawn. The dynamics of too large a home investment and too much home equity debt are particularly negative for Baby Boomers whom are now belatedly launching into retirement planning.

The chart of Household Debt to Disposable Income and Government Debt reveal several dynamics that also add to the thesis that additional consumer credit is not the medicine our society needs to jump-start the economy. First of all, the principle of mean reversion implies that American households have a very long period of debt reduction ahead of them. Second, government debt (and whatever economic stimulus that implies) has gone parabolic and appears ripe for a reversal. Before you shake your head, remember that it is basic human nature to start thinking in linear fashion when a trend has gone way further than you ever thought it would. If, as I suspect, dramatic fiscal legislation containing substantial tax increases and spending cuts are directly ahead, the initial impact on the economy will be recessionary. Hey, recessions happen. And they are more likely to happen in the first year or two of the Presidential Cycle. That means 2013 and 2014. Historically too, recessions come quicker and expansions are both shorter and weaker in periods of secular credit contraction.

It seems that we “Dorothys” have done what we were told to do and we would like to have the wizard keep his promise. But perhaps we cannot depend on Fed policy to solve our problems. In The Wizard of Oz the wizard is a bit of a liar. He is not a wizard at all, just a balloonist from Nebraska. But for some reason the loyal subjects of the Emerald City need to believe that he is the Great and Powerful Oz-and so he maintains the illusion. When first approached by Dorothy and her crew for help, he sends them on a mission to bring back the Wicked Witch of the West’s broom. Believing so deeply in his power, they enthusiastically head out. Sort of like the stock market and, to a lesser degree the economy after QEII (quantitative easing) in August, 2010. When Ben Bernanke announced his plan to massively quantitatively increase the holdings of bonds on the Fed’s balance sheet, thereby injecting hundreds of billions of dollars into the banking system, most market participants were confident that economic growth would explode. This was an extraordinarily powerful act of monetary policy considering that there was no proximate financial crisis and the economy was still expanding. And yet, the economy did not take off. It bounced a bit and the stock market flew, but for the most part behavior remained cautious at the household level. The stock market soon retreated and economic growth slowed back down to stall speed. I do not think the Fed will risk doing the same thing again, particularly because there is a risk that the response will again be negligible and the man behind the curtain will be revealed as a mere mortal.

What Ben Didn’t Promise

At the Federal Reserve Board retreat in Jackson Hole, Wyoming, the modern day wizard (Ben Bernanke) gave a much anticipated speech in which he said essentially nothing except “I am Oz, the Great and Powerful!” At first, the market rallied 14 points on the S&P500. What he did not promise is that the Fed will announce QE3 at their September meeting. However, with every negative piece of economic data reported, stocks tend to rally in the belief that bad news means good news from the Fed. In the recent past, the ultimate stock market reaction to the disappointment of “no new QE” has been decidedly negative. When QE2 was ending in July 2011, the FOMC Statement did not indicate that it would be extended. Partly as a result, an 18% collapse in stock prices occurred in 13 trading days between July 25 and August 9. The decline was halted by the Fed announcement specifying that short term rates would be held at 0% through at least mid-2013. There have been several examples of unmet expectations of lesser magnitude since then.

In reviewing the market conditions that have prevailed prior to recent major policy easing decisions, it is tempting to conclude that the Fed only does so in response to weak markets. For example, the recent sharp decline in stocks in the month of May resulted in the extension of “Operation Twist” into year end and hints of additional Quantitative Easing. They do not seem to act decisively just because employment or other economic data is weak. Admittedly, weak economic data is usually accompanied by weak stock market action, but not recently. The stock market is very near 4 year highs. Because of that, the risk that a major monetary policy announcement is not met with a visible, positive response in the market is very great. The last thing the Fed can afford is the impression that they do not have the power to control the economy. For that reason, any further action is most likely on hold until the next meaningful decline in the stock market. And even then, the Fed may believe that it has already used all of its useful tools and continue to opt for rhetoric.

Only Rhetoric Remains

But then, perhaps we, the people have always had the power to solve our own problems, and right in our own back yard. We may just have to find that out for ourselves. Unfortunately, all the wizard may have left to offer is rhetoric. Very possibly monetary policy was only a cushion for the pain and austerity that goes along with mean-reverting a credit bubble. Along with a lot of potentially dire unintended consequences, perhaps it will change the trajectory in such a way that makes the path safer and easier. But it is becoming increasingly clear that the Fed is no match for Mother Nature. She will run her course, whatever that is. Americans will most likely solve their fiscal problems by putting one foot in front of the other and getting rid of the debt. Sustainable recovery awaits—some…where — after we rebuild our collective balance sheets.

***

Trading stocks, options and commodities in these treacherous times calls for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches the challenge.

And by the way….all you gold bugs who are rejoicing today might want to stop and consider that on the outside chance QEIII does bring about a recovery in housing prices that it will probably kill golds upward trajectory. But that is a story for another day.