Stocks looked somewhat subdued at week’s end, but this was to be expected, given the downbeat economic news. Turns out the U.S. economy generated a paltry 96,000 new jobs in August while unemployment fell to 8.1% for the worst possible reason. In fact, the number fell because so many who are jobless have given up looking for work. The fact that the Dow Industrials managed to hold onto Thursday’s 250-point gain despite this suggests that bull traders will be out in force Monday morning, attempting to leverage the brazen falsehoods that were trumpeted from the podium in Charlotte.

Obama has been able to tell sensational lies about the performance of the U.S. economy simply because a left-tilting press is doing its loyal and desperate best to get him re-elected. Americans are not fooled, though, and that is why we expect the incumbent to get trounced in November, notwithstanding Gallup polls and other damned statistical lies to the contrary. We’ve tuned all of it

out and will take the odds. As far as we’re concerned, the polls are either flat-out wrong or misleading, and campaign coverage that would have us believe Romney and Obama are running neck-in-neck is delusional. Romney is a weak candidate, to be sure, but he is running against a man who has not earned anyone’s trust, let alone four more years in office. Even liberals and progressives are saying that, by the way. We were surprised to hear it last week from an old friend, a self-described Progressive who has never spoken a kind word about a Republican in the six decades we’ve known him.

America’s Shame

Ordinarily, we would rate it a plus for the markets that a president who views America’s past with shame, and whose obsessive political goal is to make us pay the Third World for our sins, is about to be turned out of office. In this case, however, there is no reason to believe that Romney will do any better at ameliorating the economic crisis that confronted Obama when he took office. And while it is profoundly comforting to know that the next Supreme Court appointments are unlikely to be hard-left ideologues like the ones Obama has chosen, we must still deal with an economy that is mortally sick, mired in a Great Recession from which there will be no easy escape. In fact, the only thing that can extricate us is a much deeper recession, one that would allow investable assets, mainly real estate, to fall to their true market values . Since no politician other than Ron Paul would have the guts to advocate such a solution, it remains inevitable that market equilibrium will be forced on us by an outright Depression.

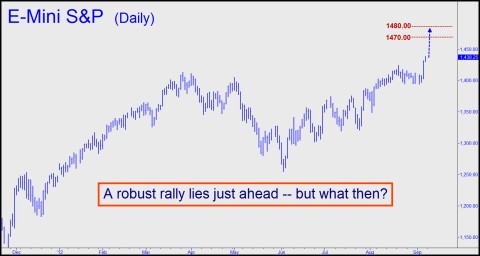

In the meantime, our cynical expectation is for higher stock prices, at least over the near term. We’ve been using a 1470.00 rally target for the E-Mini S&Ps, which settled on Friday at 1438.25. If our forecast is correct, it would imply a corresponding rally in the Dow Industrials of about 250 points. What happens after that is more speculative, although an easy move through the target would suggest that DaBoyz are planning to go for broke by running stocks higher into November. Of course, there is also a chance the S&Ps could hit our 1470.00 Hidden Pivot target and conk out, setting in motion the Mother of All Bear Markets that so many of us have expected for oh-so-long.

War a ‘Wild Card’

A wild card, one with consequences that everyone should shudder to imagine, is a pre-emptive strike by Israel on Iran. No one believes any longer that further talks with Iran, or economic sanctions, will persuade them to abandon their program to build a nuclear bomb. The Israelis, for their part, must be taken at their word. Their leaders have flatly stated that the mullahs cannot be allowed to possess a nuclear weapon. The markets have done absolutely nothing to discount the growing likelihood that Israel will act, even if without U.S. help, to stop Iran. Obama presumably is applying as much behind-the-scenes pressure as possible to thwart Israel. According to one report, he has even provided a back-door assurance to Iran that the U.S. would not jump into the fray if Iran did not attack U.S. assets. Under the circumstances, the very prospect of Obama’s reelection seems likely to impel Israel to act sooner rather than later. A Romney victory, meanwhile, would only temporarily delay a military strike.

***

Trading stocks, options and commodities in these treacherous times calls for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches the challenge.

We agree about Friedman and Soros.