Interesting times, for sure – and by no means accursed for those with the wisdom to have bought silver or gold before yesterday. Both took flight on word that Helicopter Ben has promised to do whatever it takes to bring U.S. unemployment down to more reasonable levels. If Americans knew what it will ultimately cost them to have the Fed target unemployment rather than the money supply, they’d be having second thoughts about this latest phase of Bernanke’s bold experiment. Because trillions of dollars worth of stimulus have failed thus far to keep unemployment merely from rising, we can scarcely imagine how many trillions more it might take to actually push unemployment down.

But for now, at least, because Bernanke has deigned to re-imagine QE3 with no limits, investors can be fearless about exposure to bullion. Too bad it took the ECB’s Draghi to show him the way. Recall that Draghi one-upped his colleagues a while back with a pledge to hold Spain’s borrowing costs down come hell or high water. We’re not sure which is more ambitious: ensuring the steady flow of cheap credit to Spain, with its 25% unemployment and a middle-class scramble to move savings out of the country; or creating jobs in the U.S., where restoring the illusion of prosperity will be possible only if home values can be goosed into another parabola.

Damn the Torpedoes

Whatever happens, some Rick’s Picks subscribers were in great spirits following Bernanke’s damn-the-torpedoes foray into uncharted waters. “I was long [the gold miner’s ETF] last night, and this was the biggest single trade of my life,” noted one chat-room denizen. “It was just plain unbelievable!” Another spoke for those who have patiently waited for gold and silver mining stocks to spring to life: “Today’s action has helped me recoup a nice portion of what my portfolio dropped this year,” he noted in a late-afternoon post. “I must confess that I held onto most of my precious metal and copper holdings during the long drop. That’s the price one pays for adopting a buy-and-hold strategy.” Indeed.

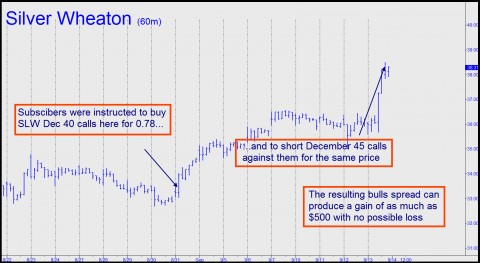

Both of these guys had acted on their own initiative, but there were pleasant and presumably rewarding tasks to occupy other subscribers who mechanically follow the trading “touts” published each day in Rick’s Picks. Specifically, subscribers were advised to short December 45 calls in Silver Wheaton for 0.78 against December 40 calls purchased earlier for the same price when the stock was trading significantly lower. Legging into a “vertical bull spread” in this way has effectively locked in a position that will produce a profit of $4,000 (on eight spreads) if Silver Wheaton shares, currently trading for $38.38, are at or above $45 come December expiration. And because the cost of the spread was zero, there is no possibility of a loss even if the stock falls by 99%. Want to get in on the action? Click here for a free trial subscription that includes not only access to two 24/7 chat rooms that draw veteran traders from around the world, but also real-time trading alerts via e-mail.

Why are we keep pretending that the FED’s mandate is an unemployment care or the price stability, while, it is clear that the FED’s mandate is an endless money for the government? Is this pretense really conductive for the forecasting of the economic matters?